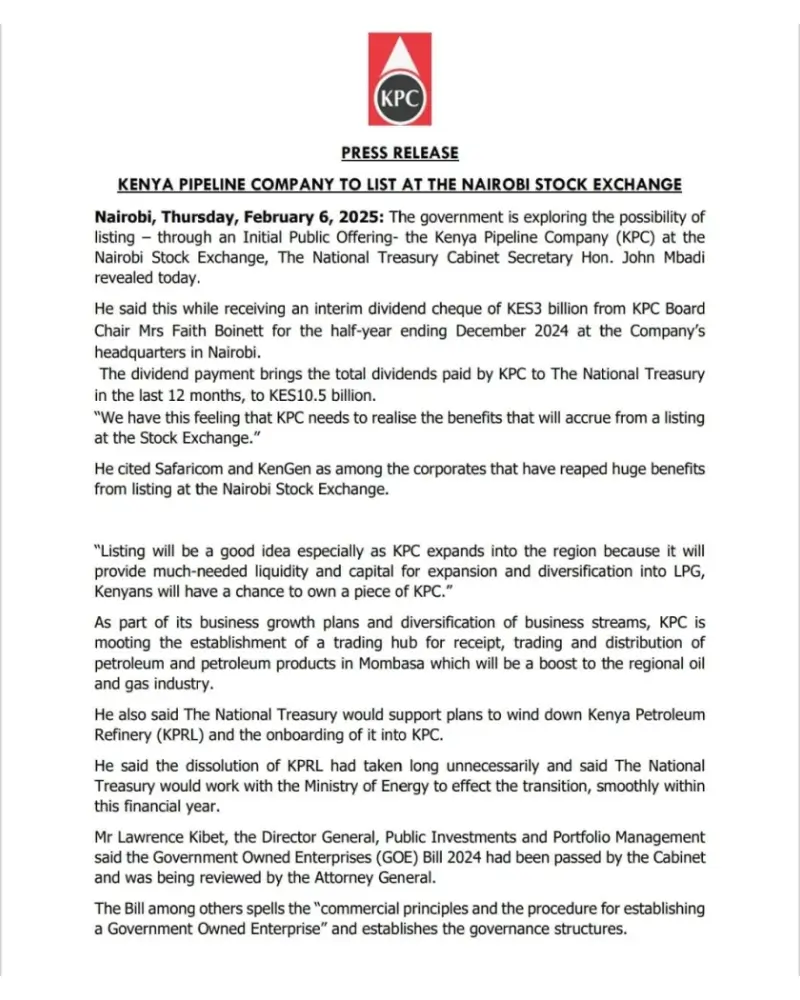

This week, the government has officially announced that it is exploring the possibility of listing Kenya Pipeline Company on the Nairobi bourse. through an Initial Public Offering.

Interestingly, the Kenya Pipeline company has paid Ksh 10.5 Bn dividends in 12 months to the National treasury.

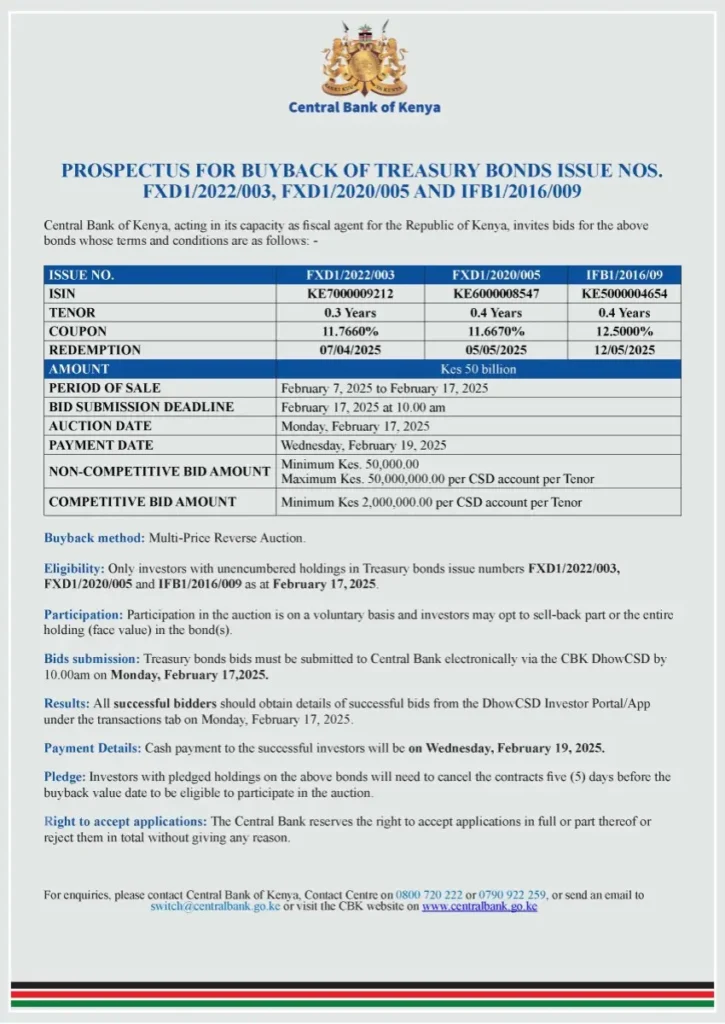

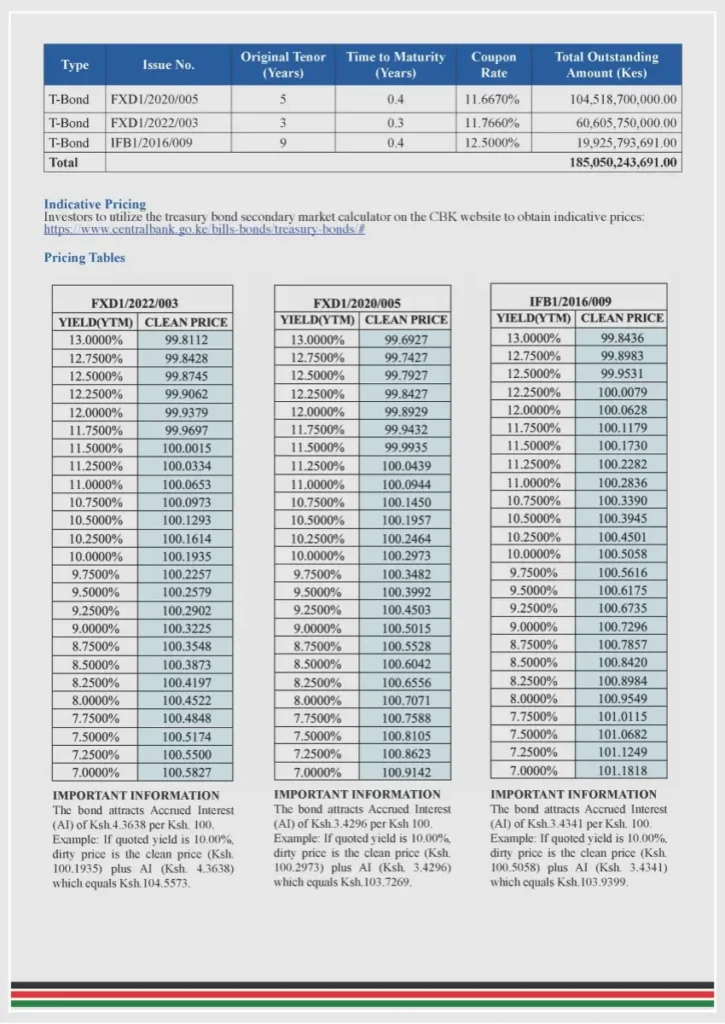

The Central Bank of Kenya (CBK) has announced a Treasury bonds buyback, offering investors the opportunity to sell back select bond issues before maturity.

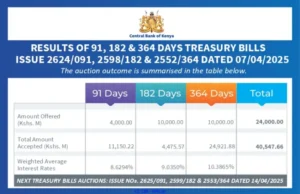

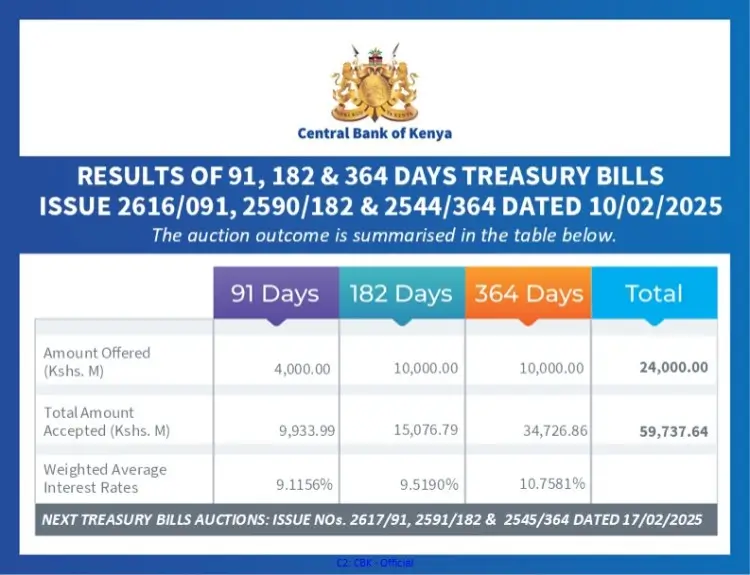

Treasury Bill rates are now in the single digit return territories. This week, interest rates for the 91 Day, 182 Day and 364 Day came in at 9.1156%, 9.5190% and 10.7587% respectively.

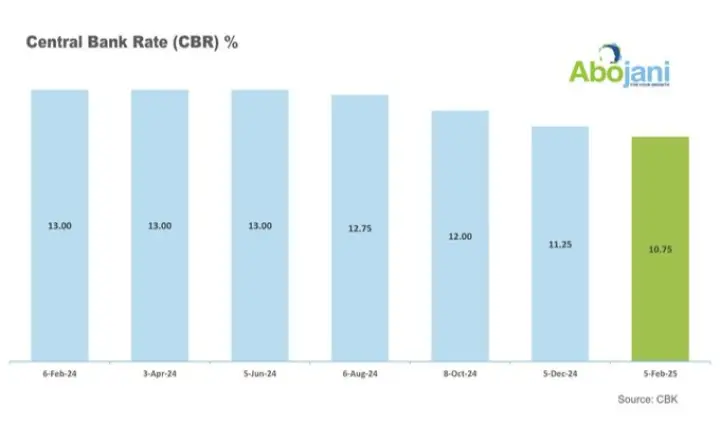

Kenya’s central bank cut its benchmark lending rate to 10.75% from the previous 11.25%.

This is good news for the private sector especially because we could start seeing slightly lower borrowing rates.

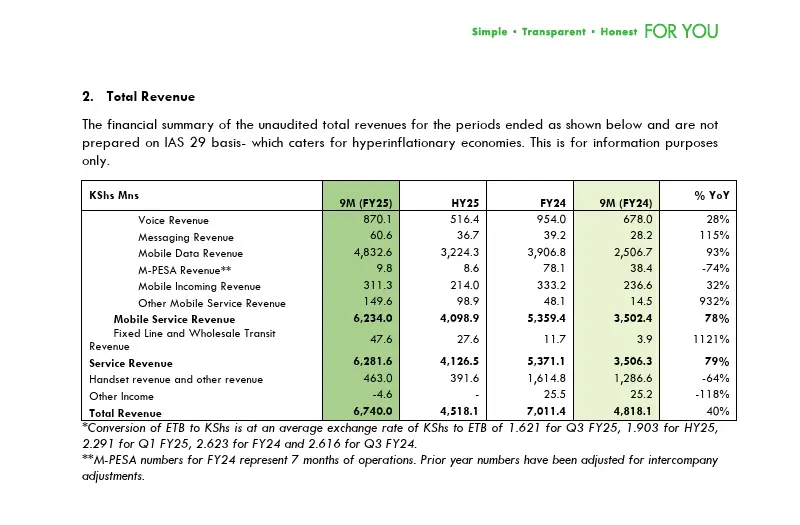

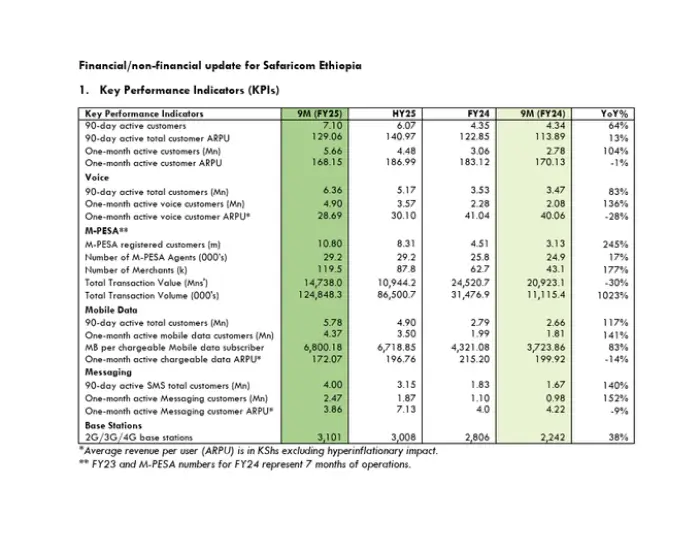

Kenya’s largest telco, Safaricom, has tripled M-pesa customers in Ethiopia from 3.1 million to 10.8 million in 2024 attributed to airtime and data purchases. 4G population coverage now stands at 48.5%, with 7.1Mn 90-day active customers

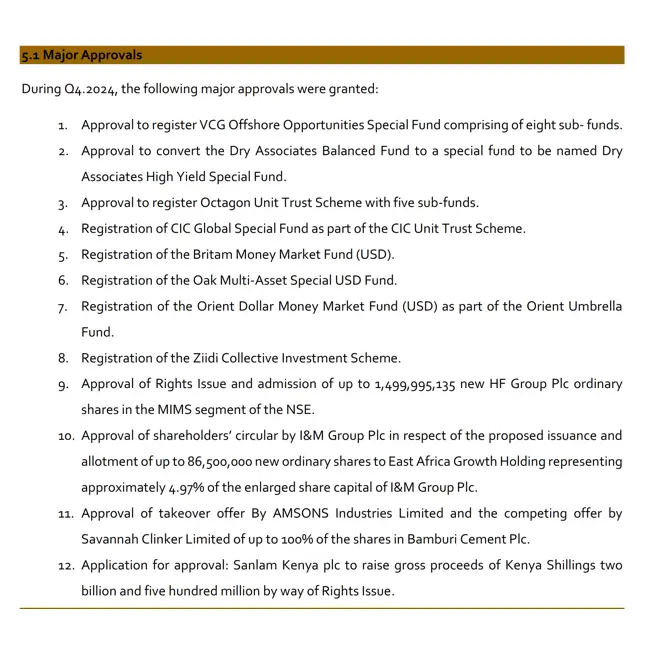

A recent report by Capital Markets Authority has revealed major industry approvals including the registration of CIC Global Special Fund as part of the CIC Unit Trust Scheme and the Britam Money Market Fund (USD).

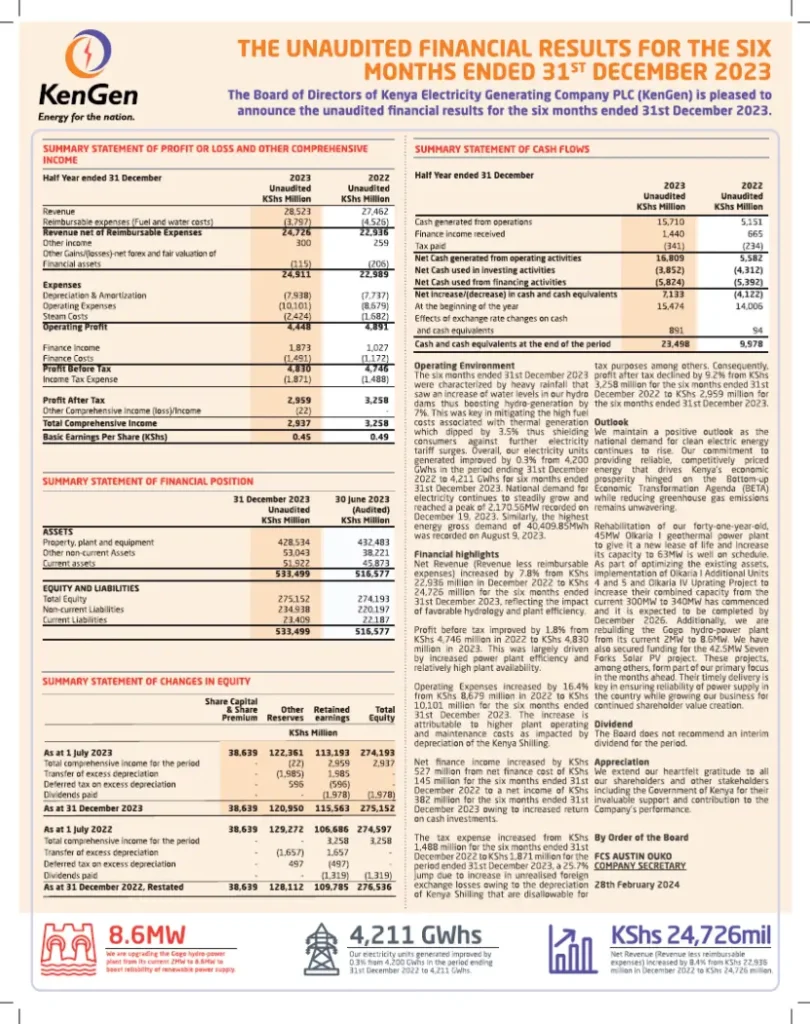

In the energy sector, KenGen released its financial results for the period ended 31st December 2024, reporting a 79% increase in profit after taxes to Ksh 5.3 Bn

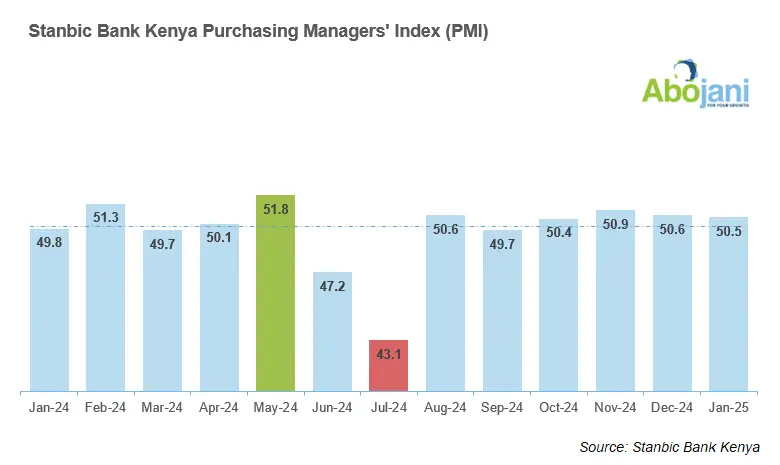

Stanbic Bank Kenya Purchasing Managers’ Index (PMI) stood at 50.5 for January 2025, signaling continued private sector growth for the fourth consecutive month, albeit at a slower pace compared to previous months.

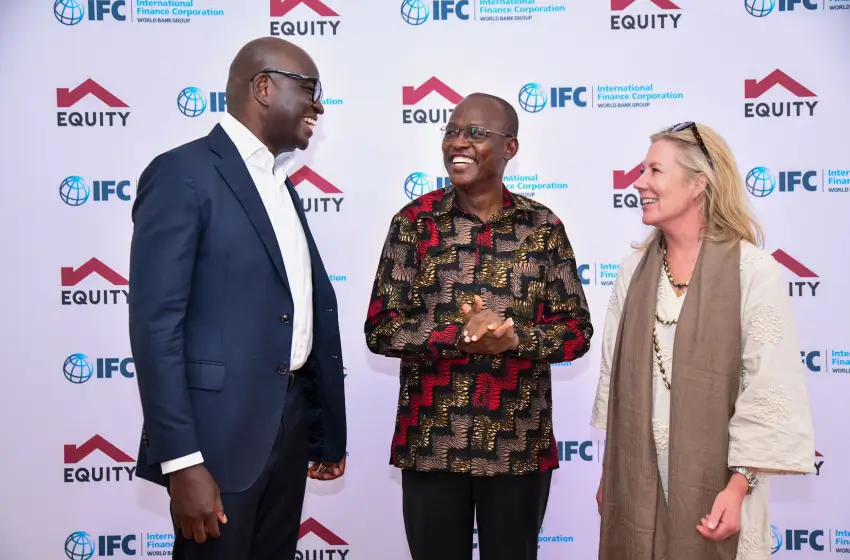

Equity Bank Kenya, in partnership with the International Finance Corporation (IFC), has launched a $20 million Risk Sharing Facility (RSF) to enhance financial inclusion within underserved regions in Kenya, including refugees and host communities.

NCBA officially launched its Sustainable Development Impact Disclosure (SDID) document, marking a significant milestone as the first African bank to adopt and disclose its development impact.

Coming up, registration for the 64th Personal Finance & Investing Masterclass is ongoing. We look forward to empowering the next generation of retail investors. Have you booked your seat yet?