Absa Bank Kenya’s net profit grew by double digits, up 28% to Ksh 20.9 billion in 2024. The bank raised its dividend payout to Ksh 9.5 billion. #AbsaFY2024Results

Absa Bank Kenya’s net profit grew by double digits

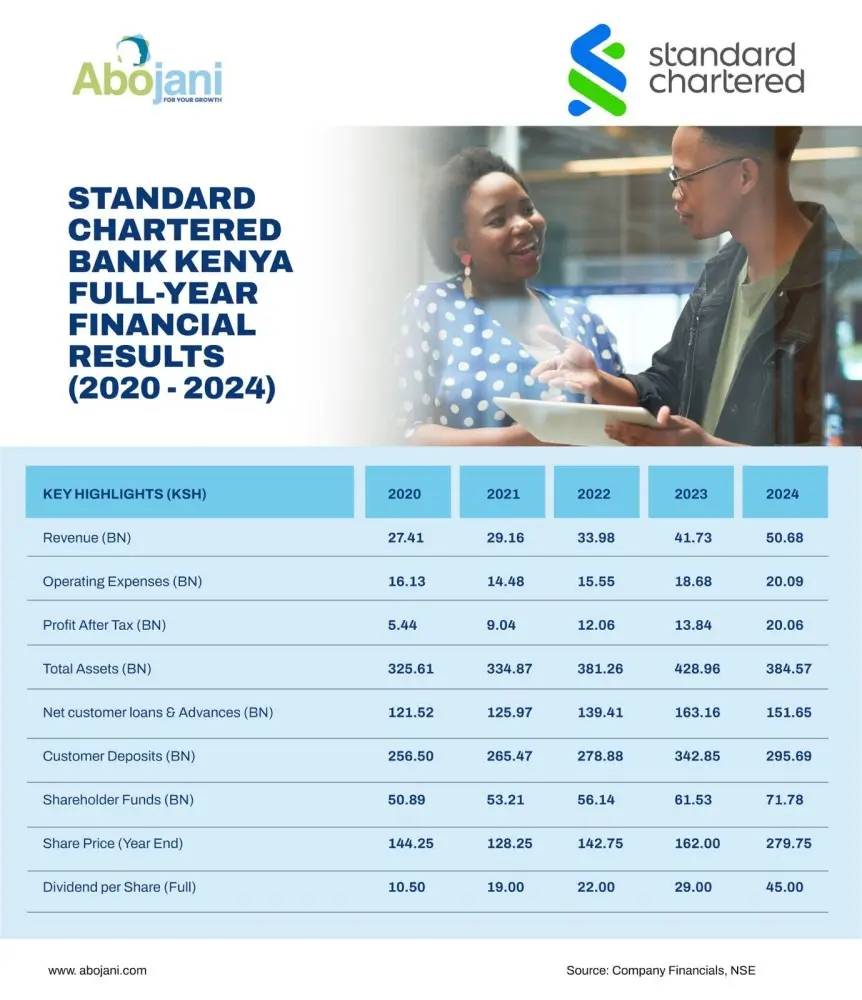

StanChart Kenya crossed Ksh 50 billion in revenue, in FY 2024, driven by strong corporate and wealth banking growth. Profit after tax rose 45% to Ksh 20 billion, with corporate banking contributing the largest share. The bank increased total dividends by 55% to Ksh 45 per share, including a final payout of Ksh 37 per share.

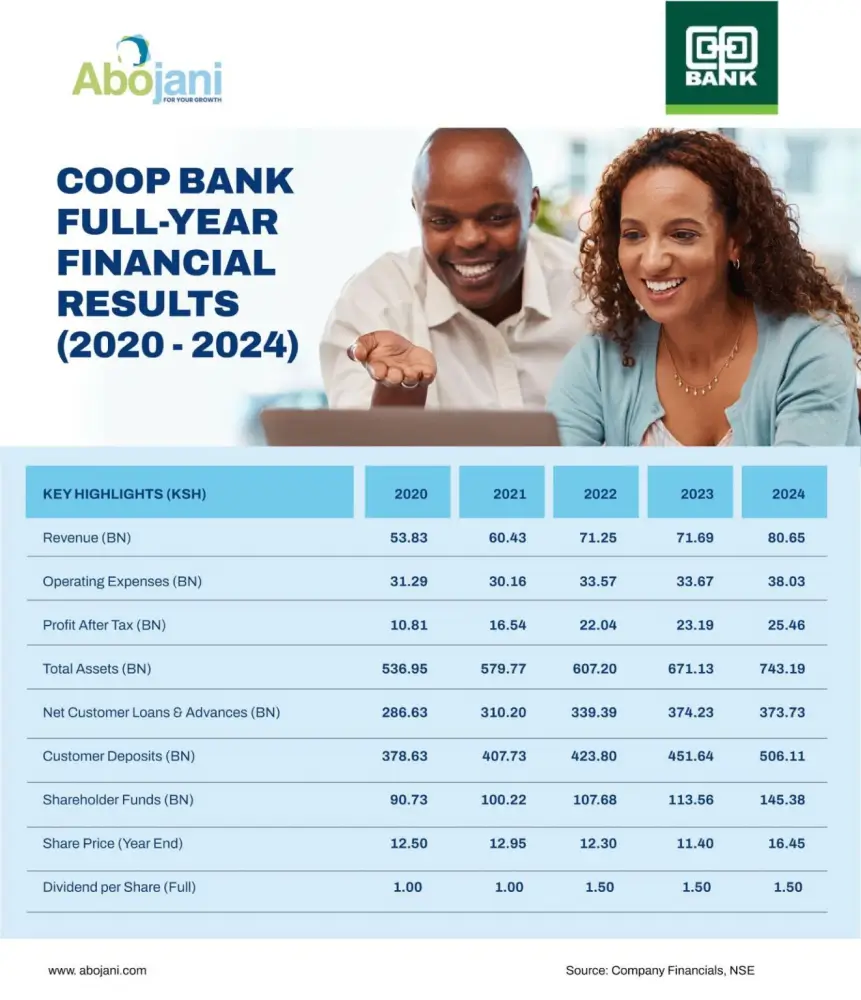

Co-operative Bank of Kenya’s profit after tax grew by 9.8%, rising from Ksh 23.2 billion in 2023 to Ksh 25.4 billion in 2024. The bank also declared a dividend of Ksh 1.50 per share, set to be paid around June 10, 2025.

NCBA Group has unveiled the new brand identity for its insurance business following the full acquisition of AIG Kenya in July 2024. The insurance subsidiary, now named NCBA Insurance Company, joins NCBA’s six other subsidiaries, strengthening the Group’s commitment to expanding its presence in the evolving financial services landscape.

Old Mutual Group posted a 550% increase in Profit After Tax for FY 2024, rising from Ksh 0.2 billion in 2023 to Ksh 1.3 billion, driven by strong asset management performance, improved underwriting profits in insurance, and solid returns on invested assets.

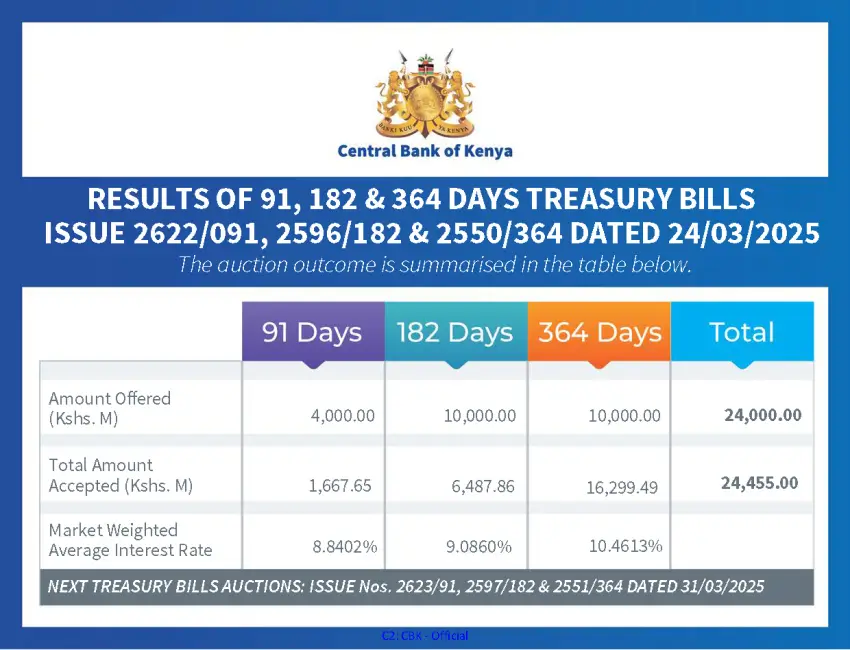

Treasury Bills were oversubscribed this week at 128.99%. The government raised Ksh 24.46bn out of the offered Ksh 24bn. The 364-Day paper was the most oversubscribed at 208.34%

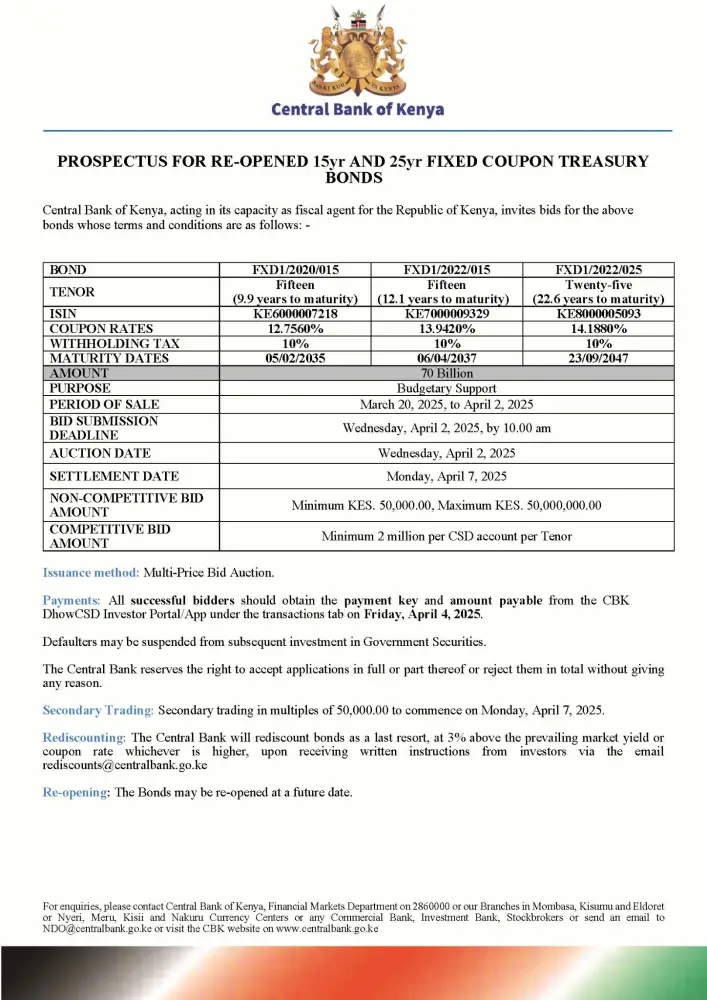

The Central Bank of Kenya is seeking to raise Ksh 70 billion from the reopened sale of three Fixed Coupon Treasury Bonds. The coupon rates are 12.7560% for FXD1/2020/015, 13.9420% for FXD1/2022/015, and 14.1880% for FXD1/2022/025. The bid submission deadline is set for Wednesday, April 2, 2025, at 10:00 AM.

In celebration of Global Money Week, we hosted an X-Space event titled ‘Demystifying Wealth Creation: Spot Scams While Building Wealth,’ in collaboration with Equity Group Foundation.

Some key takeaways:

- Be deliberate with your money and plan accordingly.

- No investment is guaranteed. All investments carry risk.

- Spend less than you earn, invest the difference and be patient

- Scammers like to use stories to market themselves because people like to follow through stories

Upcoming Events:

The earning season is in full swing! Next week, NCBA, Equity, and HF are set to release their full-year 2024 results. Stay tuned for key insights from these top banks.

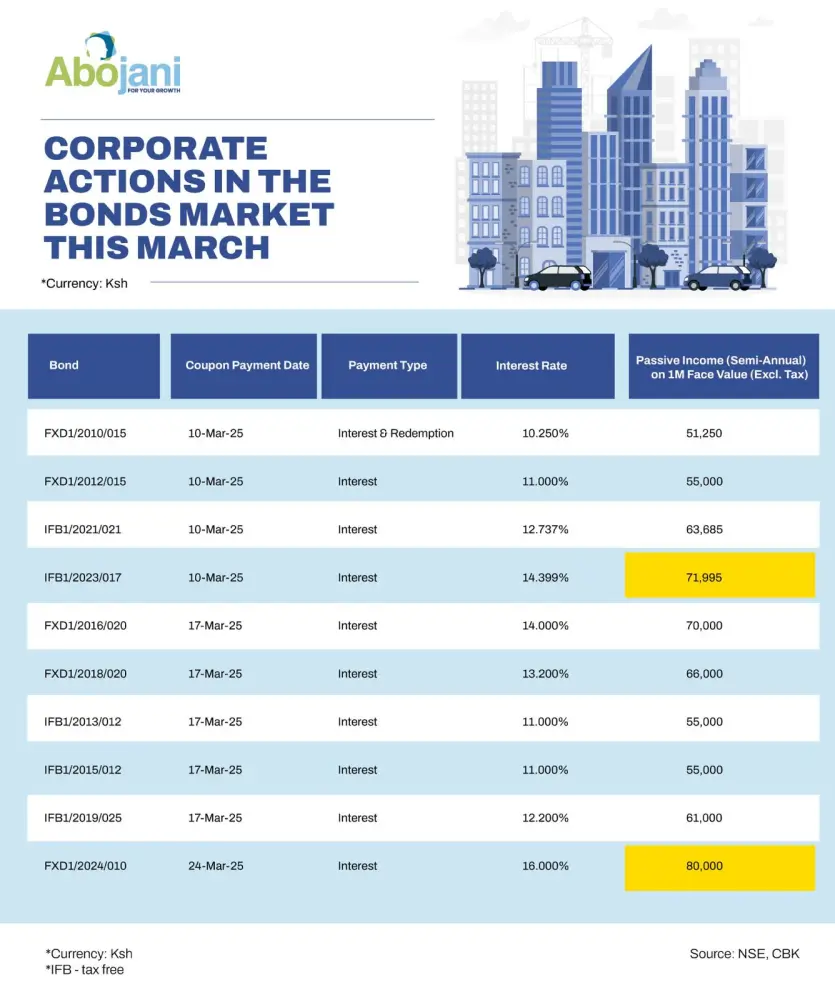

Upcoming Corporate Actions in the Bonds Market…

The coupon for FXD1/2024/010 will be paid on Monday, March 24th.

On Wednesday, 26th March 2025, we will have a webinar, “An Evening With Njeri Jomo”, the transformative CEO of Jubilee Health Insurance.

This is your chance to hear firsthand from Njeri Jomo, recognized as CEO of the Year at the 2024 Company of the Year Awards (COYA).

We’re excited to host an EXCLUSIVE online Masterclass on Offshore Investing, featuring Brian Feroldi, an esteemed financial educator. He’ll be sharing his valuable insights on US Stocks and ETFs.

Finally, April, being financial literacy month, you should commit to improving your financial literacy.

It will make you more confident when deciding to invest your retirement savings or taking a mortgage.

However, improving your financial literacy is tough to do on your own.Join our Abojani masterclass today and take control of your financial future.