When many people think of investing, they imagine buying and selling stocks to make a quick profit. The excitement of a sudden spike in stock prices, flipping them for a high return, seems to be the primary focus. But if you’re in it for the long haul, there’s something else that should grab your attention; dividends.

Dividends are the unsung heroes of the investing world. If you’re looking to create a steady flow of income and eventually build a portfolio that works for you even when you’re not working, dividends are your best friend.

Here’s everything you need to know about dividends and why they matter more than you might think:

What Are Dividends?

In simple terms, dividends are a portion of a company’s profits paid out to its shareholders. Think of them as a “thank you” from the company for your investment. If a company makes a profit and decides to share it with its investors, you get a slice of that pie based on how many shares you hold.

It’s as simple as that.

Also read: How Do Companies Benefit from Paying out Dividends?

Not All Companies Pay Dividends

Many newer or high-growth companies choose to reinvest all their profits back into the business. This allows them to fuel expansion and innovation.

However, more established companies often pay out dividend regularly. These are often referred to as “dividend-paying stocks,” and they can provide a reliable source of income.

You Don’t Need a Million to Earn Dividends

While the more shares you own, the more dividends you’ll receive, it’s important to remember that even a small amount of shares can start earning you passive income.

Let’s say you own just 1,000 shares in a stable company paying Ksh 2 per share annually. You’d earn Ksh 2,000 in dividend for that year. While it’s not much, it’s a start. And the best part? Reinvesting your dividends allows you to build wealth faster.

Dividends Provide Passive Income

This means once you invest, you don’t have to lift a finger. Your only job is to make sure you’ve chosen a solid, reliable company and then wait for the dividends to hit your account. Unlike active income, where you trade time for money, dividend earn you money even when you’re not working.

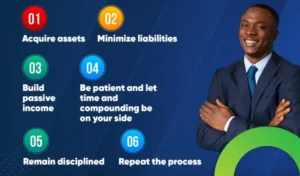

Of course, this requires patience and a long-term approach.

Reinvesting Dividends Builds Wealth Faster

You’ve probably heard the phrase “money makes money.” Well, dividends are a perfect example of that.

When you reinvest your dividends, you buy more shares in the company. These additional shares will earn you even more dividend when the payout comes around. Over time, your wealth compounds, building faster than you could imagine.

The more you reinvest, the more shares you own, the bigger your dividend payouts become, and the faster your wealth grows.

Dividend-Paying Companies Are Often More Stable

While it’s not a rule, many companies that pay regular dividend are more financially stable. Dividend-paying companies tend to be well-established, have consistent profits, and aren’t as likely to chase risky fads or unsustainable growth. These companies tend to focus on providing steady value and returns to their investors.

The stability of these companies makes them attractive investments for people looking for reliable income.

Where Can You Get Dividends?

Now that you know what dividends are and how they work, you might be wondering where to find them. Dividend-paying assets can be found in several places:

- Listed Companies: Many banks, telecom, utility, and other listed companies often pay dividend.

- SACCOs: In Kenya, SACCOs can also be good sources of dividend.

- REITs (Real Estate Investment Trusts): These pay dividend due to their requirement to distribute most of their income to investors.

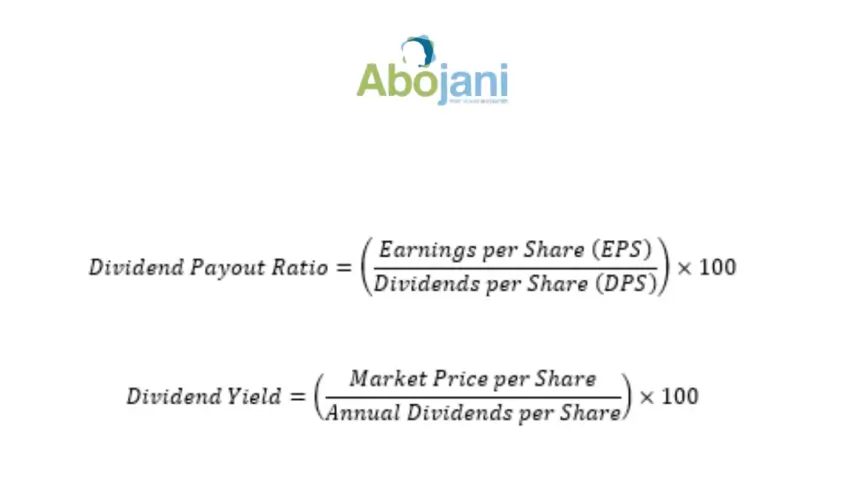

When you select an investment, you can calculate its dividend payout ratio and dividend yield.

You’re Not Just Investing. You’re Earning.

At its core, dividend income is a form of financial freedom. It’s a way for your money to work for you, without having to sell anything. As long as the companies you invest in continue to do well and pay out dividend, you can enjoy a steady flow of income.

Dividend create a situation where you can live off the passive income generated by your investments, while still maintaining your principal.

Investing in dividend-paying assets is like planting a fruit tree. You don’t expect immediate returns, but with patience, that tree grows and starts producing fruit. It’s not about short-term gains; it’s about steady, reliable growth over time.

Remember, the key is consistency, reinvesting, and letting time do the work for you. Keep investing, and the dividends will keep coming.