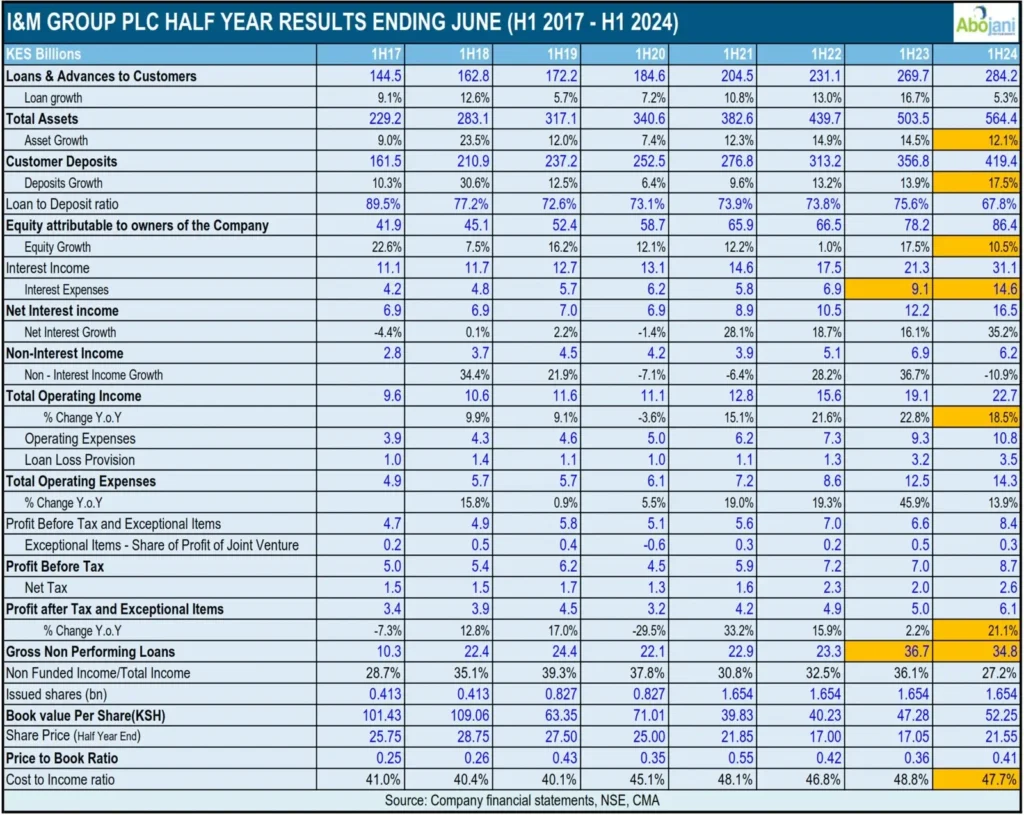

In the first half of 2024, I&M Group PLC reported a notable 24% increase in profit before tax, reaching KES 8.7 billion. This growth was supported by strong performances across all its markets, with the regional businesses contributing 26% to the group’s profit before tax.

I&M Bank Kenya was a standout performer, driven by significant growth in net interest income and fee income, alongside a decrease in loan loss provisions. The bank saw a 17% rise in operating income and a 12% increase in operating profit, reflecting a well-executed strategy to expand its retail and corporate banking segments.

A key highlight for I&M Bank Kenya was its impressive customer growth. The bank experienced a whopping 113% increase in customers compared to the same period last year. Remarkably, its small business (MSME) customer base more than doubled, thanks in part to the successful “Ni Sare” proposition.

With this “Ni Sare Kabisa” initiative, which offers free bank-to-mobile money transfers for personal accounts and solo business owners, I&M Bank Kenya took convenience to a whole new level. This initiative has alleviated the financial burden of transfer fees, allowing customers to move money instantly from their bank accounts to platforms like M-Pesa or Airtel Money without any extra cost.

This significant financial relief has undoubtedly contributed to the remarkable growth in customer numbers. Overall, I&M Bank Kenya now serves over 600,000 customers, establishing itself as one of the fastest-growing banks in the region.

On the regional front, I&M Group’s subsidiaries also performed well, contributing to the group’s overall growth. I&M Rwanda reported a 59% increase in profit before tax, driven by a 37% rise in operating income, while I&M Uganda saw a 54% growth in operating profit. Meanwhile, I&M Tanzania’s strategic focus on asset quality management resulted in a 25% increase in operating income and a 50% rise in operating profit. These results highlight the group’s successful expansion strategy and its commitment to meeting diverse customer needs across different markets.

As I&M Group celebrates its 50th anniversary, the bank continues to prioritize customer-centric solutions and market expansion. Its outstanding performance in H1 2024 is a testament to its strategic focus on innovation and customer satisfaction. With a solid growth trend and a commitment to making banking more accessible and convenient, I&M Group is positioned to continue its upward trajectory and deliver even greater value to its customers in the future.