Now that we’re in 2025, it’s time save and to do that, we have to start thinking ahead, especially when it comes to the big events and expenses that will come up throughout the year. It might feel like the holidays just ended, but if we start saving now, we can avoid financial stress later.

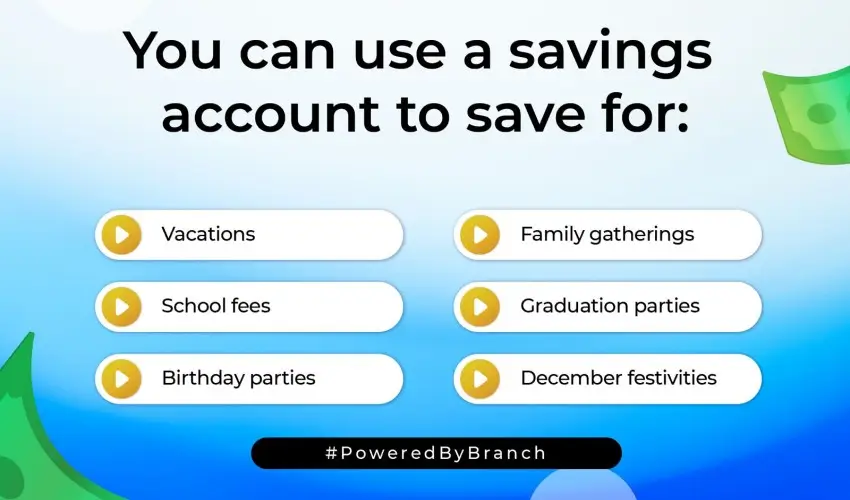

From school fees to family celebrations, a little bit of planning can go a long way in making sure 2025 is a year filled with joy and peace of mind, without the burden of scrambling for cash at the last minute.

One big expense that often sneaks up on us is school fees. Whether you have kids in school or you’re paying for your own education, those fees can be substantial. By setting aside money early, you can make sure the bills are covered without feeling like you’re stretching your budget too thin.

It’s a smart move that will help you stay ahead of the curve and avoid any financial headaches when the school year rolls around.

Can’t Afford It? Save for it!

Then, of course, there are the birthdays. Each year, it feels like there are more and more to celebrate – friends, family, and loved ones, all with their own special day. Between gifts, parties, and activities, birthday celebrations can add up quickly.

Saving now means that when it’s time to celebrate, you’ll have the cash ready, making sure you can give meaningful gifts and throw fun parties without stressing about the cost.

There are also those milestone events like graduations, weddings, and anniversaries, that we all want to celebrate in a big way. These moments are often years in the making, and they deserve to be memorable. But the travel, gifts, and celebrations can be quite overwhelming.

By starting to save now, you can ensure you’re financially prepared to enjoy these milestones to the fullest, without worrying about how to cover the costs when the time comes.

And yes, we can’t forget about the holiday season at the end of the year. Christmas, New Year’s, and all the other celebrations that come with it. These are moments we want to enjoy fully, but they can be expensive.

Whether it’s gifts, travel, or holiday meals, the costs can be financially draining. By starting to save now for the holidays, you’ll be ready for the season without worrying about how to cover December’s expenses.

So, how can you make sure all these costs are covered without breaking a sweat? One of the best ways is to open a dedicated savings account just for these upcoming expenses. With Branch, you can set aside money specifically for school fees, celebrations, and holidays, keeping it separate from your regular savings.

This makes it easier to stay on track with your goals and watch your savings grow steadily throughout the year. With Branch, it’s easy to set up a savings account for all your 2025 plans, so when the big moments arrive, you’re ready to enjoy them peacefully.

To start saving with Branch, use this link: https://bit.ly/branchApp