The last week of 2024 and here are the weekly highlights, Week 52 of 2024

Here are some of the biggest stories that made headlines this week:

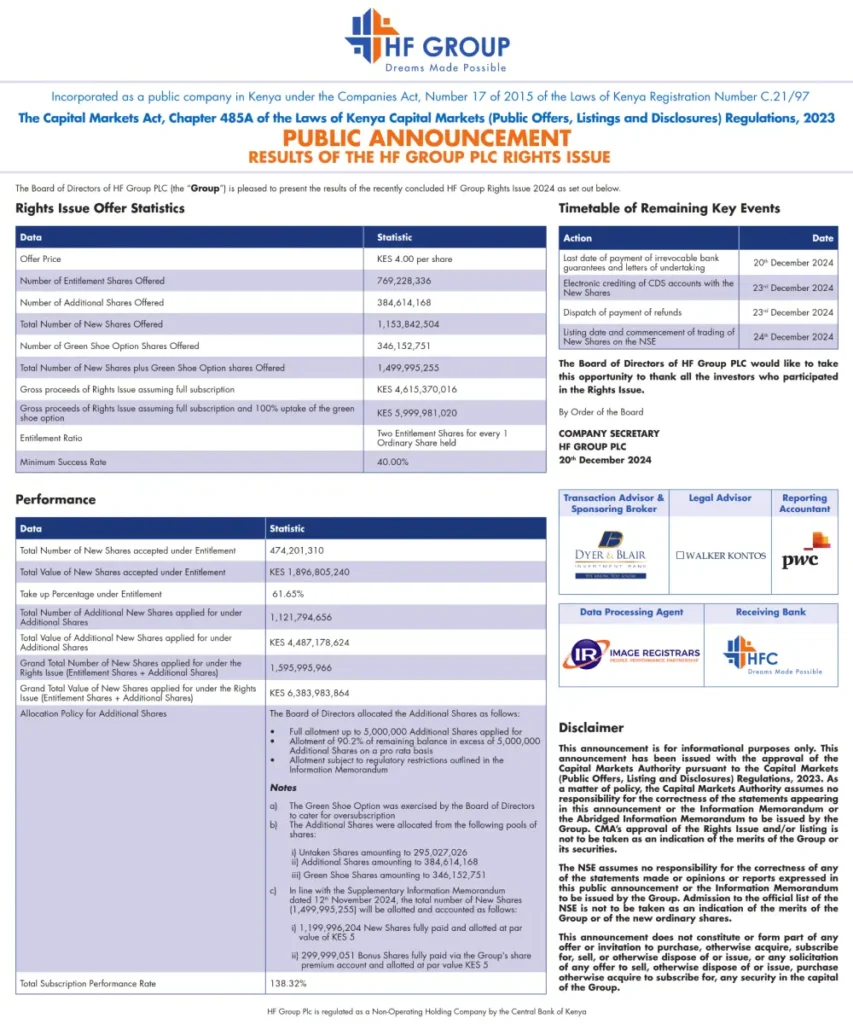

1. HF Group rights issue was oversubscribed by 38.32%, attracting Ksh6.4 billion in offers, surpassing the initial target of Ksh4.6 billion.

Also read: Monthly Spotlight Report, November 2024 Edition

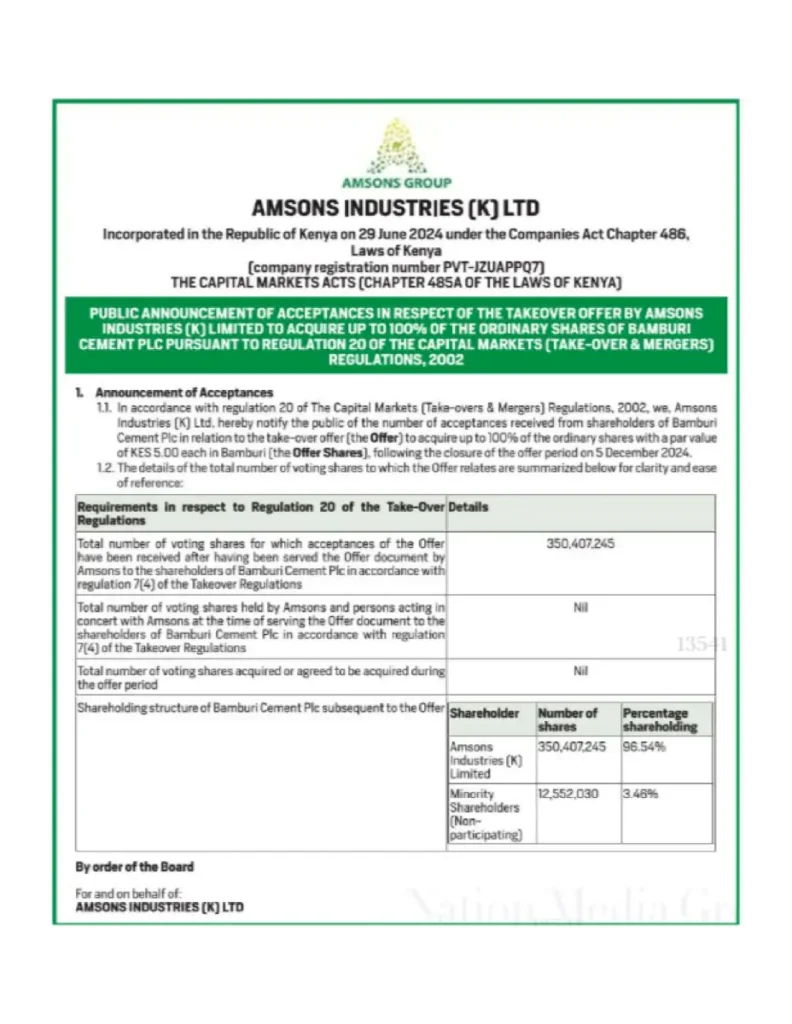

2. Amsons Industries (K) Ltd. announced the results of its takeover offer for Bamburi Cement Plc. The company now owns 96.54% of Bamburi Cement Plc, with minority shareholders holding the remaining 3.46%.

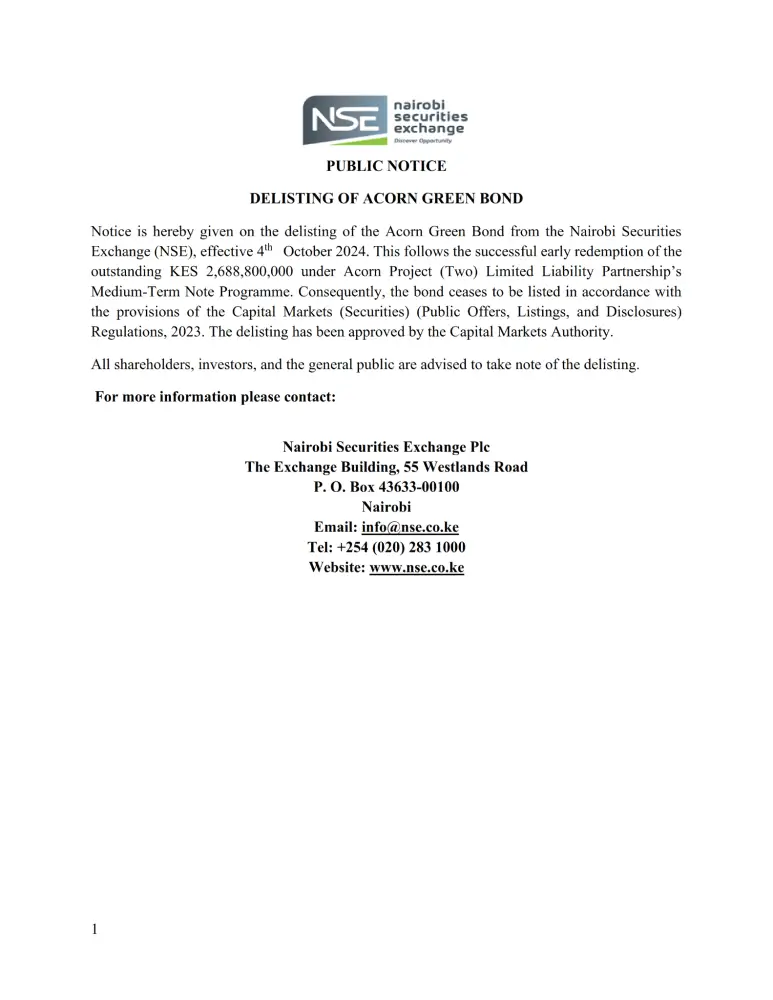

3. NSE PLC delisted the Acorn Green Bond, effective October 4, 2024. This follows the successful early redemption of KES 2,688,800,000 under Acorn Project (Two) Limited Liability Partnership’s Medium-Term Note Programme.

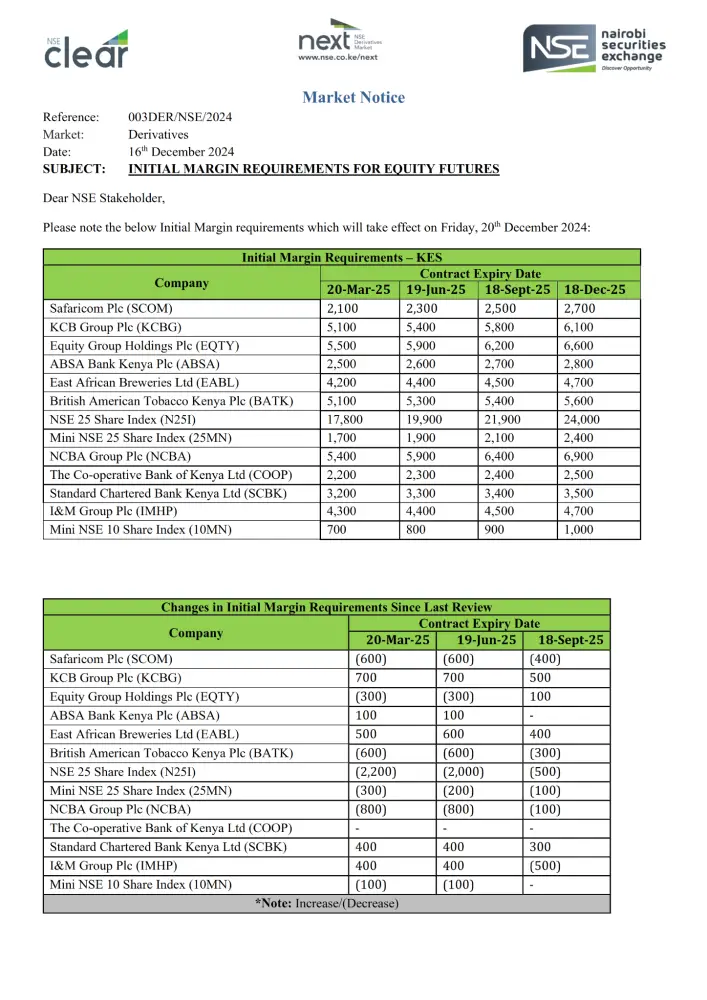

4. NSE_PLC announced new initial margin requirements for equity futures, effective Friday, December 20, 2024. The changes affect several companies and indices, with varying increases and decreases in margin requirements across different contract expiry dates.

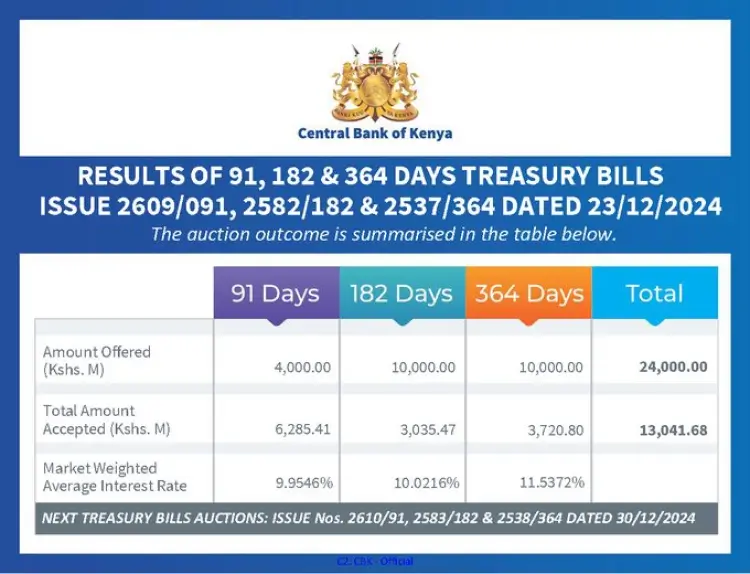

5. Treasury bills saw weak demand this week. CBK offered Sh 24 billion, receiving Sh 13.08 billion in bids and accepting Sh 13.04 billion. The 91-day Treasury bill interest rate dropped to single digits.

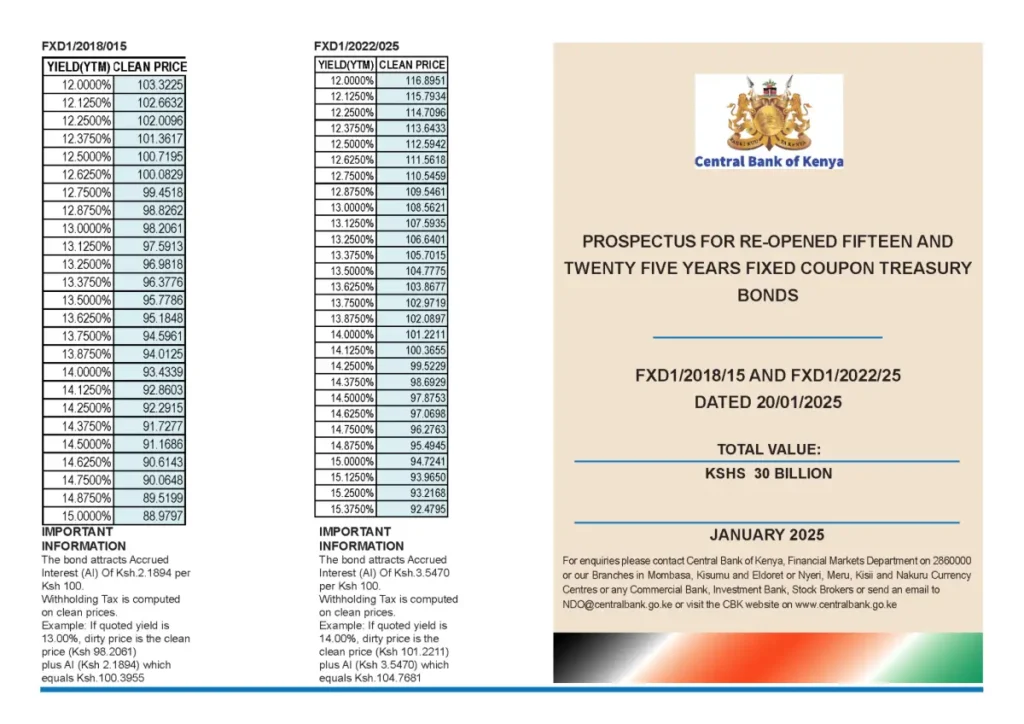

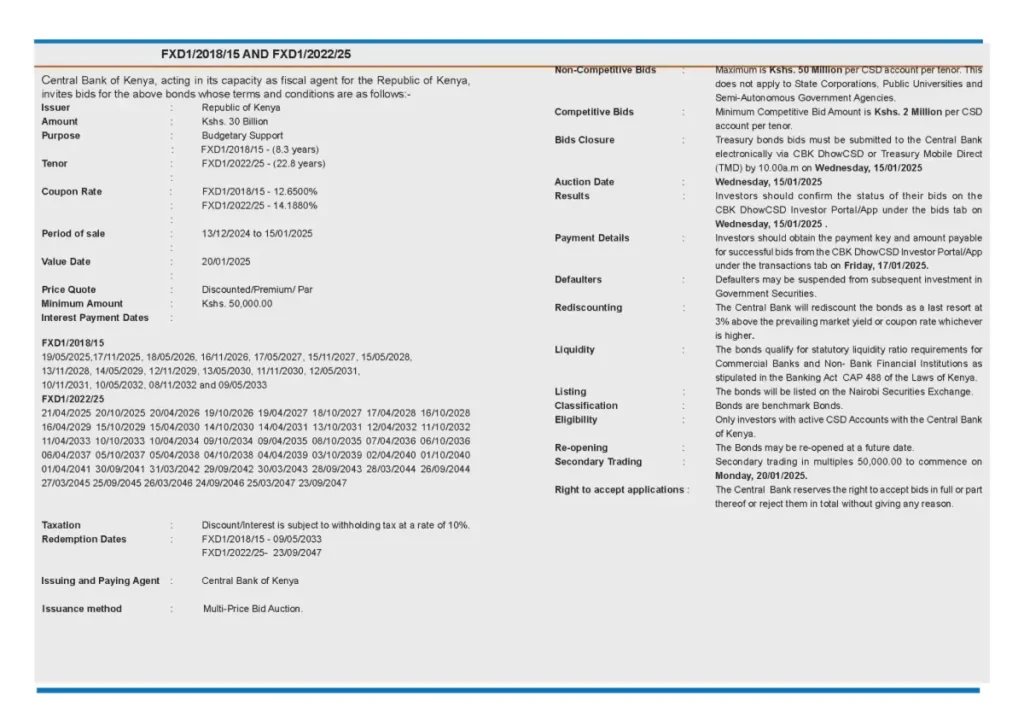

6. CBK is seeking to raise Sh 30 billion from re-opened fixed-coupon Treasury bonds (FXD1/2018/15 and FXD1/2022/25) for budgetary support. The 15-year and 25-year bonds have coupon rates of 12.65% and 14.188%, respectively. Bids close on 15 January 2025.

7. The #NCBAGoGetterInternship program, which began in April 2024 with over 40 ambitious interns, has officially concluded. Over the past 9 months, the interns immersed themselves in learning, tackled real-world projects, and grew their skills. This initiative underscores NCBA’s commitment to fostering excellence and being an employer of choice. #NCBATwendeMbele #Goforit

8. This week, at the Business Daily Africa Top 40 Under 40 Men Awards Dinner, 40 exceptional men were recognized for their tangible impact and remarkable achievements. A proud moment for us as our CEO, Robert Ochieng, stood among the awardees, a reflection of the impact and tangible results he delivers every day. #Top40Under40KE

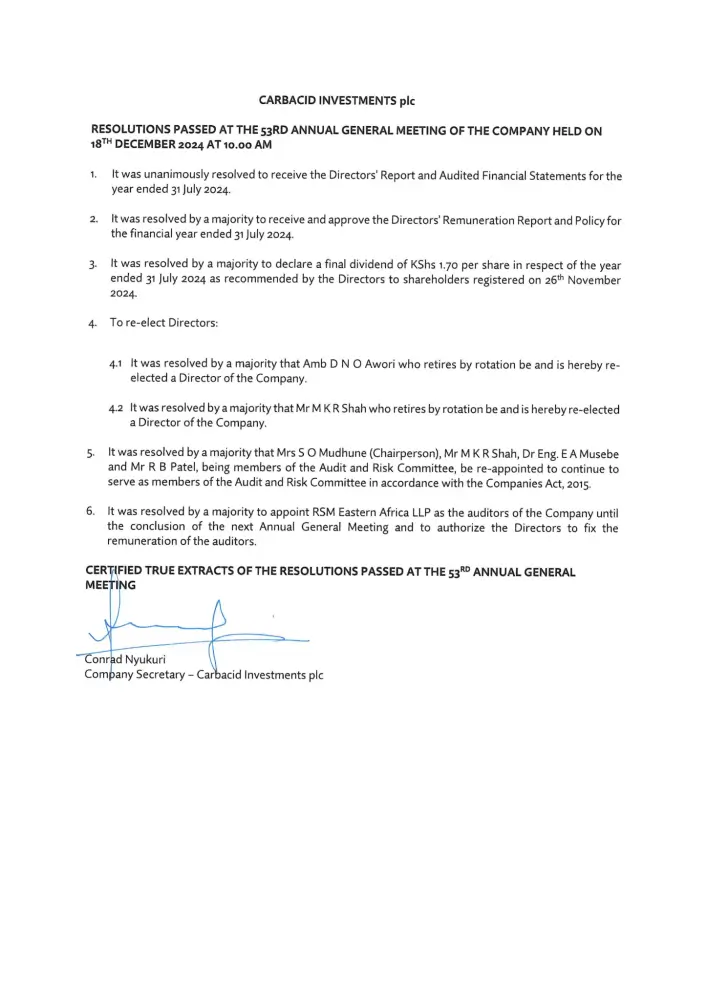

Carbacid Investments Plc held its 53rd AGM on December 18, 2024, and approved several key resolutions.

Most notably, shareholders approved a final dividend of Sh 1.70 per share for the financial year ended July 31, 2024.

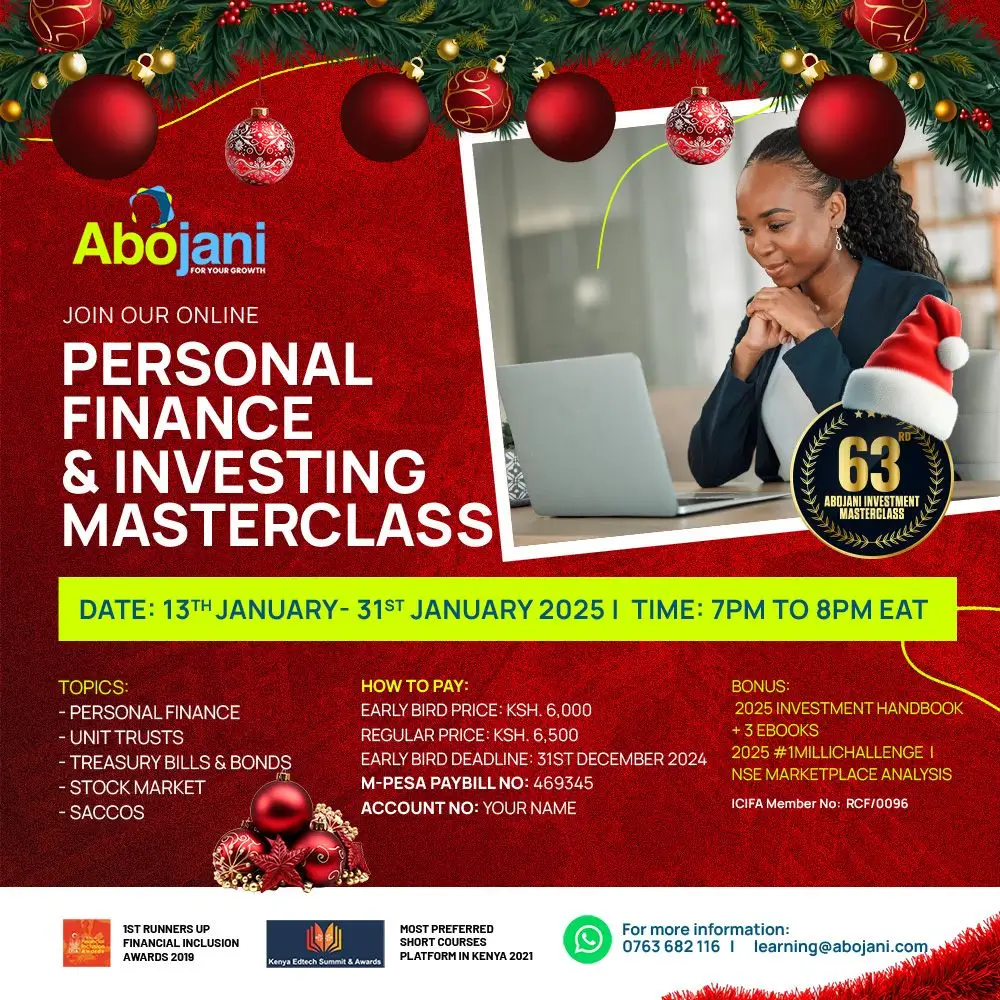

And lastly, if you missed our 62nd Masterclass, join Abojani’s 63rd masterclass to learn about personal finance, the stock market, SACCOs, MMF, bonds, and much more from 13th to 31st Jan 2025.

Book your ticket early for only Ksh 6,000 and get an investment handbook plus 3 e-books. Start 2025 with confidence and clarity in your finances.