Successful businesses know exactly what they want to achieve (Key Milestones) and how to do it better than others.

They make tough decisions about where to focus their efforts and what areas to avoid.

Rather than try to be all things to all people, they choose the specific target markets they want to serve and stay focused on what they do best.

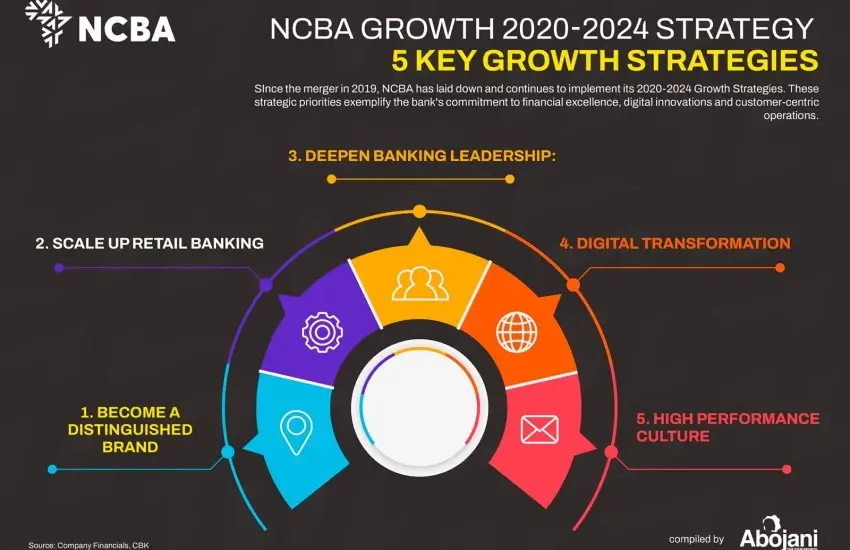

In 2020, NCBA Group launched a comprehensive 5-year strategic plan aimed at establishing itself as a leading financial player in Africa by investing in and prioritizing 5 key areas:

- Become a Distinguished Brand Known For Customer Experience

- Scale retail banking

- Deepen leadership in Corporate Banking & Asset Finance

- Digital transformation

- Develop a high-performance employee culture.

Over the past five years, the Group has made great progress. Some key milestones include:

1. Become a Distinguished Brand Known For Customer Experience

In just 5 years, the NCBA brand has gained significant recognition and respect in the financial sector.

In 2024 alone, the NCBA brand received several notable awards, including:

- Best in Customer Experience

- Best Campaign of the Year for the ‘Twende Mbele’ campaign

- 4 prestigious accolades at the FiRe Awards 2024

- Best Overall Banking Experience award at the Banking on Women Awards

How NCBA is Kicking Off Its Citizenship & Sustainability Initiatives in 2025

2. Scale Retail Banking

NCBA branch network has expanded from 104 branches in 2021 to a total of 118 branches by September 2024.

This has helped NCBA improve its ability to meet the needs of corporate and retail clients by providing greater convenience of access and building trust.

3. Deepen leadership in Corporate Banking & Asset Finance

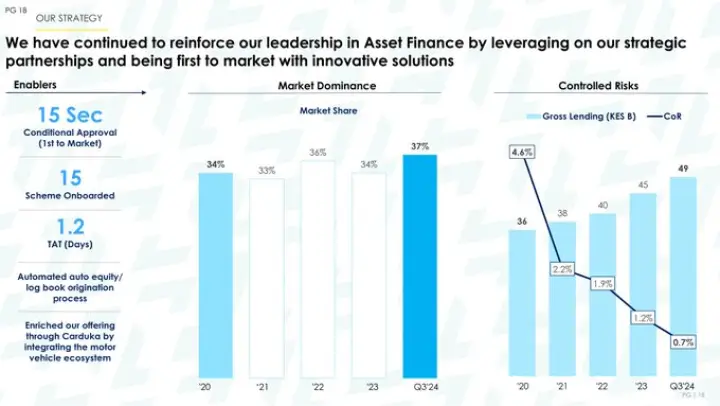

NCBA has solidified its position as the #2 corporate bank and maintained its status as the undisputed leader in Asset Finance.

The Asset Finance market share has grown from 33% in 2020 to 37% as of Q3 2024.

The group’s innovative solutions continue to drive growth and customer satisfaction, including:

- The innovative Solar PV Leasing Solution.

- The launch of Carduka in Rwanda.

- Electric Vehicle Financing

4. Digital Transformation

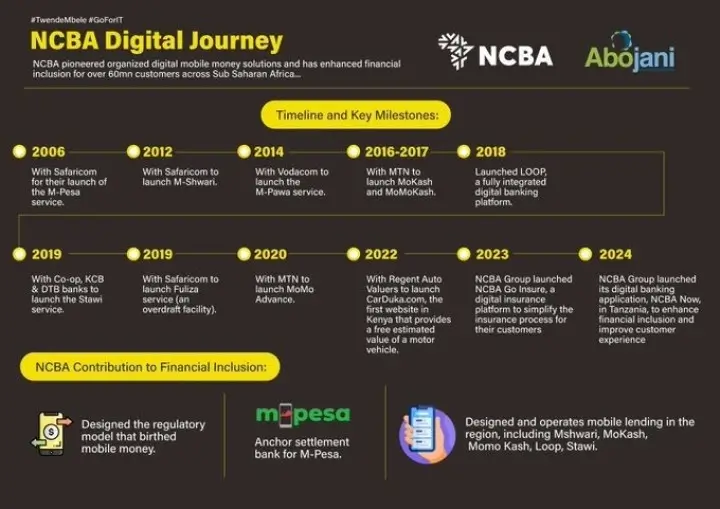

NCBA Group has undergone a huge transformation from a traditional financial institution to a customer-centric digital powerhouse.

Over the past five years, NCBA launched MOMO Advance, CarDuka.com, NCBA Go Insure, NCBA Now in Tanzania, and integrated NCBA Investment Bank services into the NCBA Now mobile app.

These initiatives have significantly improved operational efficiency, reduced costs, and enhanced the customer experience.

5. Develop a high-performance employee culture.

The difference between the best-performing organizations and others often comes down to their culture – how people behave and work together & the way they get things done.

NCBA has been keen on this. The bank has significantly increased its focus on learning and development.

In 2023, average learning hours per employee rose to 67, a 34% increase over the target of 50 hours.

Recently, the bank partnered with the Chartered Institute for Securities and Investment (CISI) to enhance the professional skills of its employees, aiming to surpass 100 certified professionals.