1H2024 Banking Sector Results – Asset Management & Bancassurance Units Performances

On Bancassurance & Insurance 1. KCB Bank Group‘s Bancassurance Intermediary recorded the highest core insurance revenue of Ksh 726 million in the first six months

Insights from your search query…

On Bancassurance & Insurance 1. KCB Bank Group‘s Bancassurance Intermediary recorded the highest core insurance revenue of Ksh 726 million in the first six months

NCBA has brought together its SACCO Banking Division customers at a forum held at Serena Hotel, Nairobi, to tackle one of the biggest cyber threats

NCBA Group’s financial results for the first half of 2024 reveal a robust performance, showcasing both strength and adaptability in the face of adversity. The

Absa Bank Kenya PLC has delivered a stellar performance for the first half of 2024, with a notable 29% increase in profit after tax, reaching

In a groundbreaking move that solidifies its position as a trailblazer in sustainable finance, KCB Group released its 2023 Environmental, Social, and Governance (ESG) and

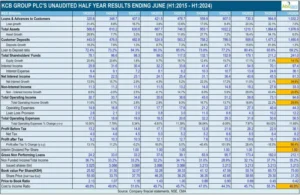

KCB Bank Group’s financial results for the first half of 2024 reveal a compelling story of growth and strategic prowess. The bank has demonstrated a

In the first half of 2024, I&M Group PLC reported a notable 24% increase in profit before tax, reaching KES 8.7 billion. This growth was

Why should you consider re-investing your dividends?

You may ask yourself, “How does a company benefit from paying out dividends, hefty amounts actually, instead of retaining this amount?” The banks listed on

As the eagerly awaited 2023 full-year results from banks listed on the Nairobi Securities Exchange PLC draw near, we present a pre-earnings review focusing on

Manga House

Kiambere Road - Nairobi, Kenya

Call: +254 763 682 116

Email: learning@abojani.com

Copyright © 2025 Abojani Investment. All Rights Reserved. Designed by Asher Group Ltd