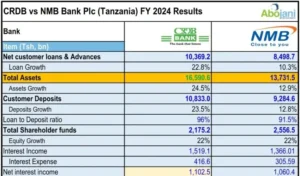

1. Tanzania’s biggest banks, CRDB and NMB, had a great year in 2024. CRDB’s profit after tax increased by 30%, hitting Tsh550.5 billion (Ksh28.0bn), and NMB’s profit went up by 18.1% to Tsh643.8 billion (Ksh32.7bn).

CRDB vs NMB

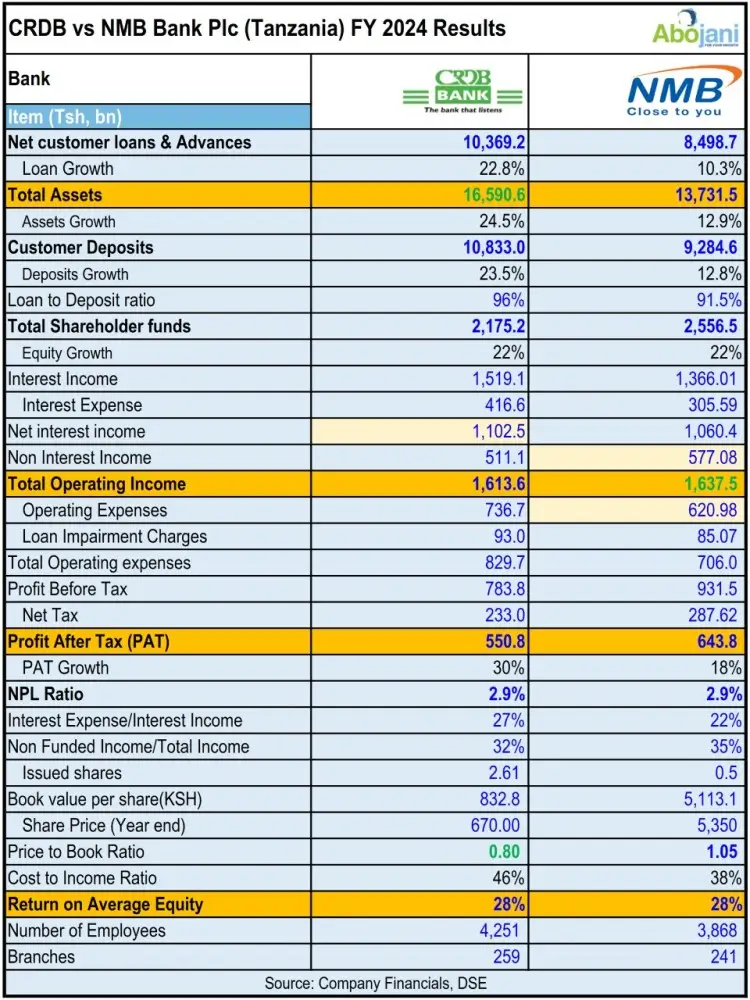

2. EABL saw a 20% increase in profit after tax, reaching Ksh 8.1 billion for the half-year ending December 31, 2024, despite the pressures of declining disposable income and rising input costs.

Revenue increased by 2%, to stand at Ksh67.9 billion, supported by favorable currency fluctuations, lower interest expenses, and the launch of new products.

The Board recommended an interim dividend of Ksh2.50 per share.

Equity Group Foundation has supported Tenwek Hospital’s transition from firewood to Liquefied Petroleum Gas (LPG), enhancing cooking efficiency and health conditions for students and staff at the hospital’s School of Health Sciences in Bomet County.

4. Family Bank relocated its Kangemi branch next to the Kangemi market to enhance customer experience, improve operational efficiency, and support local businesses. This is in line with its 2025-2029 strategic plan to provide accessible, customer-centric banking solutions.

5. ICEA LION Asset Management’s Fourth Quarter 2024 ILAM Consumer Spending Index rose by 2% driven by slight improvements in individual spending and retail business sales

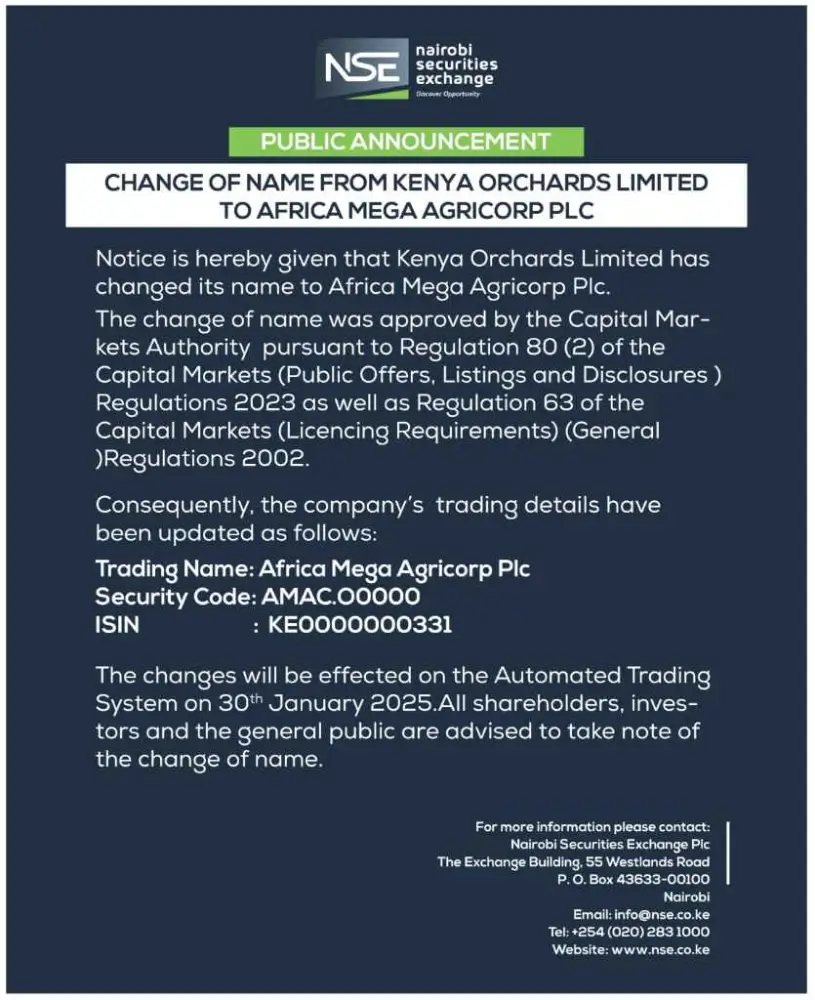

6. Kenya Orchards Limited officially changed its name to Africa Mega Agricorp Plc. This rebranding comes after receiving regulatory approval from the Capital Markets Authority.

7. KMRC announced the resignation of the company secretary, Elisha Nyikuli. Mr. Nyikuli served in that role for four years.

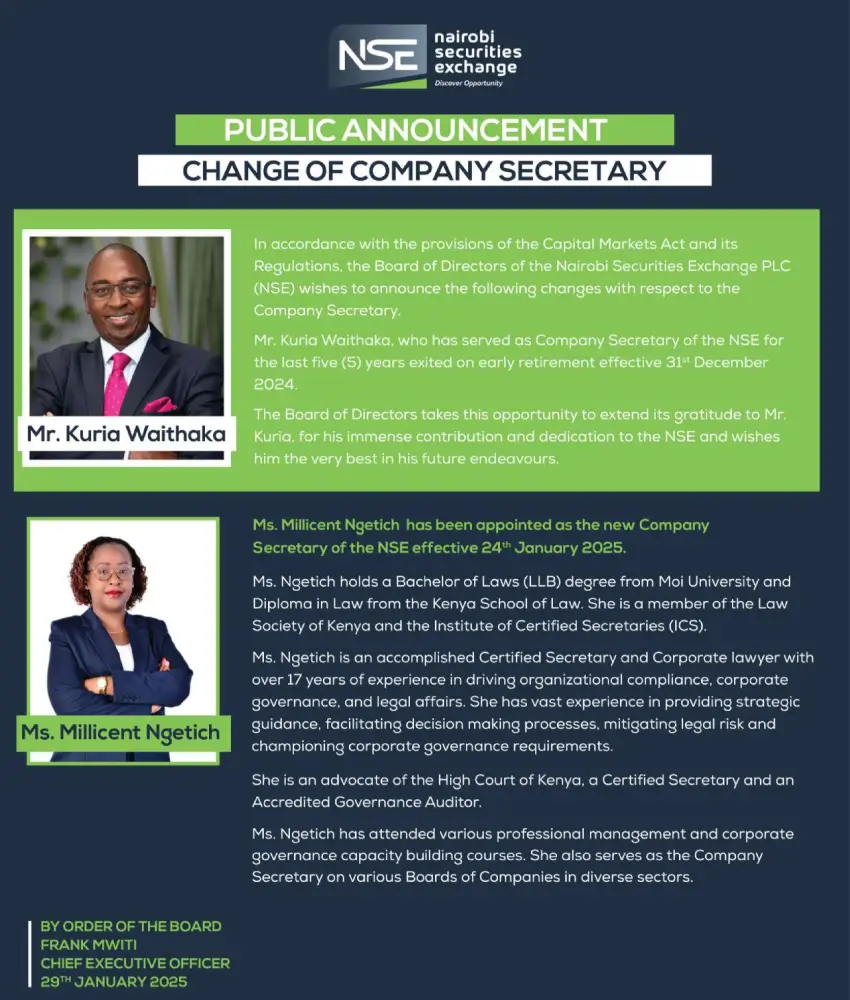

8. Kuria has retired from his position as Company Secretary at the Nairobi Securities Exchange. Millicent Ngetich has taken over the role, effective January 24, 2025.

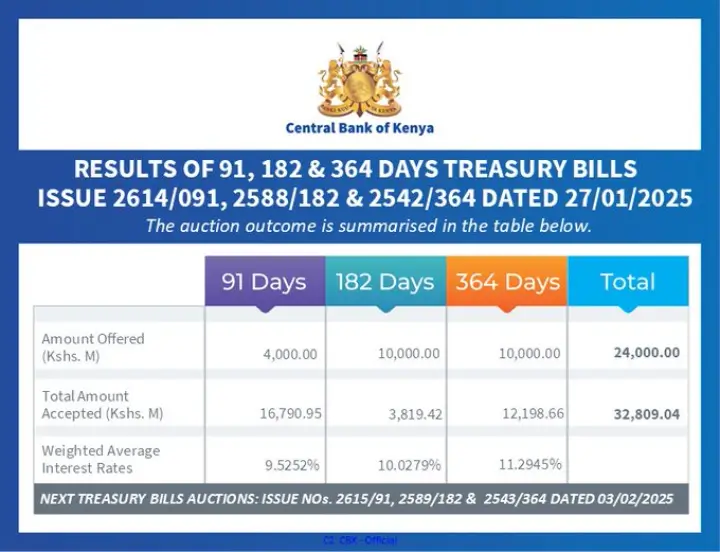

9. The Central Bank of Kenya offered Sh 24 billion worth of treasury bills, receiving Sh 13.462 billion worth of bids and accepting Sh 13.088 billion.

The 91 Days T Bills yield stood at 9.5647%.

10. Kenya Power posted a net profit of Ksh9.97 billion for the first half of the financial year ending December 31, 2024, driven by lower sales costs and reduced finance expenses. The board proposed an interim dividend of Ksh 0.20 per share.

Join us on February 10th, 2025, to learn how to manage your money and start investing. You’ll gain the skills and confidence you need to take control of your financial future.