On the evening of 20th November 2024, at the bustling hub of Kencom, KCB Group’s CEO Paul Russo engaged with shareholders, investors, and analysts to reveal the bank’s Q3 2024 performance. As keen observers at the briefing, here’s what we noted:

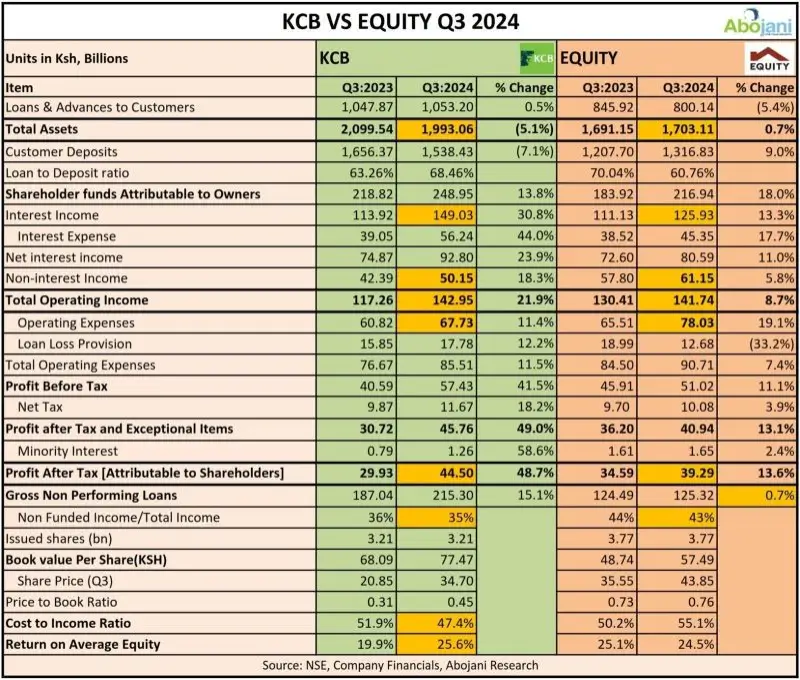

Russo announced a stellar 49% increase in profit after tax, reaching Ksh 45.8 billion, a significant jump from Ksh 30.7 billion during the same period last year. This robust growth cements KCB’s position as Kenya’s most profitable and largest bank by assets.

Read: 1H 2024 Banking Sector Results – Asset Management & Bancassurance Units Performances

The growth trajectory was driven by a notable rebound in KCB Kenya and sustained momentum in the international markets. These factors underscore the benefits of KCB’s strategic diversification.

By the end of Q3 2024, KCB’s operational footprint spanned seven countries: Kenya, Tanzania, Rwanda, Uganda, Burundi, DRC, and South Sudan. This expansion highlights the group’s robust regional presence.

The bank noted a depreciation trend in most currencies against the dollar over the nine months leading to September 2024. Interestingly, the Kenya and Uganda Shillings were the exceptions, showcasing relative stability.

KCB’s balance sheet is the largest in the region, with KCB Kenya remaining the primary contributor to the Group’s total assets. However, contributions from other subsidiaries saw a marginal increase from 33.3% in Q3 2023 to 33.7% in Q3 2024.

Despite impressive growth metrics, non-performing loans (NPLs) remain a concern. The Group is targeting NPL ratios of 16% – 18% by year-end. Notably, KCB Kenya and the National Bank of Kenya are the main contributors to the Group’s NPL stock. To address this, KCB is in discussions with the government regarding related entities and potential write-offs.

Overall, KCB Group has maintained strong capital buffers, with all banking subsidiaries reporting robust capital ratios. Except for the National Bank of Kenya, all subsidiaries complied with their respective local regulatory capital requirements.

KCB Group’s Q3 2024 performance underscores its resilience and strategic vision.

As the Group continues to navigate economic challenges and capitalize on growth opportunities, it remains well-positioned for sustained success in the region.