As is our norm, we present our Monthly Spotlight Report: January 2025 Edition.

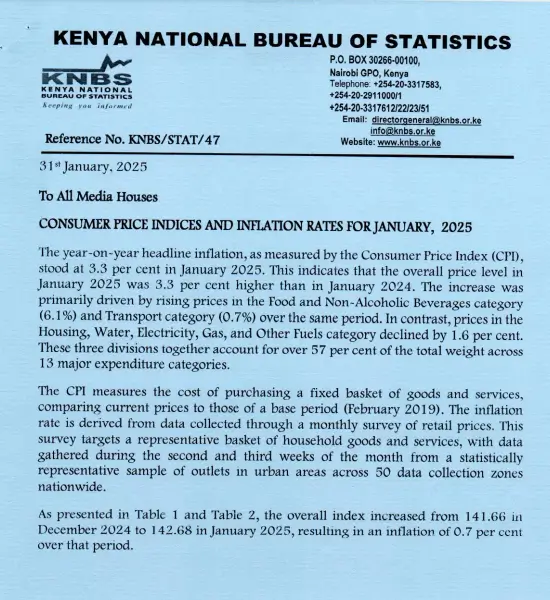

1. The year on year headline inflation rate came in at 3.3% in January 2025, attributed to rising costs of food and non-alcoholic beverages, as well as transportation costs.

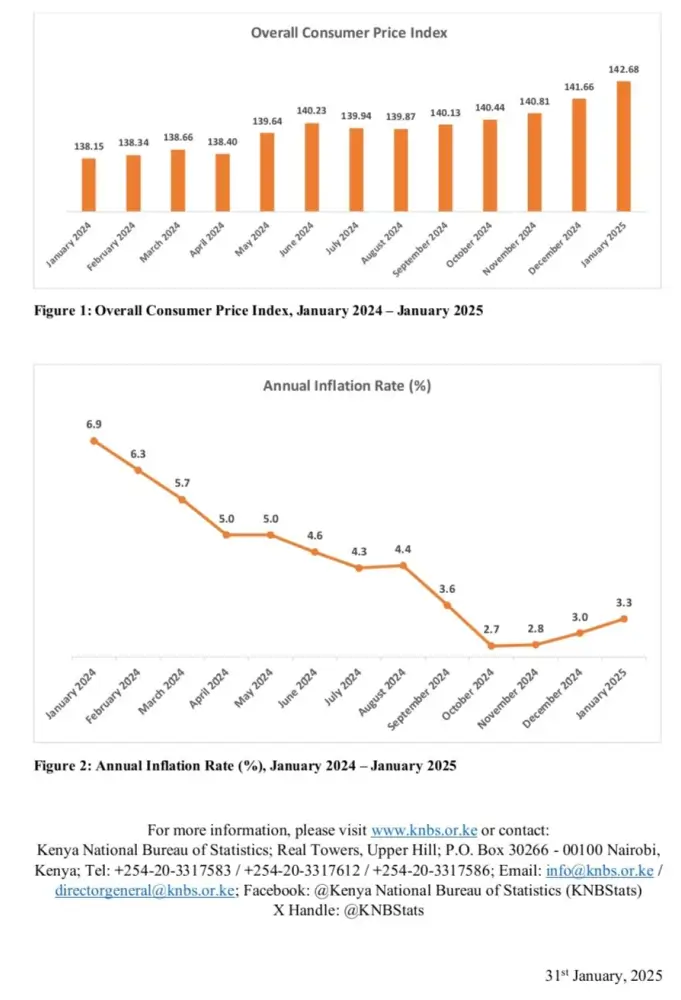

2. During the month, the government has gone to the markets to raise Ksh 70 billion from investors through the re-opening of infrastructure bonds, aimed at funding infrastructure projects for the fiscal year 2024/2025.

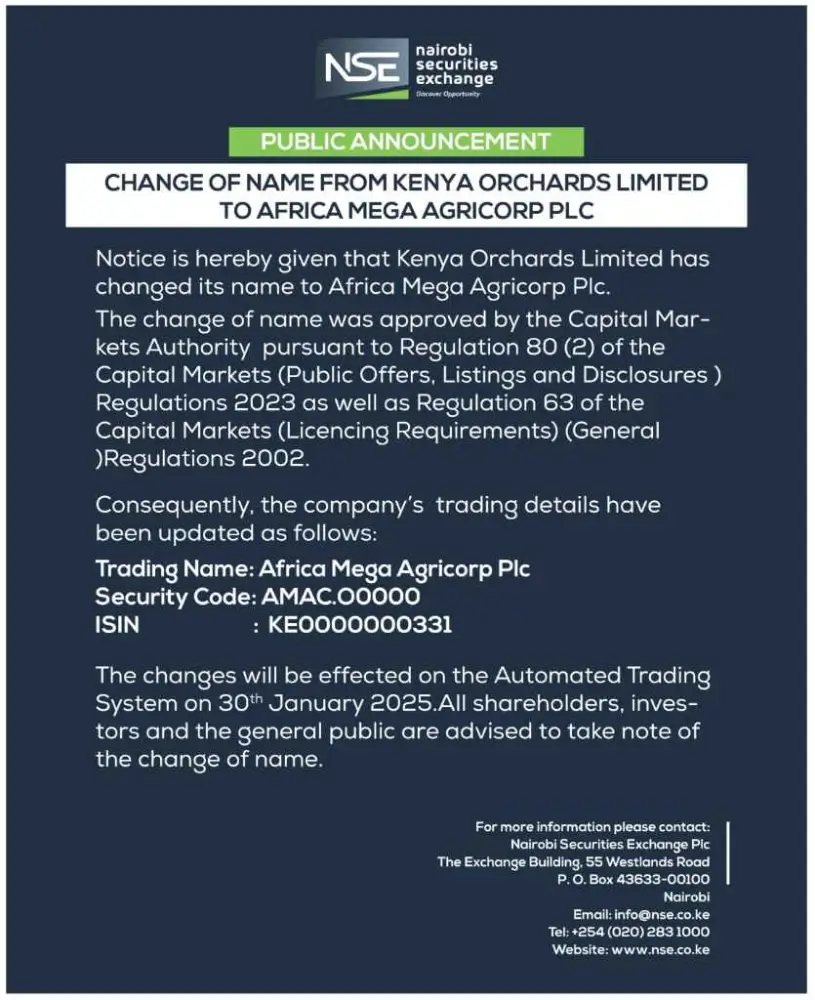

3. Approved by the Capital Markets Authority, Kenya Orchards Limited has changed name to Africa Mega Agricorp Plc

4. The Nairobi Securities Exchange then gave notice that the suspension of trading in Kenya Airways Plc securities has been lifted, effective January 5, 2025.

5. Listed brewer, EABL, has reported a 20% increase in profit after tax, reaching Ksh8.1 billion, for the half-year ending Dec 31, 2024. The Board has recommended an interim dividend of Ksh2.50 per share.

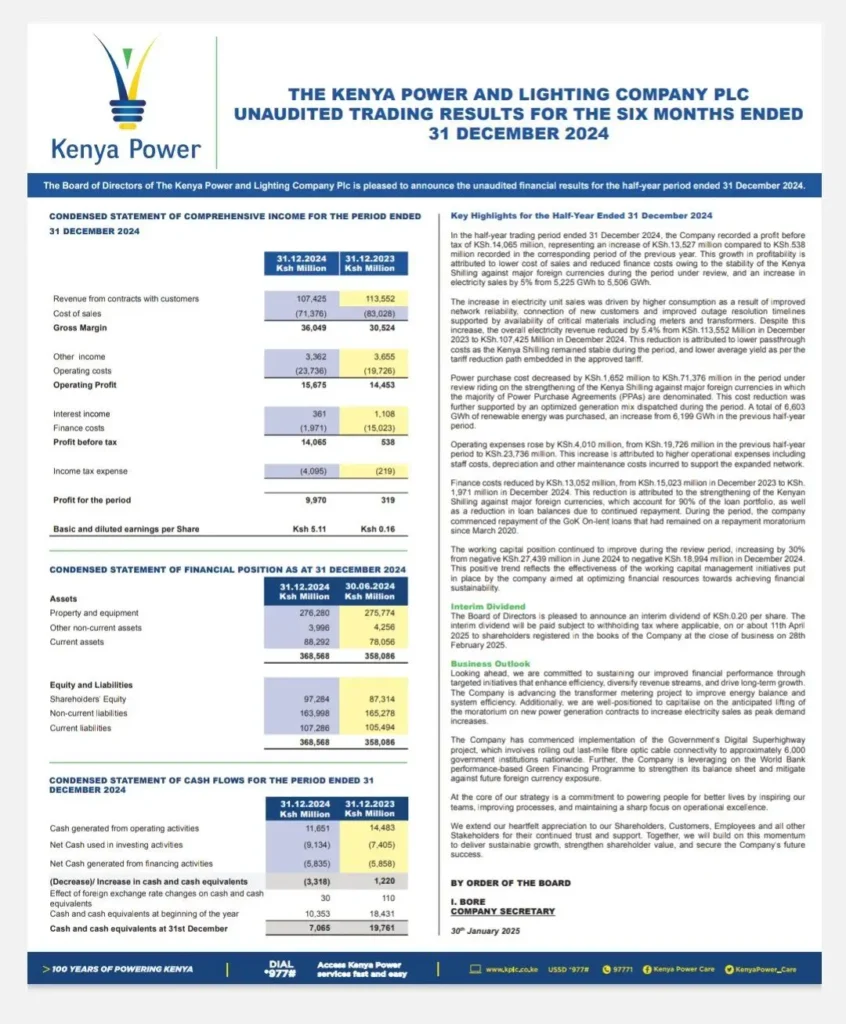

6. And in a positive development, KPLC has announced it will pay an interim dividend for the first time in nine years. This decision comes after the company reported a jump in profits owing to lower cost of sales and reduced finance costs as a result of stability of the Kenyan shilling.

7. HF Group Plc held a Bell Ringing Ceremony to mark the successful completion of its oversubscribed Rights Issue.

- The event was attended by senior representatives from HF Group, the Nairobi Securities Exchange, the Capital Markets Authority, and other key stakeholders.

8. Standard Chartered Bank Kenya released its 2025 Global Market Outlook Report.

- According to the Tier 1 lender, President Trump’s “America First” policies are expected to drive inflation and boost domestic growth, with US equities projected to outperform other regions.

9. Ipo kazi Kenya!

In a bid to strengthen its human capital muscle, NCBA Bank has announced several job vacancies and is inviting applications for various positions.

- Interested parties should apply here : Apply NCBA Jobs

10. Absa Bank Kenya and International Trade Centre partnered to launch an access to finance programme for women entrepreneurs in export businesses.

11. KCB Bank Kenya, in partnership with Mastercard, launched Kenya’s first multi-currency prepaid card, supporting 11 hard currencies.

- The card offers a cost-effective solution for managing international transactions, reducing fees, and enhancing convenience for global spenders.

12. Kenya’s largest telco, Safaricom, officially partnered with Standard Investment Bank and ALA Capital Limited to Unveil Ziidi Money Market Fund Powered By M-PESA.

- Since opening to the public in Dec 2024, Ziidi has already attracted over 450,000 opt-ins with over Ksh 2.85 billion Assets Under Management.

13. The telco was recognized by the Top Employers Institute as Kenya’s #1 Top Employer and a Top Employer in Africa for the fourth year in a row.

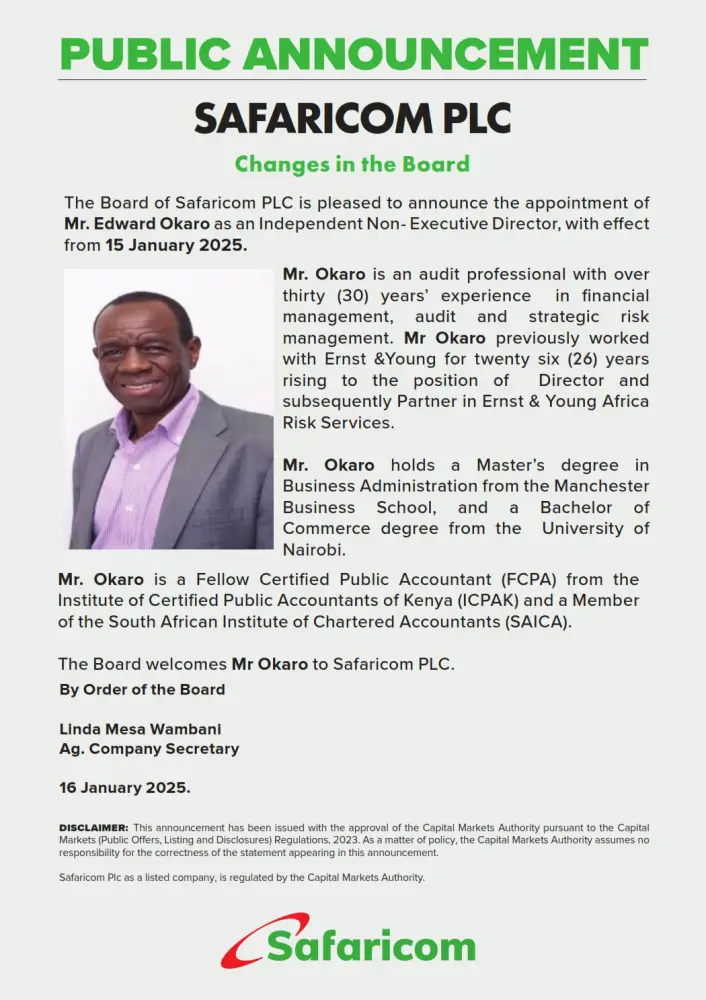

14. Safaricom PLC appointed one Mr. Edward Okaro as an Independent Non-Executive Director, effective January 15, 2025.

- Mr. Okaro is an audit professional with over 30 years of experience in financial management, audit, and strategic risk management

15. M-PESA Foundation then invested Ksh 95 million in health projects across Busia and Bungoma counties, focusing on improving maternal health outcomes through infrastructure development. #TransformingLives

16. And in an interesting turn of events, Dr. James Mwangi, the Group CEO, Equity Group, has officially joined the Council on Foreign Relations (CFR) Global Board of Advisors.

- CFR is a leading American think tank specializing in U.S. foreign policy and international relations.

17. The Central Bank of Kenya announced the appointment of one Mr. Gerald Nyaoma as Deputy Governor.

- Mr.Nyaoma comes with decades of experience in the financial services sector.

18. Standard Chartered Bank Kenya also announced that Dr. Catherine Adeya retired as an Independent Non-Executive Director, while Ms. Julie Browne resigned as a Non-Executive Director, both effective December 31, 2024.

19. NCBA officially launched the 2025 NCBA Golf Series at the Kenya Railway Golf Club, kicking off an exciting golfing season across East Africa.

- This year’s series includes partnerships with the Kenya Golf Union (KGU), Kenya Golf Foundation (KGF), and Professional Golfers Kenya (PGK).

20. NCBA Group Managing Director was recognized as one of the Top 25 Most Amazing CEOs Leading Business with Ethics and Integrity in Business Monthly’s latest edition.

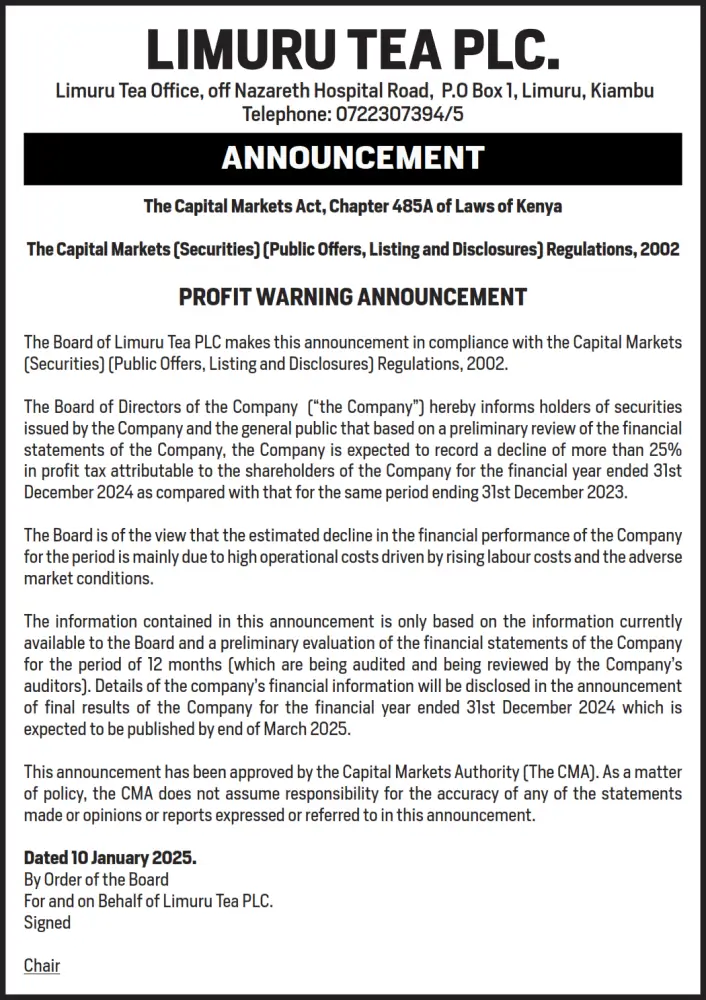

21. Limuru Tea issued a profit warning for the financial year ending December 31, 2023, projecting a decline of over 25% in profits. This is due to high operational costs driven by rising labor expenses and adverse market conditions.

22. And in the insurance sector, Xplico Insurance’s statutory management was extended to March 7, 2025, allowing more time for policyholders and creditors to claim.

- Policyholders Compensation Fund, managing the insurer since December 2023, has capped payouts at Sh250,000.

23. FTG Holdings Ltd announced the appointment of St Lawrence Management Limited as the new Company Secretary, effective 30th August 2024. The company also welcomes Mr. Deven Auracootee and Mr. Bachun (Bob) Bishwarnath to the Board of Directors.

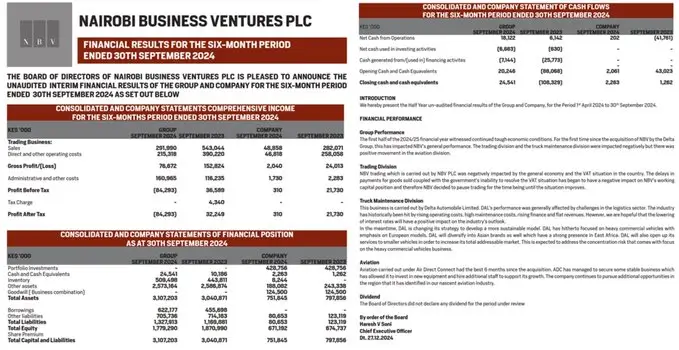

25. NBV reported a loss after tax of Ksh 84.29 million for the six months ending September 30, 2024, down from a profit of Ksh 32.25 million last year, due to economic challenges, VAT issues, and rising costs. No dividend was declared for the period.

25. Coming up this month, we look forward to the 64th Masterclass that will cover all matters Personal Finance, Saving and Investing.

- The early bird offer officially expires at midnight 31st Jan 2025. Call: 0763 682 116 or Email: learning@abojani.com

- Click HERE to Register