In the heart of the financial savannah, one beast stands tall – unyielding, strategic, and dominant. Like a lion surveying its territory, KCB Group has once again asserted its supremacy in the banking sector, with a record-breaking performance in its FY 2024 financial results.

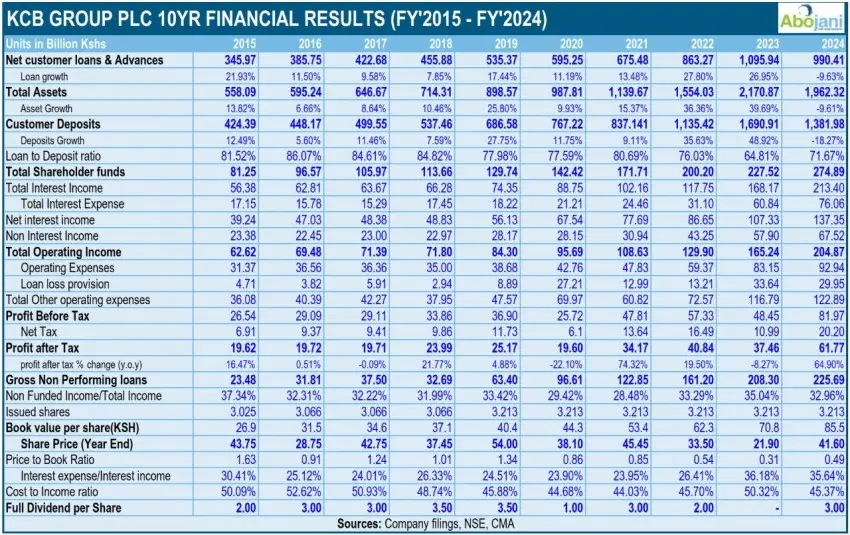

With a remarkable 65% rise in Profit After Tax to KShs. 61.8 billion, Simba has reaffirmed its dominance and demonstrated the power of strategy, and a well-executed hunt for growth.

Also Read: Absa Bank Kenya’s Net Profit Grows by 28% to Ksh 20.9 billion in Financial Year 2024

The King of the Banking Jungle – KCB

Lions do not hunt recklessly. They move with precision, leveraging strength, teamwork, and a sharp focus on their target. Similarly, KCB’s strategic diversification model has continued to yield impressive results. S

ubsidiaries beyond Kenya now contribute 34.9% of the Group’s total assets and 30.3% of the profit after tax, showcasing the growing regional footprint of Simba. This well-calculated expansion, much like a lion marking new territory, has been crucial in strengthening the Group’s position across East Africa.

The Power of the Roar: Explosive Growth in Income

Just as a lion’s roar signals dominance across vast lands, KCB’s financial results have echoed across the industry. Total income grew by 24% to KShs. 204.9 billion, fueled by a 28% increase in net interest income.

A lion thrives not just on raw power but on strategic hunting methods. KCB’s non-funded income, contributing 33% of total revenue, has been strengthened by fees, commissions, trade finance, and forex, reflecting the bank’s sharp execution of diversified income streams.

Guarding the Territory: Asset Quality and Risk Management

A lion’s survival depends on its ability to defend its territory and maintain control over its pride. Likewise, KCB has intensified its efforts in asset quality management. The Group successfully lowered provisions for expected credit losses by 11%, thanks to an aggressive recovery strategy and improved economic conditions. However, the banking jungle remains treacherous, with the NPL ratio standing at 19.2%, reflecting the challenges within the wider economic ecosystem.

Strength in Numbers: The Balance Sheet Story

A lion’s strength is measured by the size and health of its pride. For KCB, customer deposits closed the year at KShs. 1.4 trillion, while loans and advances stood at KShs. 990.4 billion. This financial muscle, despite currency pressures, reflects the bank’s stability and confidence among its customers. Additionally, Return on Equity rose to 24.6% from 17.8%, a testament to the sustained value creation for shareholders.

Rewarding the Pride: The Return of Dividends

A lion does not feast alone. It ensures the pride thrives. KCB’s Board of Directors has recommended a final dividend of KShs. 1.50 per share, bringing the total FY 2024 payout to KShs. 3.00 per share. This marks a triumphant return to rewarding shareholders, after a cautious approach in FY 2023. With a total dividend payout of KShs. 9.6 billion, KCB has reinforced its commitment to delivering value to its investors.

The Unchallenged Alpha?

KCB’s dominance remains undeniable, but the banking jungle is competitive. The battle for regional supremacy continues, across subsidiaries. It’s worth noting that KCB’s Tanzania subsidiary emerged as the most profitable among Kenyan banks operating in Tanzania for the financial year 2024, with a profit before tax of TSH 76.0 billion (KShs. 3.86 billion).

The Future of Simba…

As we look ahead, one thing is clear: Simba is not resting. With solid capital buffers, aggressive regional growth, and a strategic focus on non-funded income, KCB is well-positioned for even greater dominance.

The question now is: will Simba continue to reign supreme, or will another contender rise to challenge the throne?