Personal Finance

Unleash Your Money Mindset

Weekly and Monthy Highlights

- CBK Cuts Central Bank Rate from 10.75% to 10%14 Apr

- CBK Receives Ksh. 40.69 Billion Bids After Offering Ksh. 24 Billion Worth Of Treasury Bills07 Apr

- KCB Group Records the Fastest Growth in Profitability, a 66.1% Increase to KES 60.09 Billion31 Mar

- Absa Bank Kenya’s Net Profit Grows by 28% to Ksh 20.9 billion in Financial Year 202424 Mar

Trained Over 1 Million Individuals on Financial Awareness by 2025, and Still Counting

Join a community of like-minded people on the same journey towards their prosperous financial future.

Enable Your Money to Work as Hard as You Do

Finance Planning

Personal

Investing

Wealth Management

Risk Management

via Insurance Products

Retirement

Planning

Succession Planning

+ Estate Administration

Taxation

Tax Principles

Financial Education for You

Financial Masterclass

From budgeting to debt management, investing and beyond, invest a few hours of learning and gain the knowledge and confidence to make a lifetime of smart financial decisions on your own

Coaching & Mentorship

The annual subscription helps you get real with where you are currently with your income, debt, expenses and investments and chart the way forward to your desired future. We walk the journey with you.

Consulting

Elevate your business, investment and valuation analysis using our proven methodologies. Partner with us to educate your stakeholders and reach on finance in plain English.

Trusted By Industry Leaders

Start thinking about your

financial future

Abojani is a leading financial and investment advisory firm. We are here to help you make smart decisions with your money. Whether you’re a seasoned investor or just starting your journey towards financial freedom, we are the perfect companion to guide you every step of the way.

Ksh 750K+

+7% this month

Amount Invested by the Community Members

8,000+

Ksh 483K+

Ksh 400M+

Educate Yourself on Money and Personal Finance

Explore news, insights and our Personal Financial Management Program that level up your financial well-being.

NCBA: The Bank That Moves with You

“Progress is impossible without change, and those who cannot change

The Dawn of a New Era in the Insurance Industry

On Thursday, 20th March 2025, Nairobi’s skies were alight with

CBK Cuts Central Bank Rate from 10.75% to 10%

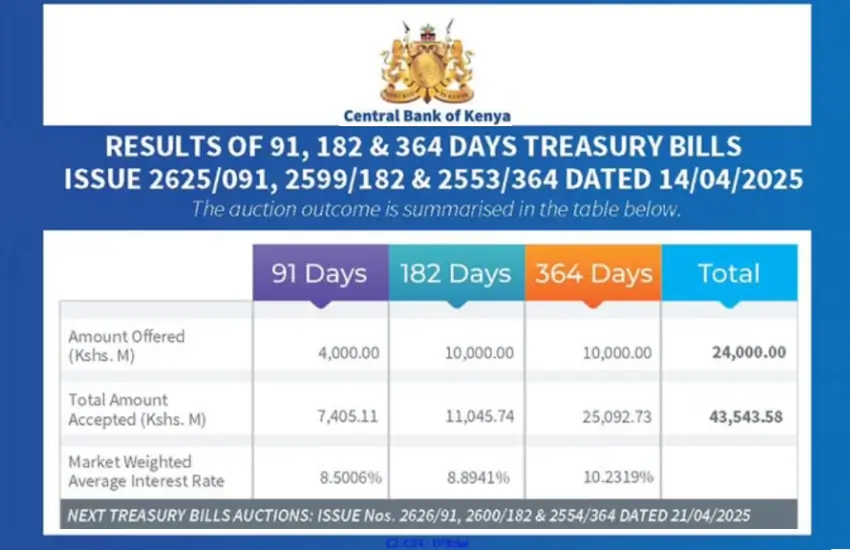

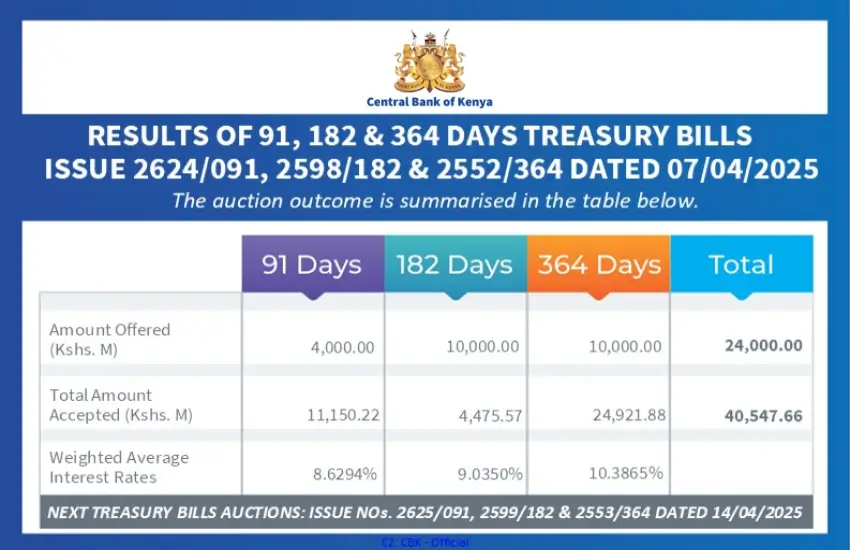

1. This week, treasury bills were oversubscribed, seeing the government

Dividends: Why They Matter More Than You Think

When many people think of investing, they imagine buying and

Budgeting: A Guide for Small Business Owners

As a small business owners, you might constantly find yourself

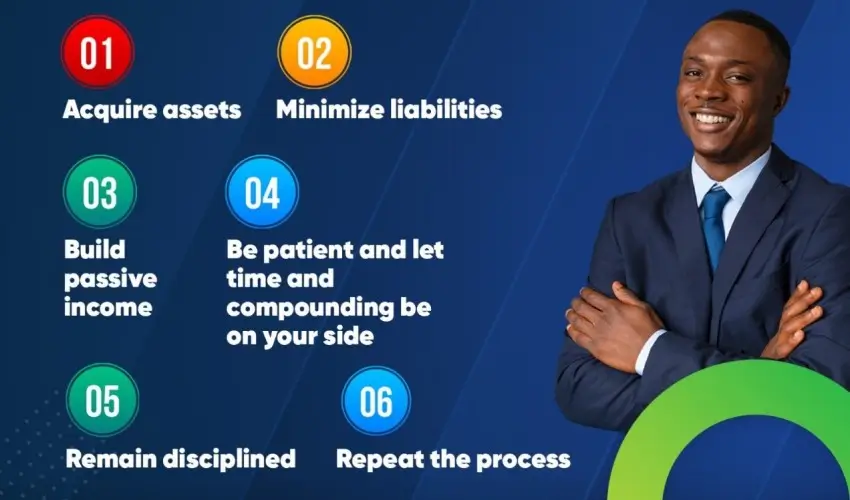

9 Money Habits that Lead to Success

You can adopt these practical habits for a financially sound

CBK Receives Ksh. 40.69 Billion Bids After Offering Ksh. 24 Billion Worth Of Treasury Bills

Here’s your round-up of this week’s key financial and corporate

I&M Bank’s FY 2024 Results: A Year of Strong Growth and Promising Returns

I&M Bank has had an impressive year, with its FY

What Business Leaders and Masterclass Alumni say about us

I attended their Personal Finance and Investing Masterclass that radically transformed my approach to handling money."

If you re looking for Practical

Financial knowledge packaged in

easy to digest format...

ABOJANI is the place.

Best value for money !!! "

Take Life’s Next Steps With Confidence

Abojani Personal Finance Training provides you with structured and unbiased advice that will help you keep your life goals on track.