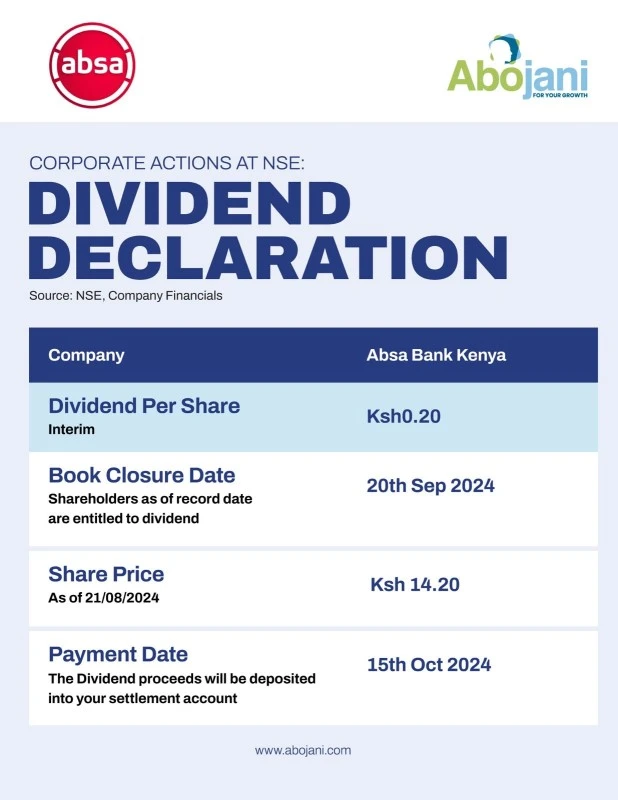

Absa Bank Kenya PLC has delivered a stellar performance for the first half of 2024, with a notable 29% increase in profit after tax, reaching Kshs 10.7 billion, highlighting the bank’s successful strategy and resilience in a challenging economic environment. In addition, the bank has declared an interim dividend of Kshs. 0.20 per share.

In the six months ending June 30, 2024, Absa Bank Kenya saw a 16% rise in total revenue, amounting to Kshs. 31.8 billion. This growth was driven by a 20% increase in net interest income, which totaled Kshs. 23 billion, and an 8% rise in non-interest income, reaching Kshs. 8.8 billion. Customer deposits also grew by 6% to Kshs. 353.3 billion, reflecting strong customer confidence.

Absa Bank Kenya PLC Reports

Staying true to its purpose of “Empowering Africa’s tomorrow, together… one story at a time,” the bank has continued to enhance its support for customers through both financial and non-financial initiatives. The bank provided Kshs. 64 billion in new lending to key economic sectors, with total loans and advances closing at Kshs. 316.3 billion.

In response to current economic pressures, the bank restructured around Kshs. 1.4 billion in loans for retail clients and boosted support for MSMEs and female entrepreneurs, benefiting over 14,000 businesses. It also revamped its La-Riba platform to offer innovative Shariah-compliant solutions and upgraded its Wezesha Stock platform for SMEs.

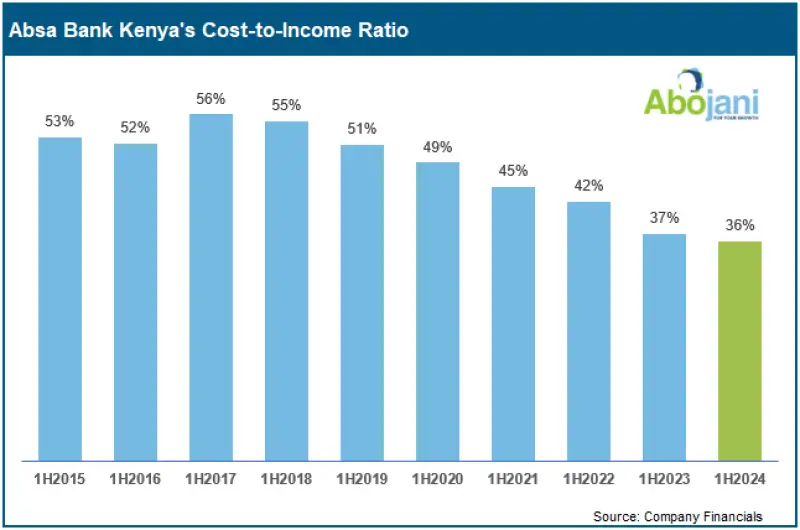

The bank’s statutory operating expenses rose by 12% due to continued investments in technology and personnel. Despite this, Absa Bank improved its cost-to-income ratio to 35.8%, down from 37% in the previous year. Impairment charges increased slightly to Kshs. 5.2 billion, but the bank’s portfolio quality remains strong compared to industry norms.

The bank’s capital and liquidity ratios are solid, with a total capital adequacy ratio of 18.6% and a liquidity reserve of 35.2%, both exceeding regulatory standards.

Read: KCB Group Leads the Way in Sustainable Finance with Landmark 2023 Sustainability Report

Abdi Mohamed, Managing Director and CEO of Absa Bank Kenya PLC, highlighted the bank’s effective strategy and dedication amidst economic challenges. “Our impressive performance reflects our strategic focus and commitment to delivering impactful financial solutions,” Mr. Mohamed stated. He emphasized the bank’s ongoing efforts to foster transformation and contribute to economic growth.

The lender’s strong results and strategic initiatives position it well for sustained growth and impact. And the declaration of an interim dividend further underscores the bank’s commitment to providing value to its shareholders.