Investing in the Nairobi Securities Exchange (NSE) presents a compelling opportunity for those in the diaspora seeking to diversify their portfolios

The Kenyan banking sector assets have grown from Ksh 578 billion in 2004 to Ksh 7 trillion in 2023. The insurance sector hit a milestone of Ksh 1 trillion in total assets this year from Ksh 311 billion in 2012.

Safaricom’s total revenue hit Ksh 311 billion for the year ended March 2023 from Ksh 84 billion in 2008.

These are some of the pockets of growth opportunities for Kenyans living in the diaspora who are keen on growing their wealth passively while being part of the Kenyan growth story.

Kenyans living in the diaspora sent home $4 billion in 2023 with 60% of that coming from North America. Channeling some of that to the Nairobi Securities Exchange would help spur local economic growth as diaspora remittances are already the top foreign exchange earner.

The stock market helps create economic investments when companies raise capital. It also provides a platform for investors to partake in the growth of listed companies, earn dividends, and benefit from the share price appreciation when listed companies perform well over time.

That said, here are the 5 things you need to have as a Kenyan living in the diaspora to invest in the Nairobi Securities Exchange:

1. It is recommended that you have a local bank account for ease of transacting. Ensure to open an account with a local Kenyan bank with a diaspora desk or unit to ensure that you get bespoke support. The bank should also have robust digital channels where you can transact digitally.

2. You should also figure out the best channels or services through which to send money back to Kenya cheaply and with the cheapest currency exchange rates.

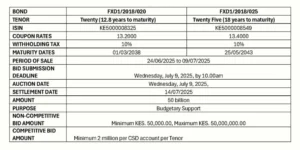

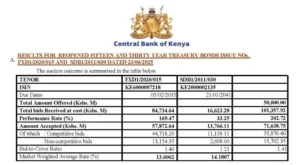

3. You should open a CDS account with a Central Depository and Settlement Corporation (CDSC) agent which should be a stockbroker or investment bank. You could also speak to your bank of choice which could have a custodian account or an investment banking unit. All the investors in the Nairobi Securities Exchange must have a CDS account.

4. Ensure you have access to market information such as financial reports, financial analysis, and news and share prices from digital platforms such as the Dosikaa App which has been endorsed by the Capital Markets Authority (CMA), Central Depository and Settlement Corporation (CDSC),

Nairobi Securities Exchange (NSE), and the Kenya Association of Stockbrokers and Investment Banks (KASIB). The app helps keep you updated with market information to ensure that you invest from a point of information.

Take your time to analyze the competing opportunities and choose the best stocks based on your analysis. Stockbrokers and investment banks also provide analyses on different listed companies on the NSE with recommendations on which shares to buy or sell for your review and consideration.

5. Confirm that you can transfer money from your commercial bank to your shares trading account online using the digital channels of your bank.

With the above pointers, you should be set and ready to invest in the NSE-listed companies including Safaricom, Standard Chartered Bank Kenya, Kakuzi, KCB Group, Britam, Equity Group Holdings, Carbacid, etc. based on your analysis or professional advice from your stockbroker/custodian.