Here are some of the biggest stories that made headlines – Week 45 of 2024:

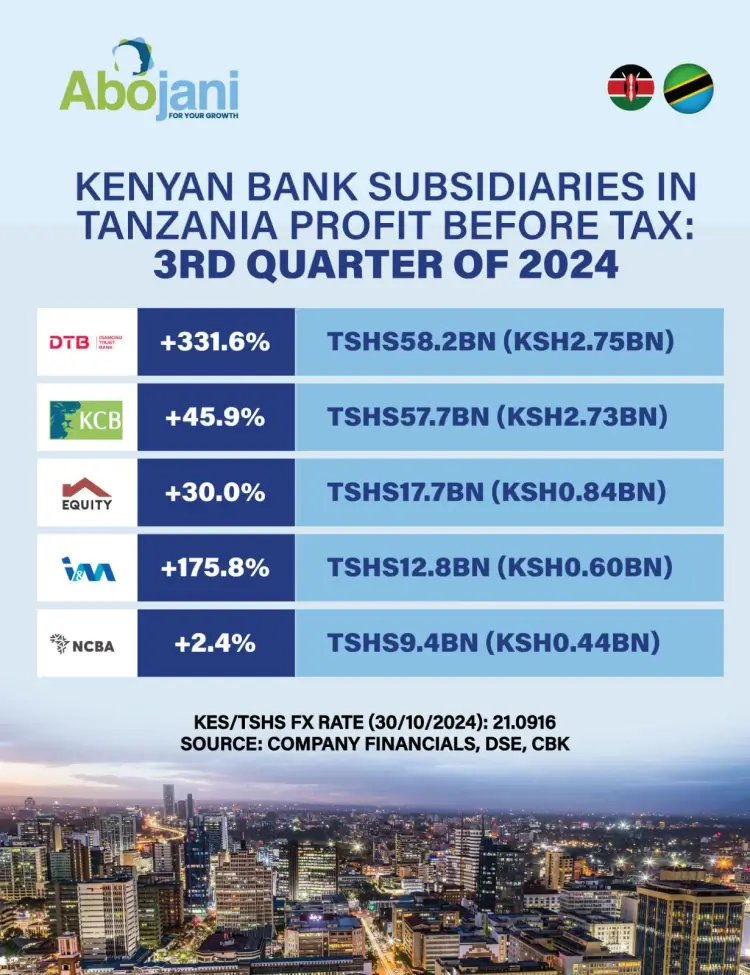

1. Kenyan banks’ subsidiaries in Tanzania saw impressive profit growth, with DTB achieving the largest increase, growing by over 300% to reach Tsh 58.2 billion (Ksh 2.75 billion).

2. Carbacid saw a 20% rise in turnover to Ksh 2.07 billion and a 3.3% increase in net profit after tax to Ksh 0.84 billion for the fiscal year ending July 31, 2024. The company declared a final dividend of Ksh 1.70 per share, payable to shareholders registered by 26th November 2024.

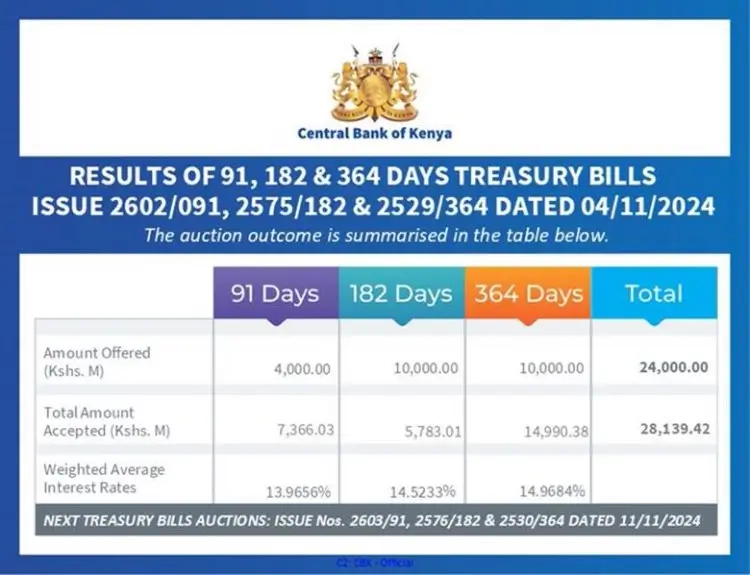

3. This week, treasury bills were oversubscribed, with the government raising Ksh 28.1 billion out of the Ksh 24 billion that was on offer. @CBKKenya

4. Last week, in partnership with Equity Bank, we hosted an X space event discussing the importance of insurance in investment portfolios for businesses, and households.

Key takeaways:

- Understand the cost vs. value before choosing an insurance product.

- Lack of awareness is a major reason for low insurance uptake.

- Insurance provides peace of mind, knowing you’ll be covered for any losses.

5. Safaricom hosted a two-day Cybersecurity Summit to raise awareness about the importance of investing in technologies to protect sensitive information and critical systems from cyber threats. @SafaricomPLC

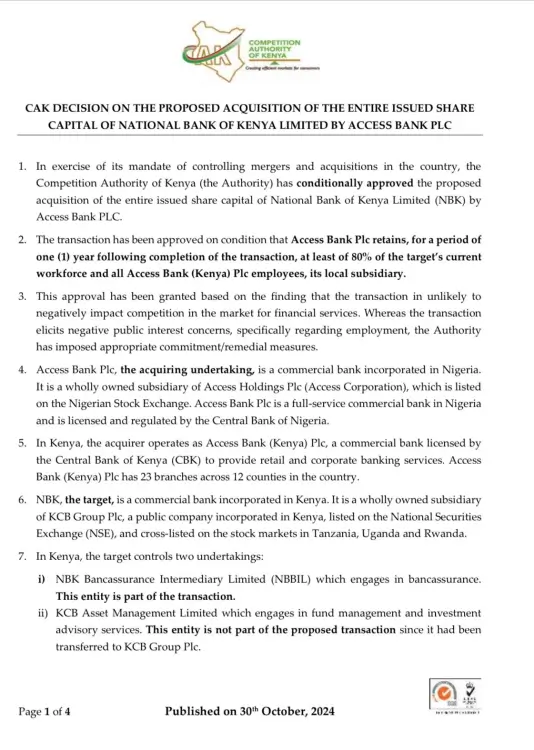

6. The Competition Authority of Kenya approved Access Bank PLC’s acquisition of National Bank of Kenya Limited. @CAK_Kenya

The approval requires Access Bank to retain at least 80% of NBK’s workforce for one year.

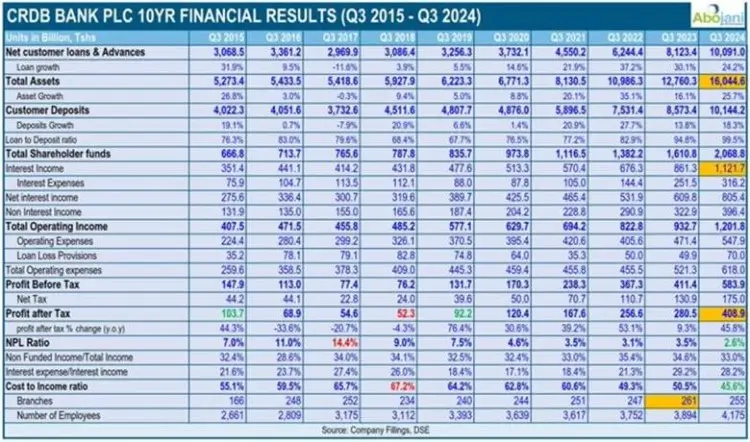

7. CRDB Bank PLC saw significant growth in Q3 2024, with profits after tax increasing by 45.8% to Tshs 408.9bn (Ksh19.4bn).

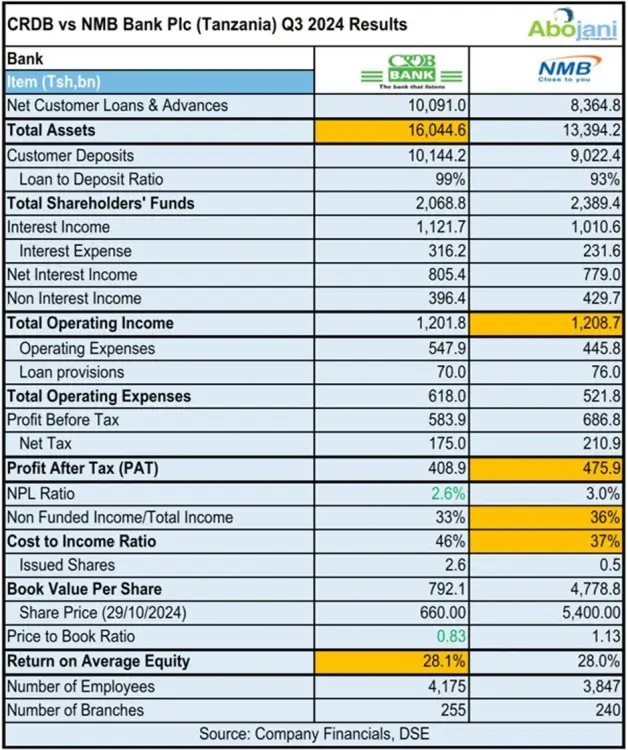

8. Tanzania’s largest banks released their Q3 2024 results this week. CRDB Bank retained its top spot by assets, while NMB Bank led in profitability.

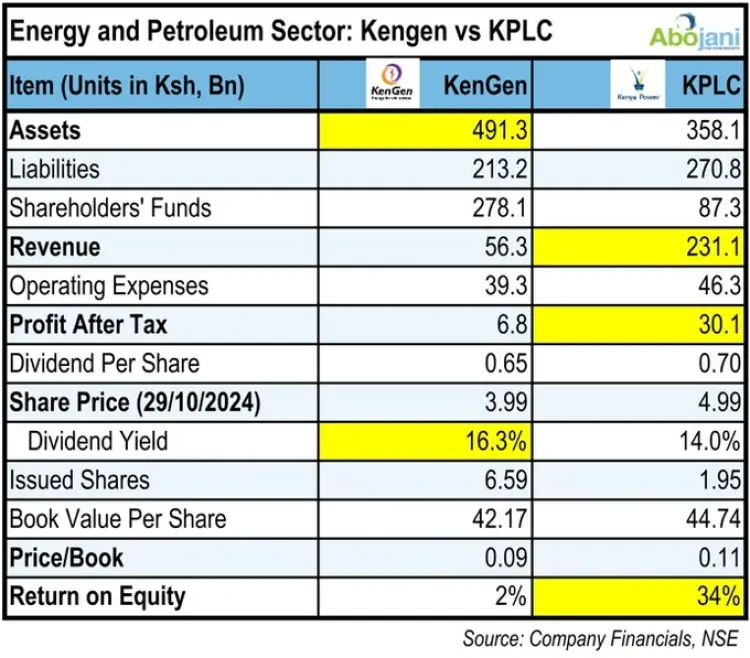

9. KenGen’s after-tax profits rose by 35.5% to KES 6.8 billion. KPLC reported a net profit of KES 30.1 billion, recovering from a KES 3.2 billion loss last year.

KenGen’s growth came from increased electricity revenue and finance income, while KPLC’s turnaround was due to higher revenue and lower finance costs.

10. NCBA Group partnered with Sanlam Life Insurance to offer new life insurance products. The collaboration introduced two insurance products: Digital Last Expense for funeral costs and Go Educator for educational expenses.

Additionally, a savings product will be introduced in the near future. @NCBABankKenya #NCBATwendeMbele

11. We’re thrilled and honored to announce ICEA LION Group, one of Kenya’s most trusted insurance providers, as a sponsor for our upcoming Economic Empowerment Conference. @ICEALION #WhatsYourPlan

They will provide guidance on how much coverage you need, the types of insurance available, and the role each can play in your overall investment strategy.

#EconomicEmpowermentKE #StayingPowerKE

Upcoming Event:

12. Safaricom will announce its half-year results on November 7, 2024, at 7:30 AM. The group announced Sh46.9bn net profit for the half-year ended Sept 2023.

13. We invite you for our 4th Economic Empowerment Conference on 23rd November 2023 at Radisson Blu in Upper Hill.

This year, we will make it a full day event with speakers from renowned institutions as well as panel discussions and a chance for everybody to expand their network.

See you there! #EconomicEmpowermentKE #StayingPowerKE

Call: 0763 682 116 or Email: learning@abojani.com