We’re ushering in 2025, and like many others, you’ve probably made a resolution to start saving more money. It’s a common goal, yet so many of us fall short, often because the task of saving can feel daunting or overwhelming. The good news is that you don’t need to make drastic changes to your lifestyle to start saving.

With a Branch Savings Account, you can take small, simple steps towards your savings goal, and before you know it, you’ll be building a financial cushion that makes the future feel a little less uncertain.

The beauty of a Branch Savings Account is its flexibility. There’s no need to wait until you’ve “saved up enough” to begin. Even if you’re only able to start with a small amount, that’s perfectly fine.

Also Read: The Power of a Savings Account to Redeem your Rainy Days

Life has a funny way of demanding funds when you least expect it, so saving in a Branch account helps you avoid the frustration of scrambling for cash when a sudden expense comes up.

By starting with whatever you can afford, you’re already building a habit of saving, something that will serve you much more effectively over the long term.

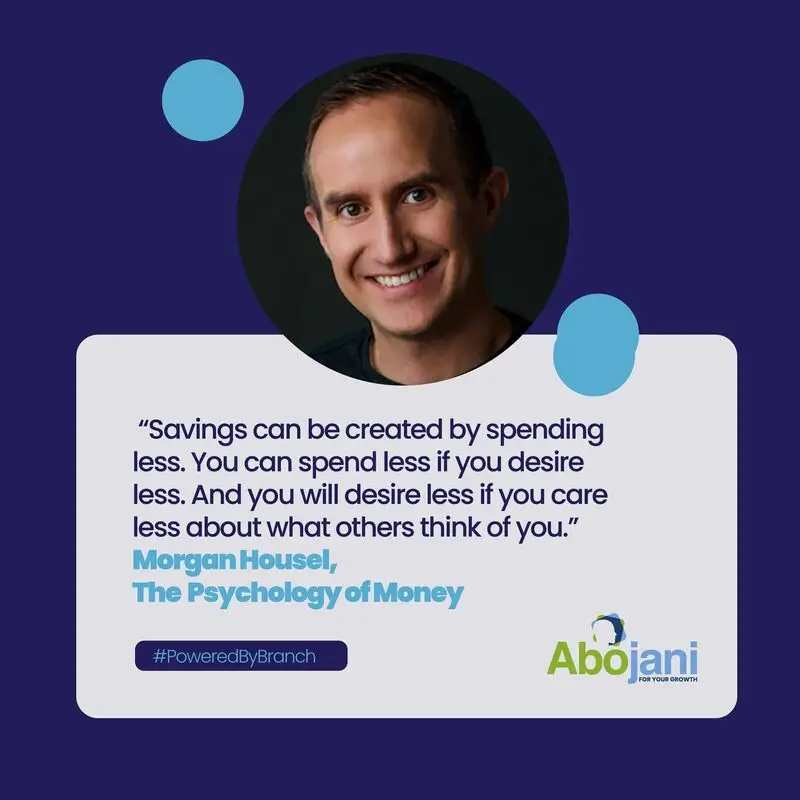

What makes this even better is that your money doesn’t have to sit around doing nothing while you’re figuring out how to save more. It’s not just about putting money away; with a Branch Savings Account, you can actually earn interest on the balance you’ve set aside.

It’s not a huge amount, but it’s something. And that little bit of interest is a reminder that saving, no matter how small, has its rewards. Over time, those tiny interest deposits can add up, and suddenly, that savings account feels a lot more valuable than it did at first.

Another reason Branch is a great tool for anyone looking to save in 2025 is how accessible it is. We’ve all been there. Setting money aside and then needing it sooner than expected. The last thing you want is to lock up your savings in a way that makes it difficult to access when you need it most.

With Branch, you don’t have to worry about that. Your money is always within reach, but it’s also growing while it’s there, which makes it a great solution for those who want the peace of mind that comes with having a little extra without sacrificing flexibility.

Saving in 2025 doesn’t have to be a burden. With Branch, it’s easy to start small and gradually build a healthy savings habit that can carry you through the ups and downs of the year ahead. It’s not about making big sacrifices or locking away large sums of money; it’s about making the decision to get started and sticking with it. By using a Branch Savings Account, you’re taking control of your financial future, one deposit at a time.