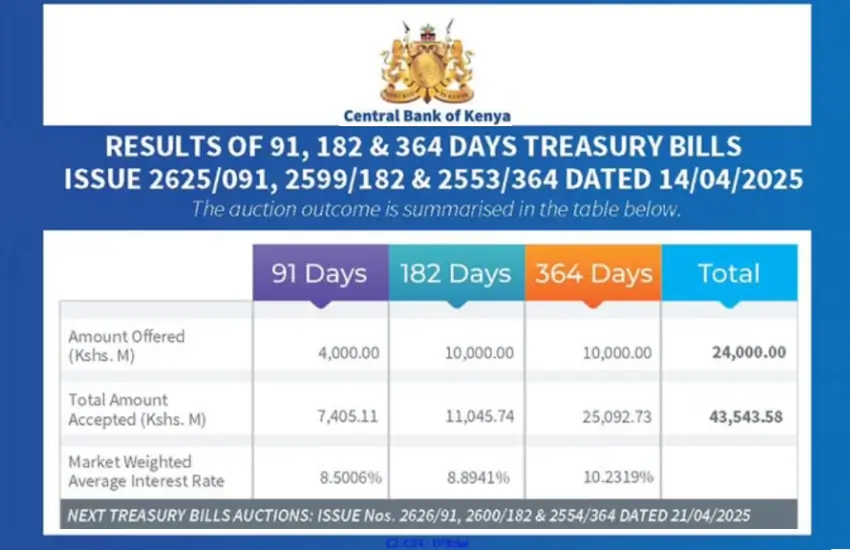

1. This week, treasury bills were oversubscribed, seeing the government lock in Ksh 43.5 Bn out of the Ksh 24.0 Bn that was on offer. The rates are now at 8.5%, 8.9% and 10.2% for the 91-Day, 182-Day and 364-Day papers respectively.

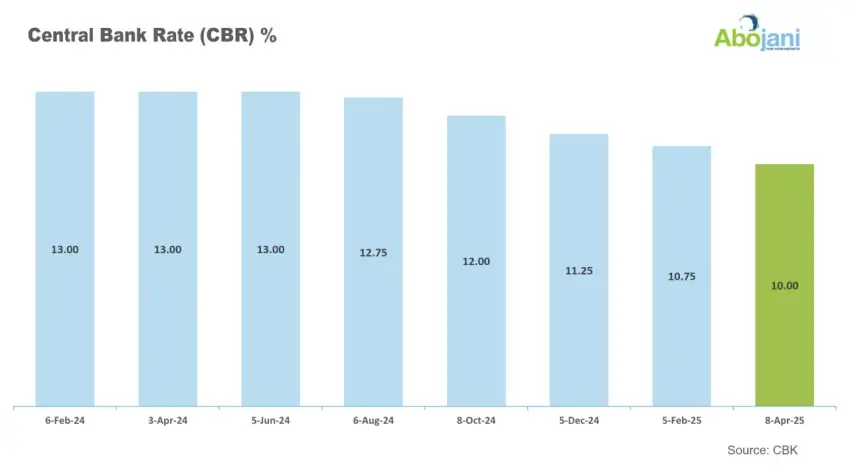

2. It was good news as the Central Bank of Kenya (CBK) once again lowered the Central Bank Rate (CBR), signaling a shift toward a more accommodative monetary stance.

Following a Monetary Policy Committee (MPC) meeting held on Tuesday, April 8th, the CBK announced a 75 basis point cut in the CBR, bringing it down to 10.00 percent from the previous 10.75 percent.

3. This week, Nairobi successfully hosted the World Chambers Federation (WCF) Africa Summit, bringing together delegates from more than 70 countries at the Kenyatta International Convention Centre (KICC).

The summit was a collaborative effort between the Kenya National Chamber of Commerce and Industry (KNCCI), the World Chambers Federation (WCF), and Absa Bank Kenya.

4. KCB Group has officially launched its inaugural University Scholarship Program, marking a big step toward inclusive education in Kenya.

The program, launched this week, aims to remove financial barriers and support academic talent across the country.

5. Jubilee Health Insurance Limited has posted a remarkable financial performance, more than doubling its annual profit to Sh910.4 million for the year ended December 2024, up from Sh438.5 million the previous year.

The impressive growth was driven by a surge in premiums, with the company recording a Sh546.7 million insurance service result, a sharp turnaround from a loss of Sh36.5 million in the prior year. This rebound came on the back of a 32 percent increase in insurance service revenue, which rose to Sh13.4 billion, compared to Sh10.1 billion in 2023

6. NCBA held an exclusive event celebrating its longest-standing mortgage customers who’ve trusted them on their homeownership journey.

7. We ended the week on a high note at the Financial Literacy Forum 2025 by the Engineering Students Association (ESA) at the University of Nairobi. It was an honour to contribute to the important course of financial empowerment.

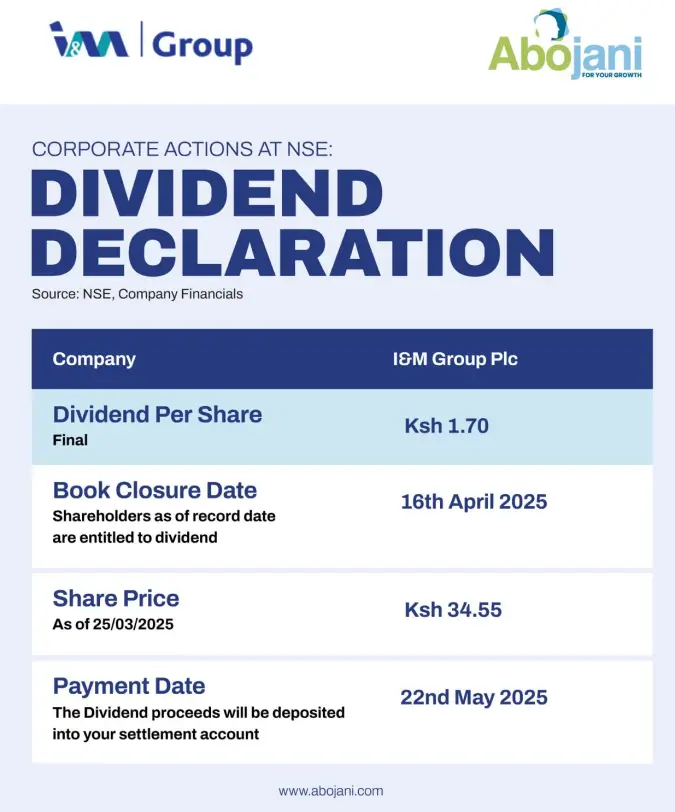

8. I&M Book closure date is coming up next week. Following the release of FY’24 results, the lender announced a Ksh 1.70 final dividend per share to be paid on 22nd May 2025

9. This Tuesday, the #WisdomSeries brings you an unmissable session featuring Tom Gitogo, Group MD & CEO of Britam Holdings Plc.

The topic, ‘Building Passive Income as Professionals and Entrepreneurs’, will explore how to create reliable income streams, even as the economy shifts.

Details:

- When: Tuesday, 15th April 2025

- Time: 7pm EAT

- Zoom Joining Link: https://bit.ly/TomGitogoWisdomSeries

- Passcode: Wisdom2025

See you then!

10. The 67th Personal Finance, Saving and Investing Masterclass officially starts on 12th May.

We look forward to an informative month where we will shed more light on Money Market Funds, SACCOs, Stock markets, treasury bills and bonds