NCBA Group’s financial results for the first half of 2024 reveal a robust performance, showcasing both strength and adaptability in the face of adversity.

The banking conglomerate has reported a post tax profit of Ksh 9.8 billion for the first half of 2024, marking a 5.0% increase from the Ksh 9.4 billion reported in the same period last year.

Customer deposits grew by 2.4% year on year, closing at Ksh 529 billion, while total assets increased by 4.3% to Ksh 689 billion.The bank rode on its digital capabilities this year, with digital loans disbursed seeing a 4.0% rise, reaching Ksh 478 billion, underscoring the Group’s solid foundation and growing market presence.

Read: Absa Bank Kenya PLC Reports 29% Profit Surge, announces Ksh 0.20 per share Interim Dividend

Operating income rose slightly by 1.1% to Ksh 31.4 billion, though operating expenses surged by 15.5% to Ksh 16.5 billion. The increase in expenses is reflective of the broader economic pressures and the Group’s ongoing investments in digital transformation and expansion.

A significant achievement was the 38.3% reduction in provision for credit losses, which dropped to Ksh 2.7 billion, highlighting the Group’s effective management of loan impairments and credit risk..

The non-banking subsidiaries, including Investment Banking, Bancassurance, and Leasing, contributed Ksh 0.6 billion to overall profitability, reflecting a remarkable 56% year-on-year growth. This diversification has bolstered the Group’s financial standing and added substantial value.

NCBA Group PLC reports

Speaking during their H1 ‘2024 Media & Investor Briefing, John Gachora, the Group Managing Director, emphasized the strategic pillars guiding NCBA’s success: enhancing customer experience, scaling retail banking, leading in corporate banking and asset finance, embracing digital transformation, and fostering a high-performance culture

NCBA’s commitment to exceptional customer service has been recognized with several accolades, including the Excellence in Customer Experience at the Connected Banking Summit and the Best Bank in Customer Experience by the Africa Bank Awards.

But perhaps what stands out more than its numbers is the impact that the bank has on the community it serves. The Group has rolled out several initiatives to support financial inclusion and customer engagement. Notable efforts include the SME Development Programme with Strathmore Business School, partnerships with vehicle dealers to maintain leadership in asset finance, and the waiver of monthly account maintenance fees for retail banking customers.

The group’s focus on environmental and social impact is evident in their achievements, such as awarding 169 education scholarships, planting over 175,000 trees, and mobilizing Ksh 6.5 billion in green and sustainable financing.

Looking ahead, the Group remains optimistic about the prospects for sustainable growth. The commitment to fiscal discipline and a supportive financial environment will be crucial for continued success.

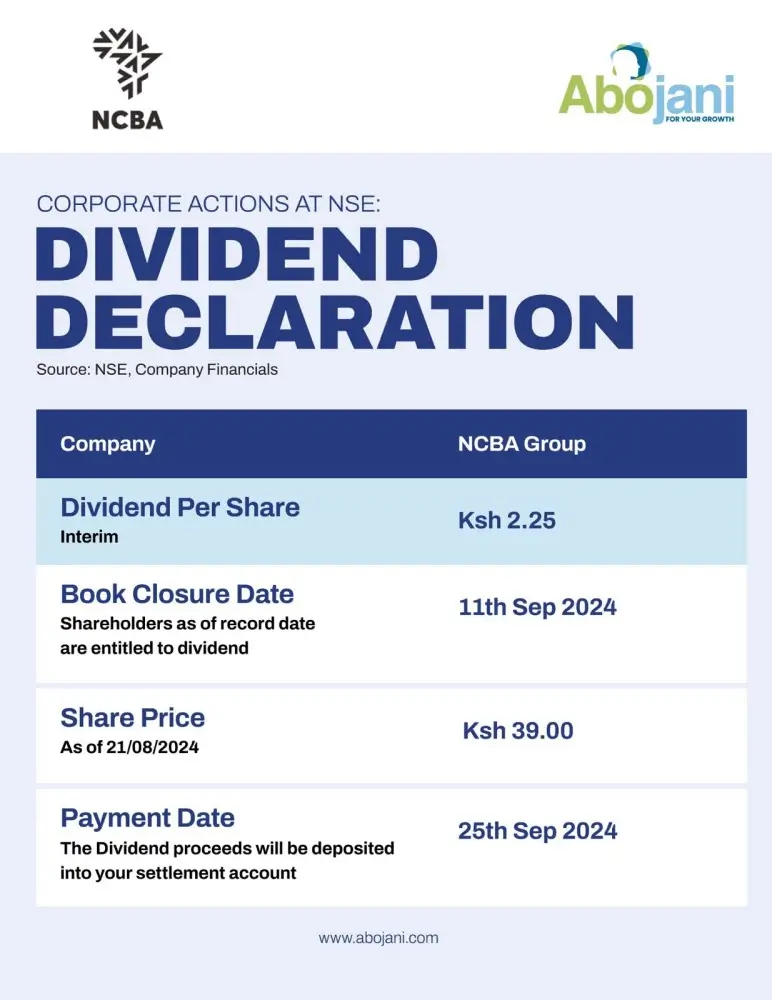

In recognition of its strong performance, the Board of Directors has approved an interim dividend of Ksh 2.25 per ordinary share, reflecting the Group’s commitment to delivering value to its shareholders.