Our weekly highlights opens with:

1. Investors, SME’s, entrepreneurs and industry experts gathered at the 4th Abojani Economic Empowerment Conference at Radisson Blu, on Saturday the 23rd of November 2024 #EconomicEmpowermentKE

Key speakers shared insights on how to build resilience in 2025 and beyond…

2. The banking sector was been busy bee with activity as the banks rushed to roll in their Q3’2024 numbers. Absa Bank Kenya reported a profit after tax of Kshs. 14.7 billion for Q3’2024, a 20% increase compared to the same period last year….

3. Paul Russo , CEO of KCB Group would then follow, reporting an impressive 49% rise in Profit After Tax to Kshs. 45.8 Bn, up from the Kshs.30.7 Bn posted in Q3’2023…

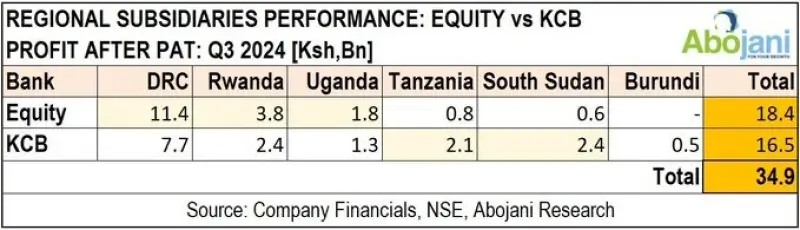

4. Notably, both Equity and KCB continue to rake in Billions from their regional subsidiaries. DRC continues to be the Chief Subsidiary contributor to both Group’s profits…

5. Standard Chartered Bank Kenya also rolled out Q3’2024 numbers @StanChartKE Kariuki Ngari announced a 63% increase in post tax profits from Ksh 9.74 Bn in Q3’2023 to Ksh 15.84 Bn in Q3’2024…

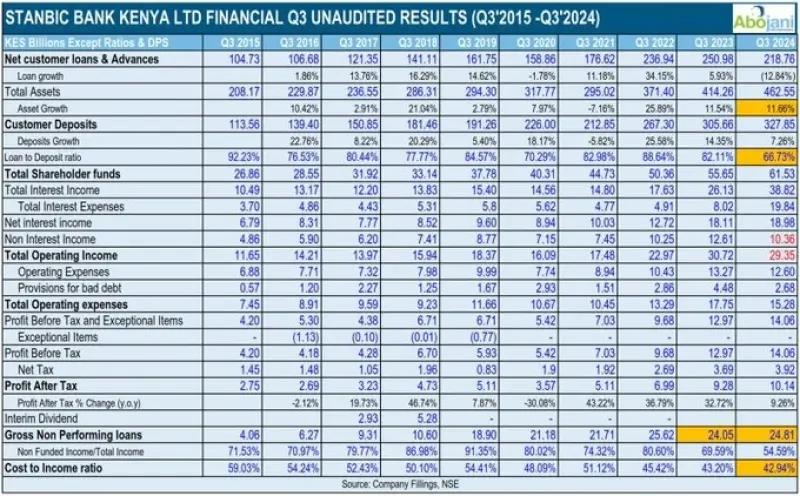

6. Stanbic Bank Kenya recorded a strong performance in Q3 2024, with a 9.26% increase in profit after tax, reaching Ksh 10.14 billion…

7. Equity Bank Ltd Kenya announced a reduction in interest rates on all new and existing Kenya Shilling-denominated credit facilities, following the recent decision by the Central Bank of Kenya’s Monetary Policy Committee (MPC) to cut the Central Bank Rate (CBR) from 12.75% to 12.0%…

8. On the other hand, @NCBABankKenya officially unveiled a new physical branch in Kerugoya, marking a strategic expansion aimed at enhancing its presence and better serving the local community…

9. I&M Group declared a rare interim dividend of Ksh1.3 per share, continuing with its move to distribute more of its earnings to shareholders.

@imbankke The company has historically paid only a final dividend after the close of each financial year…

10. The Insurance Regulatory Authority (IRA) has started the process of reviewing the current underwriting laws to cut claims payment period from the current 90 days, as well as improving the management of insurers…

UP NEXT: We invite registrations for the 63rd Abojani Masterclass that will run from 13th to 31st January 2025.

Our goal is to empower investors start the next year on a high note by improving their personal finance game!

Grab the Early Bird Offer, Register Here