The Art of Strategic Borrowing

We often have aspirations whose financial obligations are beyond our reach. We may wish to buy a home, open a business, fund education, among other

Insights from your search query…

We often have aspirations whose financial obligations are beyond our reach. We may wish to buy a home, open a business, fund education, among other

Borrowing, when managed wisely, can facilitate opportunities for growth, investment, and financial stability. It allows us to access resources we may not have immediately, enabling

Factors that can help you assess whether you’re borrowing smart: ◾ Purpose Evaluate the purpose of the borrowing. Is it for a strategic investment that

Purposeful borrowing Healthy borrowing involves taking out loans for specific purposes that align with your financial goals. Comparing options Healthy borrowing involves shopping around for

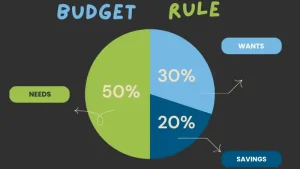

This rule is a simple guideline to help you manage your money wisely. Here’s how it works: 50% for Needs Allocate 50% of your income

If you find yourself desiring to create a budget but feel uncertain about the tools or the process, consider using spreadsheets like Excel or Google

The 50-30-20 budgeting rule was popularized by US senator Elizabeth Warren and her daughter Amelia Warren Tyagi, in the book “All Your Worth”. It is

A budget is an estimate of income and expenses over a period of time. A budget is an expression of self-awareness when it comes to personal

Budgeting serves as a powerful instrument for self-awareness, offering us valuable insights into our financial habits, priorities, and values. Here’s how the practice of budgeting

If you have a particular goal in life, you can find numerous books that offer guidance on how to achieve it. The secret is to

Manga House

Kiambere Road - Nairobi, Kenya

Call: +254 763 682 116

Email: learning@abojani.com

Copyright © 2025 Abojani Investment. All Rights Reserved. Designed by Asher Group Ltd