Here’s your round-up of this week’s key financial and corporate highlights.

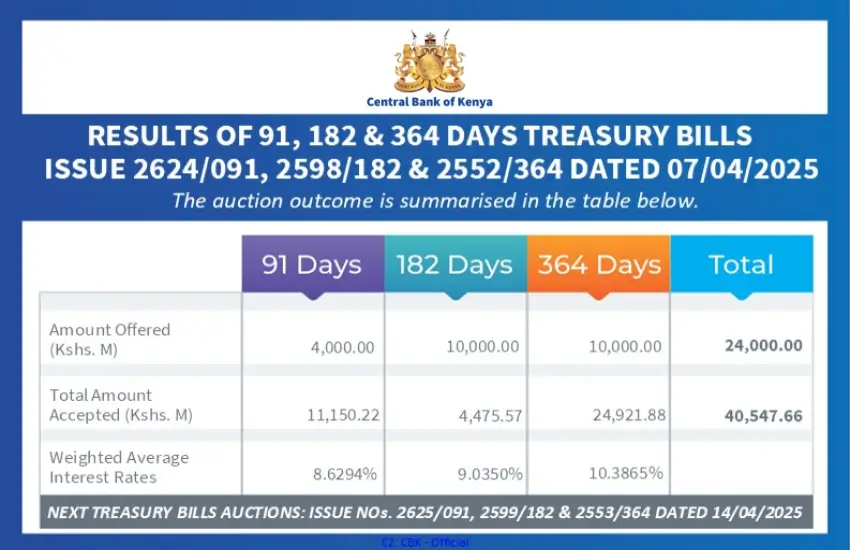

The Central Bank of Kenya offered KSh. 24 billion worth of treasury bills, receiving KSh. 40.69 billion worth of bids and accepting KSh. 40.55 billion. The 364-Day paper was the most oversubscribed at 250.12%

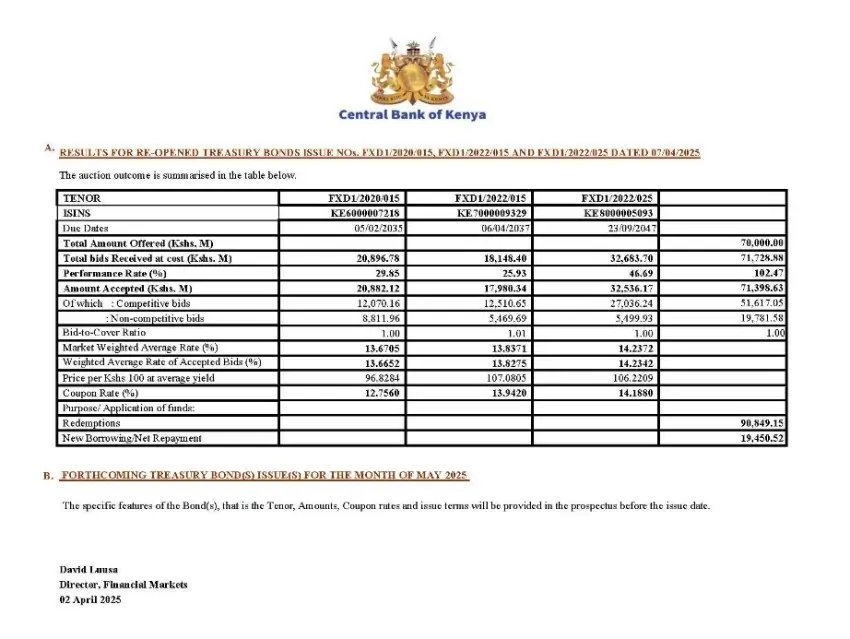

CBK successfully raised KSh. 71.398 billion through the re-opening of three Treasury bonds. The auction attracted total bids worth KSh. 71.728 billion, slightly exceeding the target amount of KSh. 70 billion.

The Central Bank of Kenya (CBK)

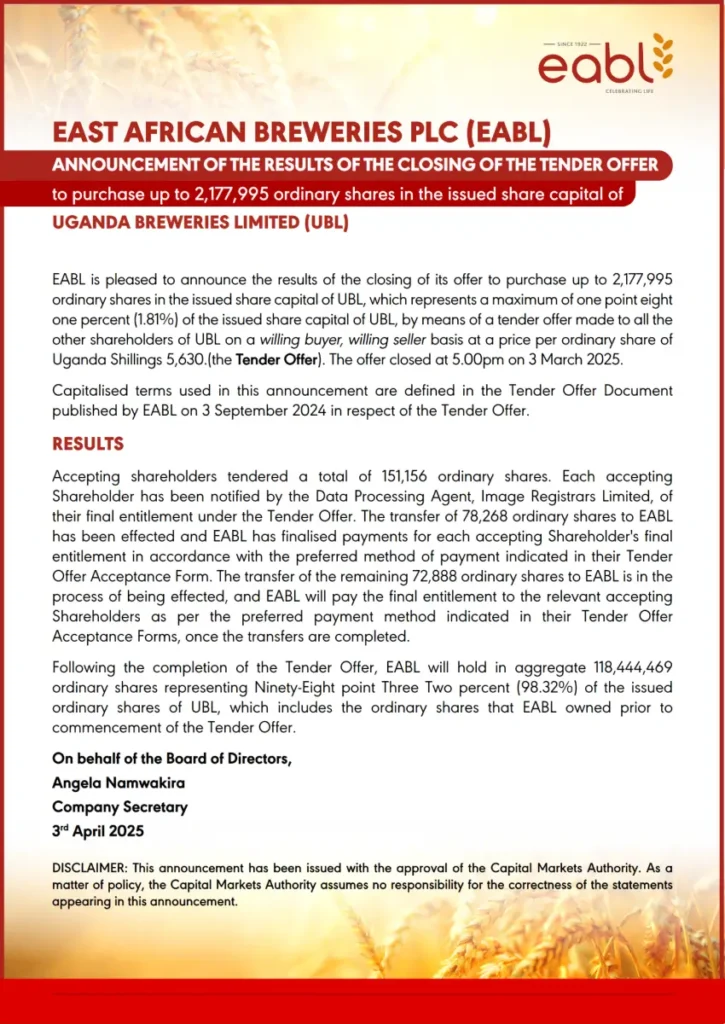

EABL successfully closed its tender offer to buy shares in Uganda Breweries Ltd (UBL). A total of 151,156 shares were tendered, with 78,268 shares already transferred and payments made. The remaining 72,888 shares are in process, with payments to follow. After completion, EABL will own 98.32% of UBL.

Jubilee Holdings has appointed Juan Cazcarra as its new Deputy Group CEO. With over 20 years of experience in the insurance industry, Juan has played a key role at Jubilee as the Group Chief Operating Officer (GCOO), leading major initiatives like Changamk@, the company’s digital transformation agenda.

TotalEnergies Marketing Kenya PLC has appointed Ms. Fernanda Schröder as a Non-Executive Director. Fernanda brings over 10 years of experience in the energy industry, having held key roles at TotalEnergies and TechnipFMC.

Absa Bank Kenya PLC announces the retirement of Ms. Patricia Ithau as an Independent Non-Executive Director, effective 31st March 2025. Patricia joined the Board in 2016.

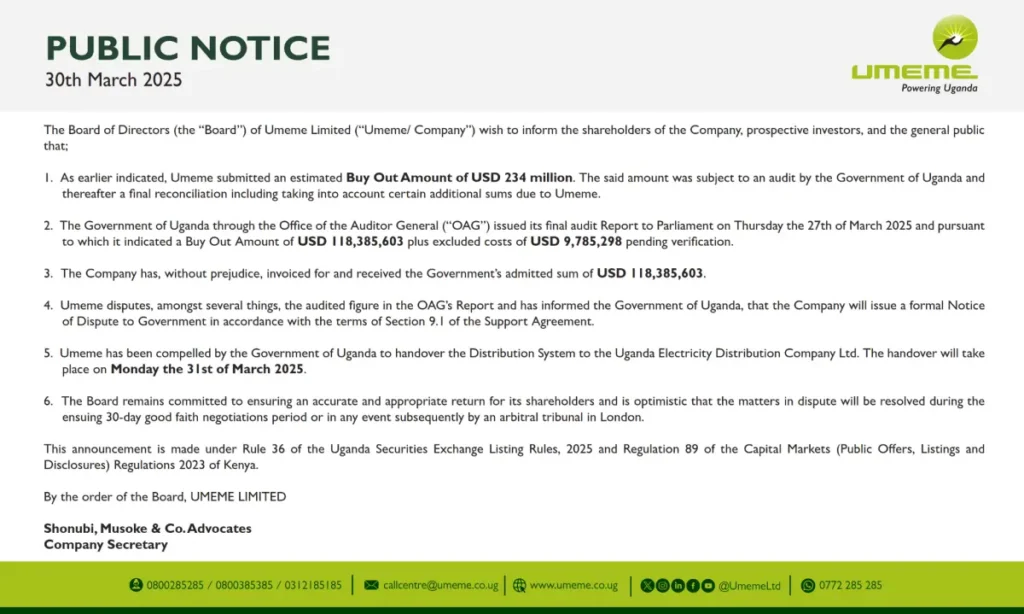

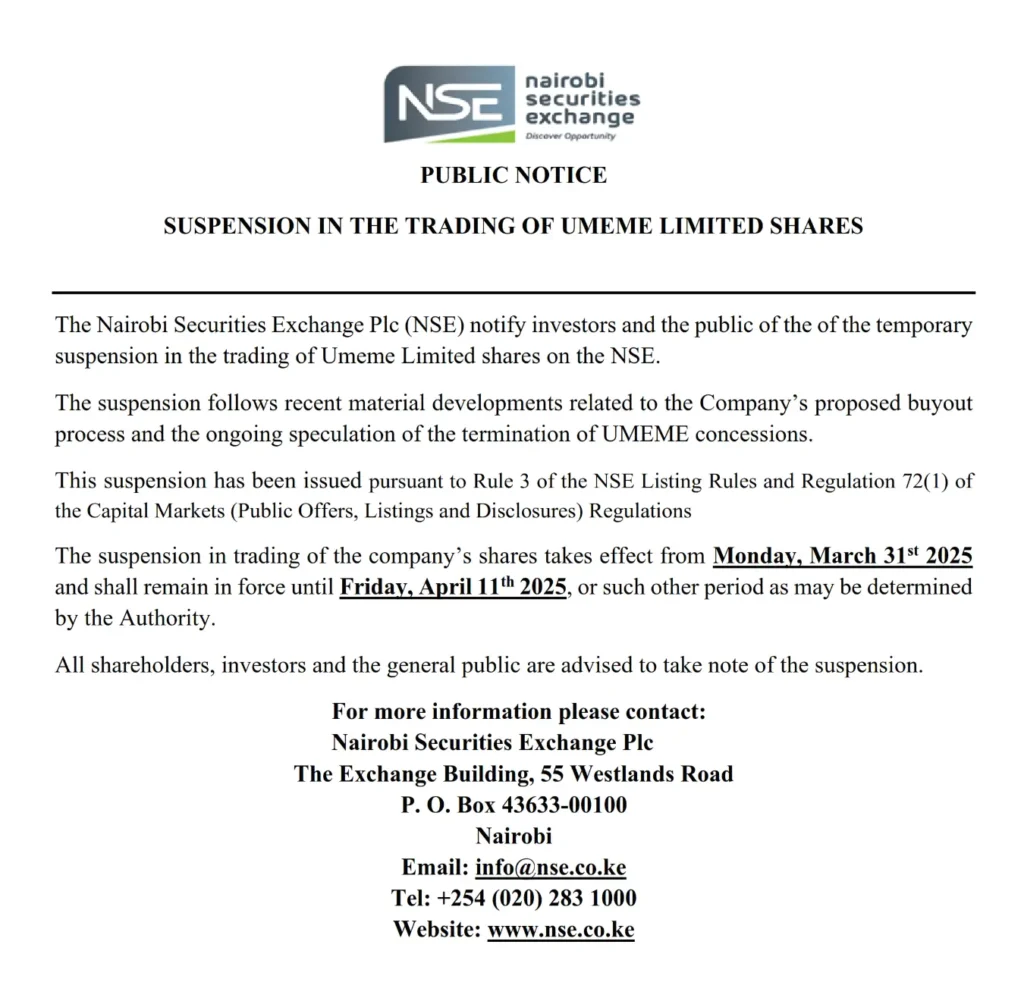

The Nairobi Securities Exchange has temporarily suspended trading of Umeme Limited shares from 31st March 2025 to 11th April 2025. This follows developments related to the company’s buyout and concession issues.

NCBA has renewed its partnership with the African Guarantee Fund (AGF), securing a Ksh. 3 billion agreement to support SMEs, especially women-led businesses and those in sustainable sectors. The partnership has already created over 7,200 jobs, with a focus on women and youth.

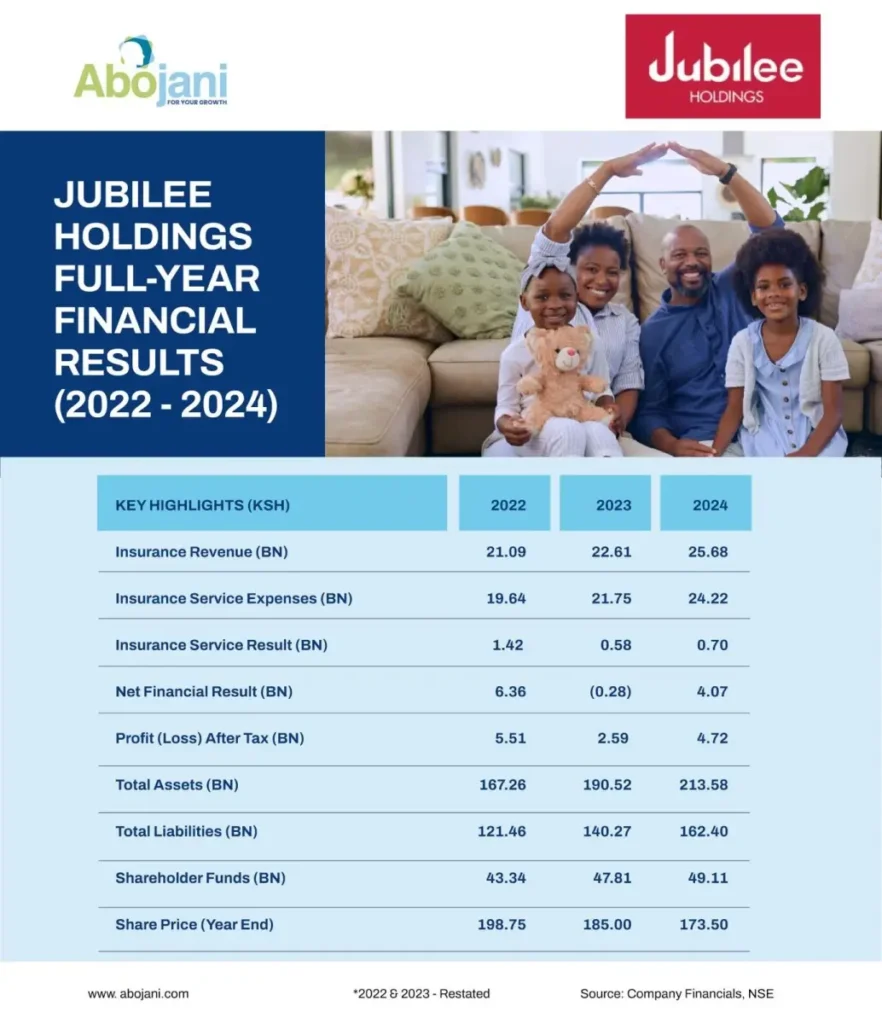

Jubilee Holdings posted a KSh. 4.72 billion Profit After Tax (PAT), marking an 82.5% growth from last year’s KSh. 2.59 billion. For the first time in history, their gross premium surpassed KSh. 50 billion. The board has also recommended a final dividend of KSh. 11.50 per share.

Upcoming corporate actions

The Monetary Policy Committee (MPC) to Meet on April 8, 2025. In the previous meeting, the benchmark rate was lowered to 10.75%.

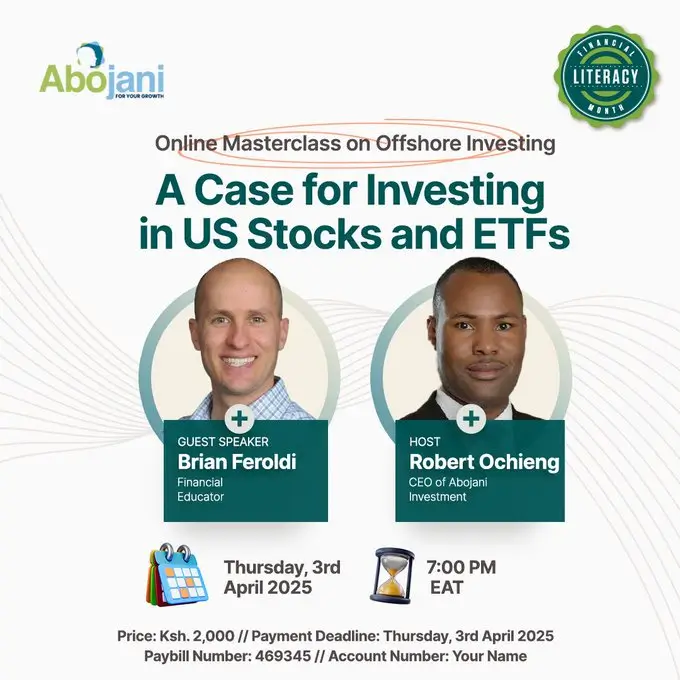

We kicked off Financial Literacy Month on a high note, hosting Brian Feroldi, who shared invaluable insights on investing in U.S. stocks and ETFs. The session was incredibly informative, breaking down complex topics into simple concepts that anyone can follow.

And finally;

As we kick off Financial Literacy Month, there’s no better time to invest in yourself. Our Personal Finance & Investing Masterclass is your chance to learn how to manage your money, make smarter investment decisions, and build a solid financial future. Don’t miss out on this opportunity to level up your finances.