M-Pesa has long been a driving force in Kenya, transforming how millions handle money in their daily lives. As the mobile money service by Safaricom, MPesa has gained immense popularity, providing a fast, secure, and widely accessible way to transact.

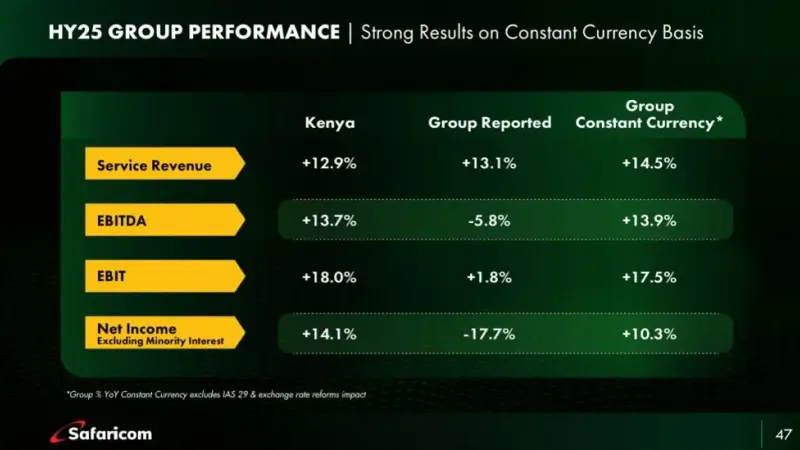

Safaricom’s recent H1 2025 results highlighted M-Pesa’s strength, confirming it as a critical pillar in Safaricom’s success and a backbone of Kenya’s digital economy.

Read: NCBA Group PLC reports a 5.0% uptick in post tax profits to Ksh 9.8 Billion in H1’2024 Results

In the first half of 2025, M-Pesa achieved significant growth, with revenue climbing to KES 77.2 billion, a 16.6% increase compared to H1 2024.

This growth highlights the continuing expansion of digital financial services and the demand for mobile money in everyday transactions, emphasizing M-Pesa’s role in making financial services accessible across Kenya.

Consumer payments were the largest revenue contributor, accounting for 62.9% of M-Pesa’s total revenue, amounting to KES 48.6 billion. This reliance on consumer payments illustrates how embedded M-Pesa is in people’s routines, from buying essentials to paying bills. The consistent rise in consumer transactions reflects how M-Pesa continues to be a trusted tool for managing personal finances.

The overall transaction value for M-Pesa also saw remarkable growth, increasing by 10.7% to reach KES 20.9 trillion. Additionally, transaction volumes grew by 30%, totaling 17.1 billion transactions, a sign of the increasing number of people who rely on M-Pesa for daily transactions.

Notably, Lipa na M-Pesa, Safaricom’s merchant payment service, grew by 5.2% to reach KES 3.7 billion, showing how business payments through M-Pesa are strengthening.

One of the most impressive highlights was the growth of Pochi la Biashara, a service that enables small businesses to manage payments. Pochi la Biashara saw a whopping 229.8% growth, with revenue rising to KES 0.9 billion.

This growth points to a rising trend of small business owners embracing mobile money to streamline transactions, manage income, and foster business growth.

Overall, Safaricom’s H1 2025 results confirm that MPesa continues to be an essential part of Kenya’s economic fabric.

From consumer payments to small business solutions, M-Pesa’s growth showcases its impact on Kenya’s financial inclusion and economic empowerment, further solidifying its position as a leader in mobile financial services.