As is our norm, we present to you our MONTHLY SPOTLIGHT REPORT: November 2024 Edition

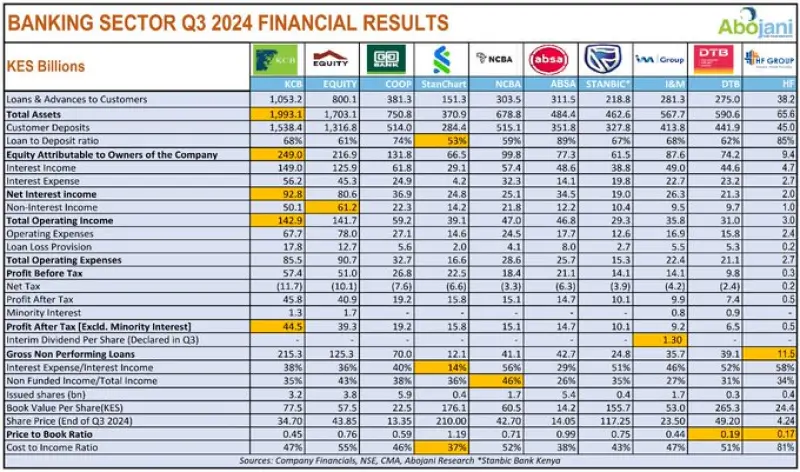

During the month, the banking sector was busy with activity as the listed banks rushed to roll in their Q3’2024 numbers…KCB Group reclaimed its status as the most profitable Bank in Kenya.

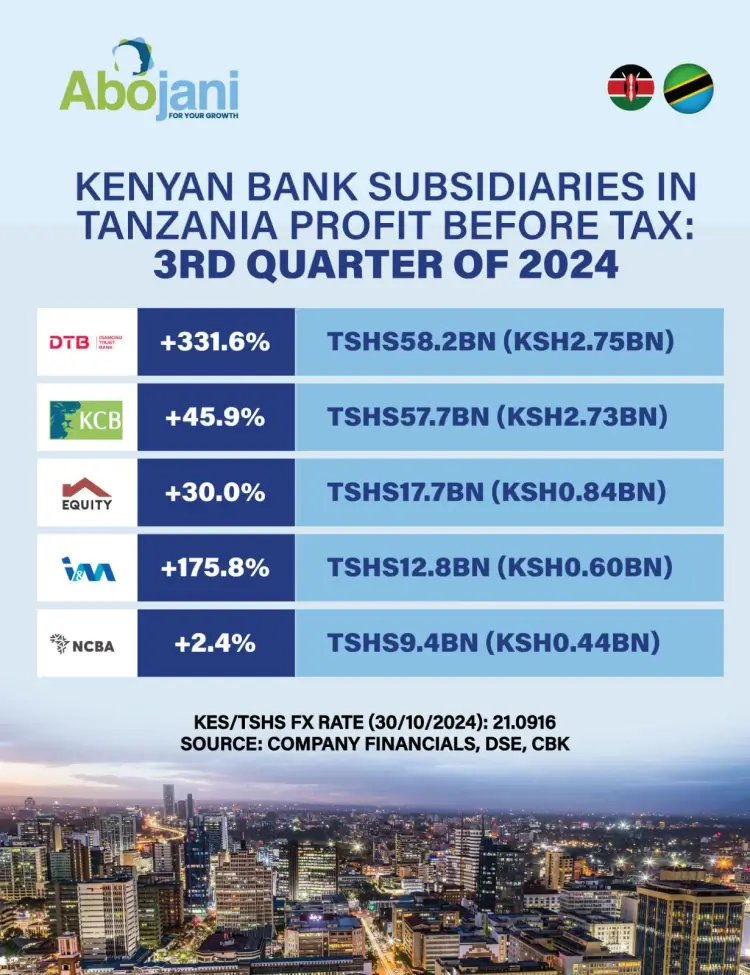

The banks’ subsidiaries in Tanzania saw impressive profit growth, with DTB achieving the largest increase, growing by over 300% to reach a pre-tax profit of Tsh 58.2 billion (Ksh 2.75 billion).

Safaricom released its half year financial results, signaling strong performance in the Kenyan business, supported especially by M-Pesa revenues

Christmas came early for I&M Group shareholders as the lender declared a rare interim dividend of Ksh1.3 per share, continuing with its move to distribute more of its earnings to shareholders. The company has historically paid only a final dividend after the close of each financial year…

The Central Bank of Kenya issued a press release addressing attempts by malicious actors to spread false information about the banking sector.

CBK reassured the public that the banking sector remains stable, resilient, and adequately capitalized.

The Competition Authority of Kenya approved the acquisition National Bank of Kenya Limited by Access Bank PLC

The approval requires Access Bank to retain at least 80% of NBK’s workforce for one year.

Equity Bank Ltd Kenya announced a reduction in interest rates on all new and existing Kenya Shilling-denominated credit facilities, following the recent decision by the Central Bank of Kenya’s Monetary Policy Committee (MPC) to cut the Central Bank Rate (CBR) from 12.75% to 12.0%…

In an Economic Forum held during the month, NCBA Bank Kenya then forecasted a steady growth in the country’s GDP with output projected to close at 4.8% in 2024 and remain consistent into 2025.

NCBA was on a roll this month, opening several physical branches across the country in a bid to expand its geographical footprint…

In addition to the new branches, NCBA also signed a Memorandum of Understanding with Xpress Money, a cross-border international payment solutions platform.

This partnership aims to offer efficient remittance services to its diaspora customers.

#GoForIt #NCBATwendeMbele

The Capital Markets Authority released the Kenya CIS Q3 2024 Report, highlighting key developments in the sector:

Total assets under management rose by KES 62.32 billion (24.53%), increasing from KES 245.06 billion in June 2024 to KES 316.38 billion in September 2024.

Sanlam Kenya Plc proposed a rights issue aimed at raising up to Ksh 3.25 billion, pending approval from shareholders and the Capital Markets Authority.

Britam has introduced a new Female Wellness Product, designed to provide comprehensive health coverage for women, with premiums starting at just Ksh 620 per year.

ICEA LION was on party mode as the Group celebrated 60 years of trust, resilience, innovation, and legacy.

In his address, ICEA LION Group Chairman James Ndegwa recognized the contributions of past and present leaders, employees, partners, and clients, highlighting the efforts of those who believed in and supported ICEA LION’s mission.

Liberty Kenya Holdings announced the appointment of Rosalyn Mugoh MBA, as new Heritage Insurance Kenya Managing Director

The Board of Directors of Jubilee Holdings Limited has announced the appointment of Ms. Gladys Karuri as an Independent Non-Executive Director

Joe Muganda has joined Nation Media Group PLC as Independent Non-Executive Director

Old Mutual Kenya hosted a media engagement forum, aimed at enhancing financial literacy across the country.

Old Mutual Group COO Isaac Nzyoka emphasized the media’s power to transform financial narratives, democratize financial education, and set the standard for quality financial education in our markets.

Safaricom then hosted a two-day Cybersecurity Summit to raise awareness about investing in technologies to protect sensitive information and critical systems from cyber threats

But of course the highlight of the month was the 4th Abojani Economic Empowerment Conference, where over 300 delegates gathered to discuss the theme: Building Staying Power as African Households and Businesses. #EconomicEmpowermentKE

And finally,

We invite registrations for the 63rd Abojani Masterclass that will run from 13th to 31st January 2025.

Our goal is to empower investors to start the next year on a high note by improving their personal finance game!