In the fast-paced world we live in, managing our finances can often feel like walking a tightrope.

On the one hand, there are immediate financial needs that require attention, such as paying bills, covering daily expenses, and handling unforeseen emergencies.

On the other hand, there is the long-term goal of building wealth for a secure and comfortable future. Striking a balance between these two priorities is crucial for financial well-being.

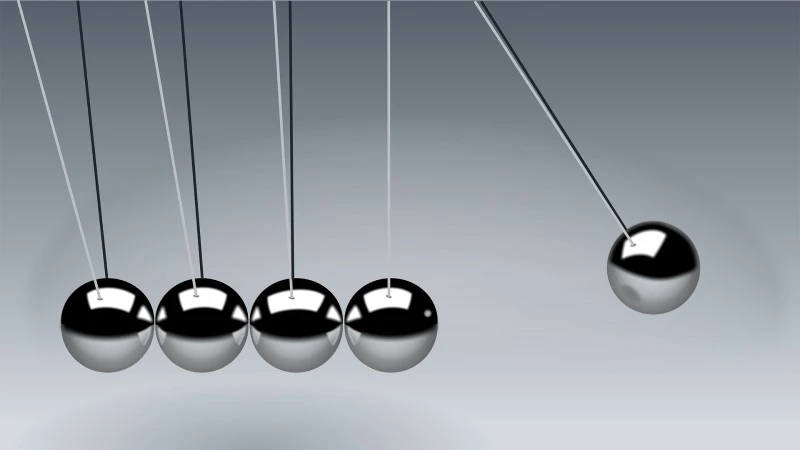

Balancing short-term and long-term goals involves prioritizing and allocating resources effectively.

While short-term goals may require more liquidity, long-term goals can benefit from compounding and strategic investment.

For example, you might allocate a portion of your portfolio to more liquid, short-term investments while focusing the majority on long-term, growth-oriented assets.

In conclusion, a holistic financial plan that integrates budgeting, tax efficiency, diversified investments, and periodic reviews will help individuals strike a balance between short-term needs and long-term wealth accumulation.

Regularly reassessing and adjusting the plan based on changing circumstances ensures that financial goals remain achievable over time.