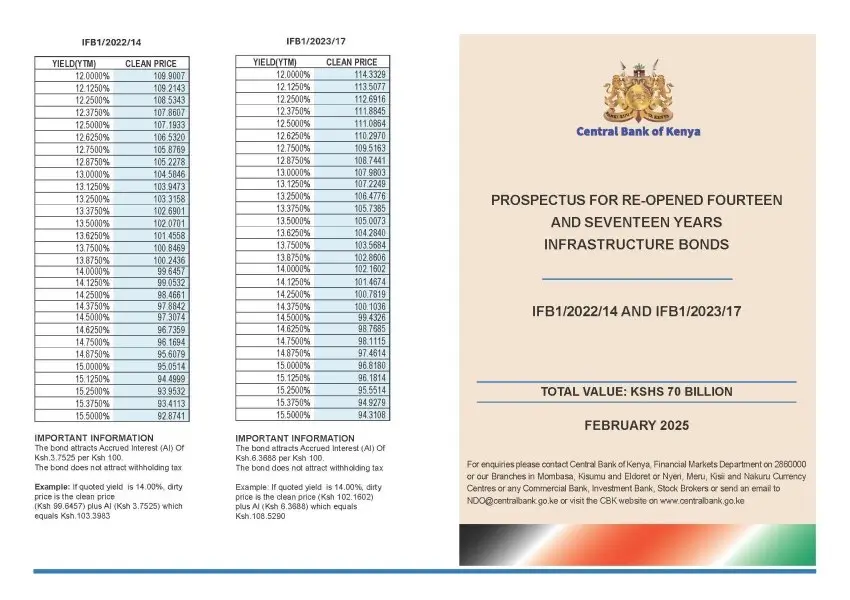

This being week 4 of 2025, the Central Bank of Kenya has issued a prospectus for 2 re-opened infrastructure bonds. These are tax free with tenures spanning 11.8 and 15.1 years. Interested parties are asked to submit their bids before 12th February at 10.00 am.

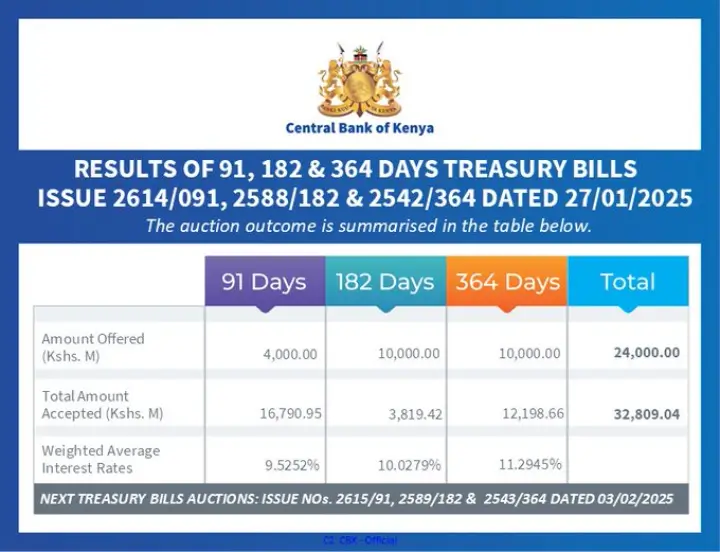

Treasury Bills interest rates have gone down once again, coming in at 9.5252%, 10.0279% and 11.2945% for the 91-Day, 182-Day and 364-Day papers respectively

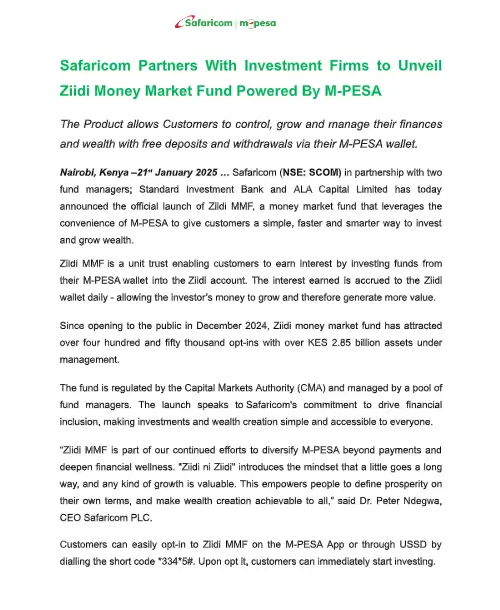

Safaricom officially partnered with Standard Investment Bank and ALA Capital Limited to Unveil Ziidi Money Market Fund Powered By M-PESA. Since opening to the public in Dec 2024, Ziidi has attracted over 450,000 opt-ins with over Ksh 2.85 billion Assets Under Management.

HF Group Plc held a Bell Ringing Ceremony to mark the successful completion of its oversubscribed Rights Issue. The event was attended by senior representatives from HF Group, the Nairobi Securities Exchange, the Capital Markets Authority, and other key stakeholders.

Standard Chartered Bank Kenya released its 2025 Global Market Outlook Report. According to the Wealth Management leader, President Trump’s “America First” policies are expected to drive inflation and boost domestic growth, with US equities projected to outperform other regions.

Kenya has introduced a new core inflation measure, covering 81.1% of the CPI basket with 275 items, compared to the previous 53.4% under Non-Food, Non-Fuel inflation. This updated measure excludes volatile items like unprocessed foods, energy, and transport, offering a more stable and reliable indicator of long-term price trends.

It has been a good week for several Asset Management companies as they achieved significant milestones…..

Sanlam money market fund surpassed Ksh 50 Billion in Assets Under Management.

Click Here To open an MMF account with Sanlam

On the other hand, the CIC Unit Trust Fund has reached an impressive KES 80 billion as of , marking a growth of KES 10 billion since Q3 2024 to Q4 2024. To open a Money Market Fund with CIC, use the link below: https://bit.ly/CICMMF

NCBA Bank has announced several job vacancies and is inviting applications for various positions.Interested parties are invited to apply via : https://t.co/6eWkpl8E0u

NCBATwendeMbele #GoForIt

Absa Bank Kenya and International Trade Centre partnered to launch an access to finance programme for women entrepreneurs in export businesses. The programme focuses on equipping participants with the skills needed to create bank-ready business plans and manage business risks effectively.

KCB Bank Kenya, in partnership with Mastercard, has launched Kenya’s first multi-currency prepaid card, supporting 11 hard currencies. Designed for students, athletes, online shoppers, businesses, and corporates, the card offers a cost-effective solution for managing international transactions, reducing fees, and enhancing convenience for global spenders.

Kenya Investment Authority (KENINVEST) and the Kenya Private Sector Alliance (KEPSA) have launched a collaborative multi-agency partnership aimed at significantly improving Kenya’s business environment.

Coming Up, the 64th Abojani Personal Finance & Investing Masterclass is set to start this February. We look forward to discussing in depth various investment products including Money Market Funds, SACCOs, and even stock markets. Have you booked your seat?

Register for Abojani 64th Masterclass