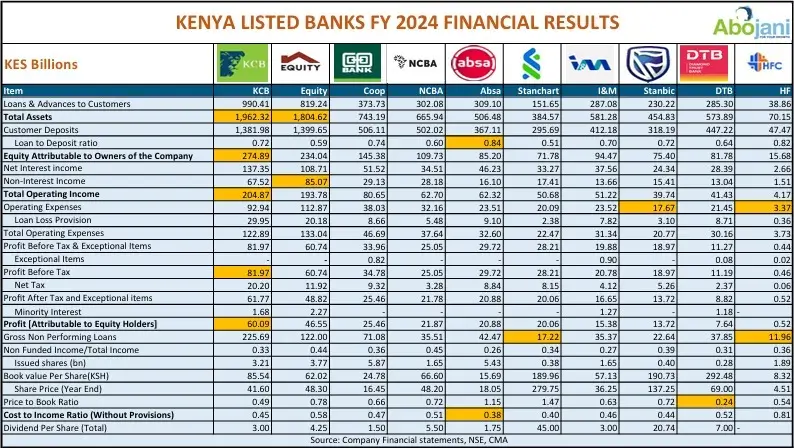

It was a busy last week of the month as the Kenyan listed banks rushed to release their FY’2024 results.

KCB Group recorded the fastest growth in profitability, a 66.1% growth to come in at Ksh 60.09 Bn.

KCB Group recorded the fastest growth in profitability

Equity Group Holdings announced a 12% uptick in Profits After Tax, to come in at Ksh 48.8 Bn for FY’2024, up from the Ksh 43.7 Bn reported in the previous year.

HF Group, led by Robert Kibaara, closed the earnings season, reporting yet another year of profitability for the lender. HF Group after tax profits surged 35.17% to stand at Ksh 0.52 Bn up from the Ksh 0.39 Bn recorded the previous year.

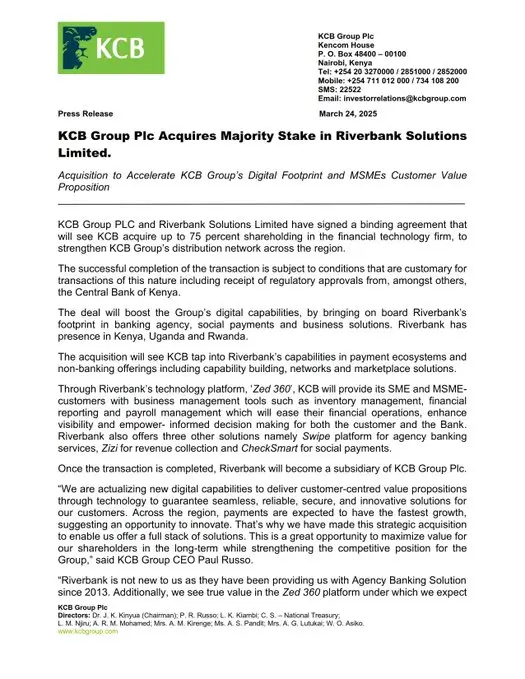

KCB Group has acquired a 75% majority stake in Riverbank, a Nairobi-based digital payments firm linked to former Football Kenya Federation President Nick Mwendwa, in a deal valued at approximately Ksh 2 billion. Once completed, Riverbank will become KCB’s 13th subsidiary, marking the bank’s expansion into non-banking solutions, though it’s unclear if Mwendwa will remain CEO of the new subsidiary.

Interestingly, all the banks recorded double digit growth in profitability, save for Coop Bank and NCBA that reported 9.8% and 2.0% growth respectively.

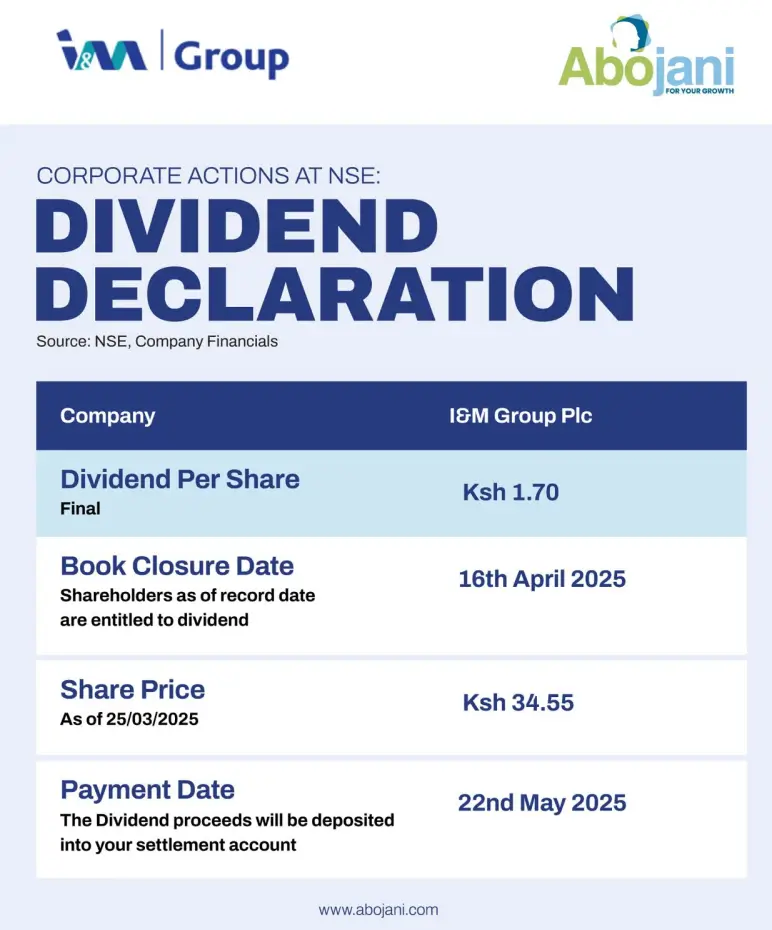

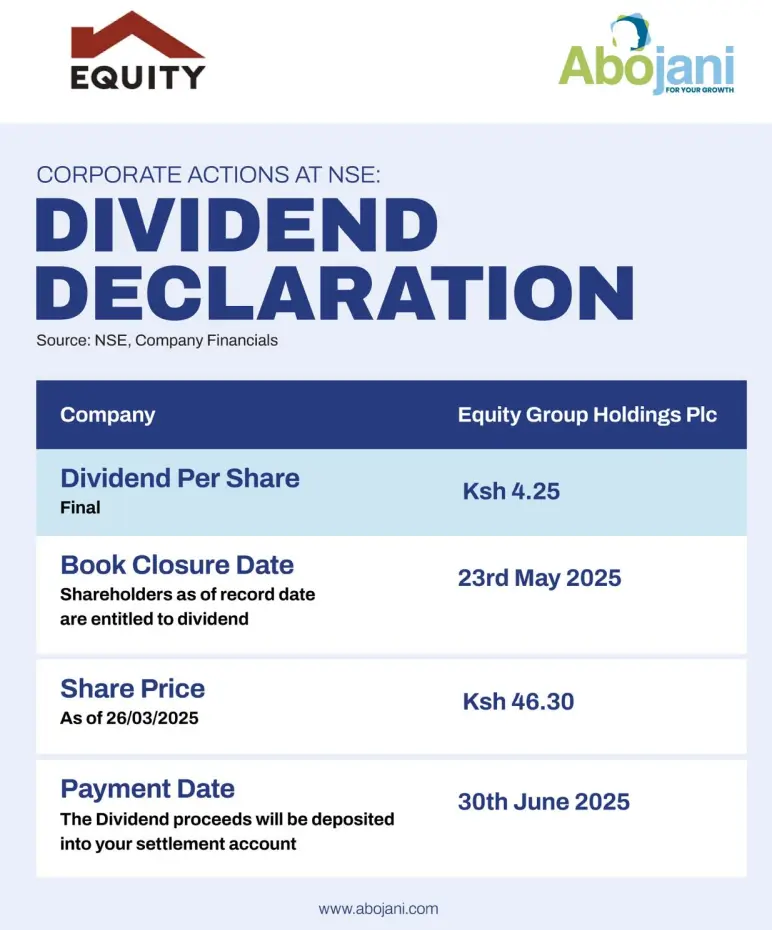

It was also a dividend party for investors as the banks rewarded them handsomely following the results…

Insurance companies also continued to roll in their FY’2024 numbers. CIC Group reported a 98.0% increase in profit to Ksh 2.85B, driven by a 74.0% rise in net investment result and a 49.1% growth in operating profit, while maintaining a dividend payout of KES 0.13 per share.

Britam reported strong 2024 results with a 53.5% increase in profit to Ksh 5.03B, driven by a 163.4% surge in net investment income and a 52.1% rise in profit before tax, although no dividend was declared.

Kenya Re reported a mixed FY24 performance with a 10.8% decline in net profit to Ksh 4.44B, despite a strong 336% increase in insurance service result and a 23% rise in total investment income, while reducing its dividend payout to Ksh 0.15 per share from Ksh 0.30

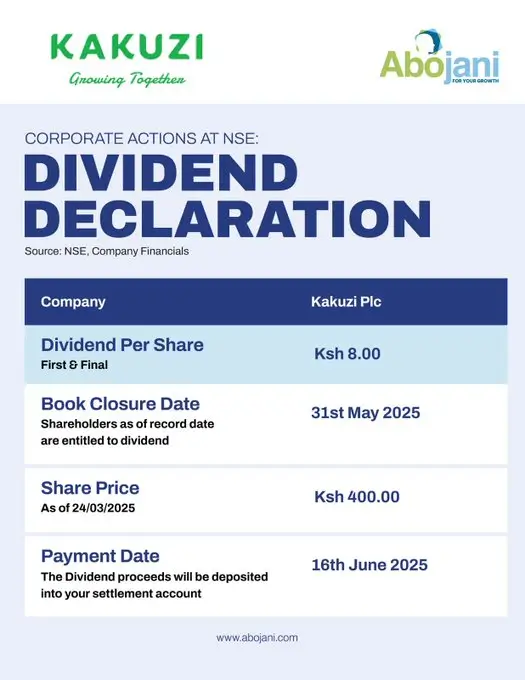

On the other hand, Kakuzi declared a dividend of Ksh 8 per share for the year ended December 31, 2024, payable on June 16, 2025.

To be eligible, you must be a shareholder on record by the book closure date, May 31, 2025.

During the week, ICEA LION General Insurance introduced Kenya’s first Motor Extended Warranty, an innovative solution designed for second-hand vehicle owners to safeguard against major mechanical or electrical breakdowns.

With comprehensive coverage for vehicles up to eight years old or 150,000 kilometres, the policy addresses the uncertainty faced by used car buyers, offering peace of mind at affordable premiums.

Absa Kenya Foundation has committed Ksh 3 million towards supporting the vulnerable in the community during the Holy month of Ramadhan. Working closely with the Muslim community associations and the local mosques, the donations, which are being done countrywide, will see over 800 households receive foodstuffs and other supplies reaching over 2,400 livelihoods in Nairobi, Garissa, Kisumu, Isiolo, Bungoma, Eldoret, Murang’a, Kajiado, Oyugis and Nkurumah impacted.

But the highlight of the week must have been our #WisdomSeries Webinar, which featured Njeri Jomo, the CEO of Jubilee Health Insurance. It was an insightful conversation on success and career.

Click HERE to Catch the Recording. Passcode is: Wisdom@2025

We ended the week with the most awaited FY’2024 Banking and Insurance Sector Analysis. The discussion shared more context on the financial services performance, offering value both to shareholders, customers and investors.

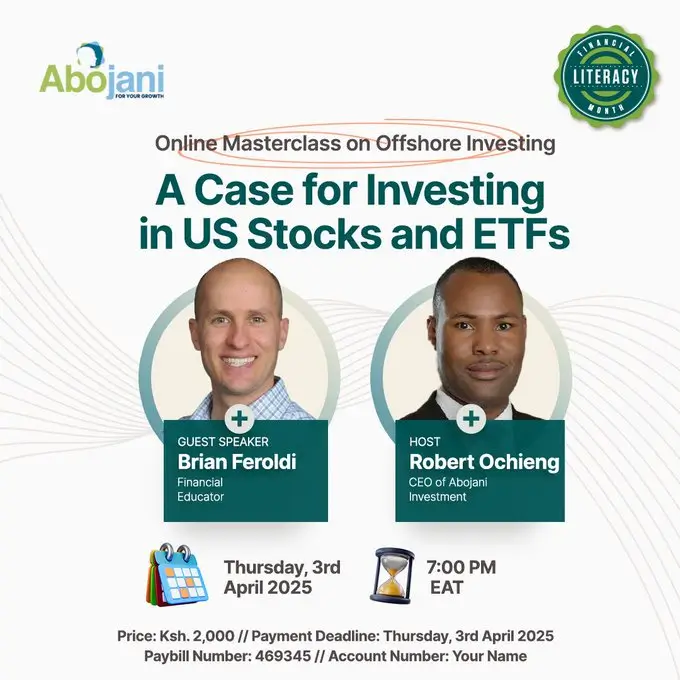

Coming up is Financial Literacy Month. We will start the month on a high note, with an offshore investing Masterclass featuring top educator, Brian Feroldi. See details on the flier.

This time we will also go bigger and better at the 66th Personal Finance, Saving & Investing Masterclass. Early bird registration is still ongoing.

Call: 0763 682 116 or Email: learning@abojani.com