You can adopt these practical habits for a financially sound year, for whichever financial goals you may have, the Money Habits That Lead to Success

1. Educate Yourself About Money

This should be your first focus as it will help you make educated decisions in your finance planning. Knowledge is power when it comes to managing finances.

Read finance blogs, attend webinars, or take online courses on personal finance. Better knowledge means fewer costly mistakes.

What Better Way to Educate Youself about Money than to Join Abojani Personal Finance and Investing Masterclass?

Click Image below for Details and Registrations

2. Track Your Expenses

Keep track of where your money goes daily using your bank statements, M-Pesa transactions, etc. Make use of financial planner apps or journals to log your expenses.

This helps you identify areas you could improve on in your spending habits.

3. Set Clear Financial Goals

It’s easier to achieve goals that have a set timeline. Whether it’s to save for a trip, an education, paying off a debt or buying a house, setting goals help you track your progress and milestones.

Having goals holds you accountable therefore keeps you motivated and focused to realize your dreams.

4. Budget Wisely

After reviewing your expenses, build a budget that works for you. Using your financial planning app or journal, allocate funds for your fixed expenses and introduce a buffer for unexpected expenses.

Your budget is your friend, it’s not meant to restrict but to empower you. This will give you the financial discipline needed to attain your goals.

5. Build An Emergency Fund

Start building a safety net to cater for unforeseen circumstances. Aim for a 4-6 month worth of living expenses that will reduce your reliance on debt and give you peace of mind.

Don’t worry if it exceeds or you don’t use it, a larger buffer can be comforting! Just make sure the fund is easily accessible and put it in a high yield account.

6. Utilize Financial Security Instruments

Retirement plans, medical insurance, education funds etc. are helpful financial tools that help you plan for expected or unexpected future expenses. They give you a piece of mind and reduce your reliance on debt in such times.

These instruments are readily available and start at very affordable levels.

7. Treat Your Savings As A Fixed Expense

Make it non-negotiable and deduct your savings as soon as you receive your income. Building on this point, put the funds in an interest-accruing account, that way your money will be working for you.

8. Review Your Financial Plans Regularly

It’s important to review your financial plans regularly as it helps you stay on track with your goals. Your priorities, goals, expenses, and income might change overtime, so you need to adjust your plan accordingly.

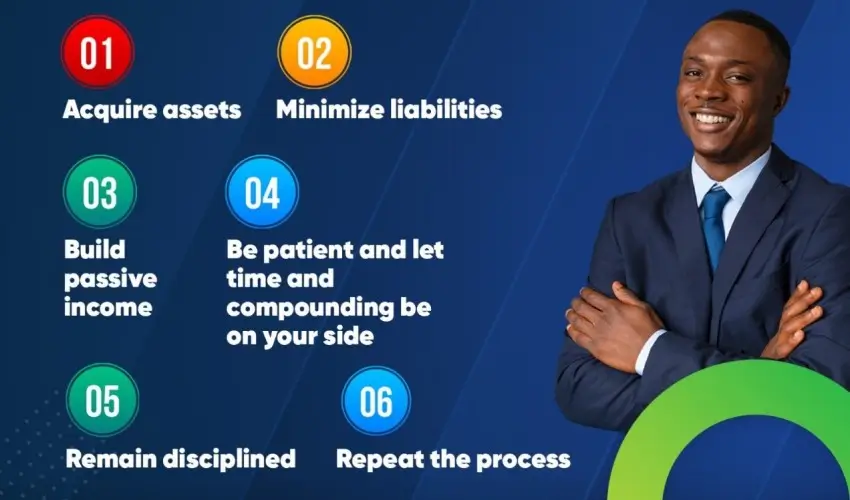

9. Invest Regularly

Consistent investing builds wealth over time. Research stocks, mutual funds, or REITs, and commit to small, regular investments. Leverage blogs, classes and courses that build your knowledge on various investment tactics and options.

Building good money habits takes time and consistency, but the rewards are well worth it. Start small, focus on one habit at a time, and watch your financial health improve throughout. Remember, the best time to start is now!