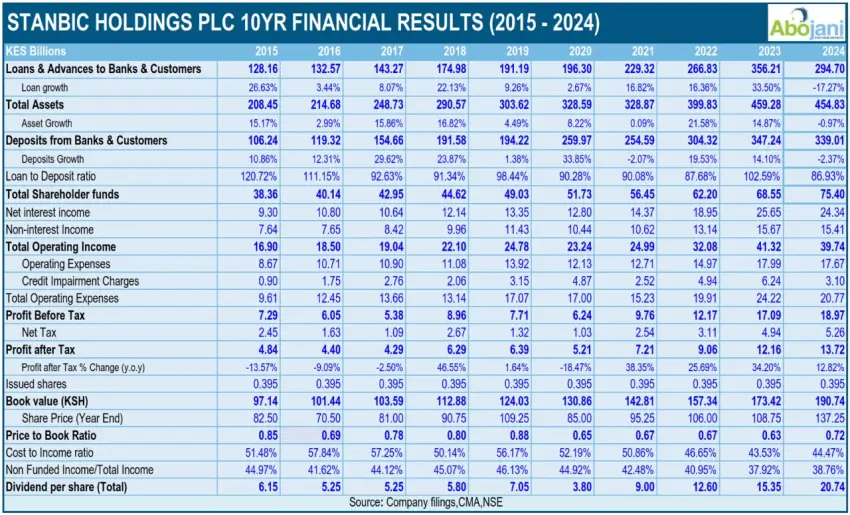

Stanbic Holdings Plc reports a 13% increase in profit after tax to Ksh 13.7bn for the year ended 31 December 2024, driven by lower income compared to the prior year, lower operational costs, and reduced credit impairment charges.

Still on Stanbic Holdings, the group has appointed Mr. Stephen Odinga Okello as an Independent Non-Executive Director. Mr. Okello brings a wealth of experience to the board, having previously worked in auditing, financial advisory, tax consulting, and corporate management.

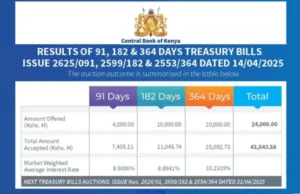

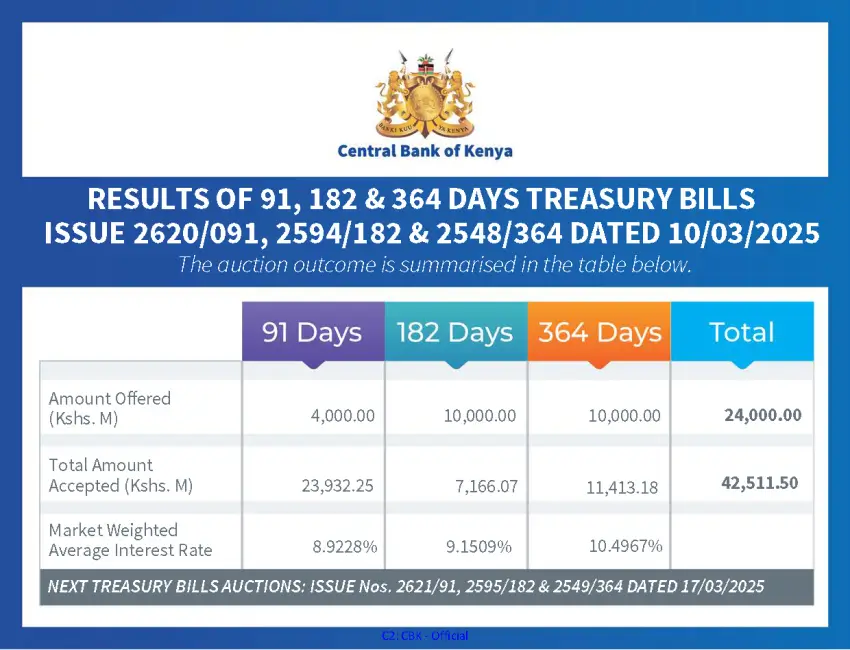

Central Bank of Kenya received bids worth Ksh50.559 billion at this weekly treasury bills auction against an advertised amount of Ksh24.0 billion, a performance rate of 210.66% and accepted Treasury Bills worth Ksh42.511 billion. The 91-day T-bill average interest rate stood at 8.9228%.

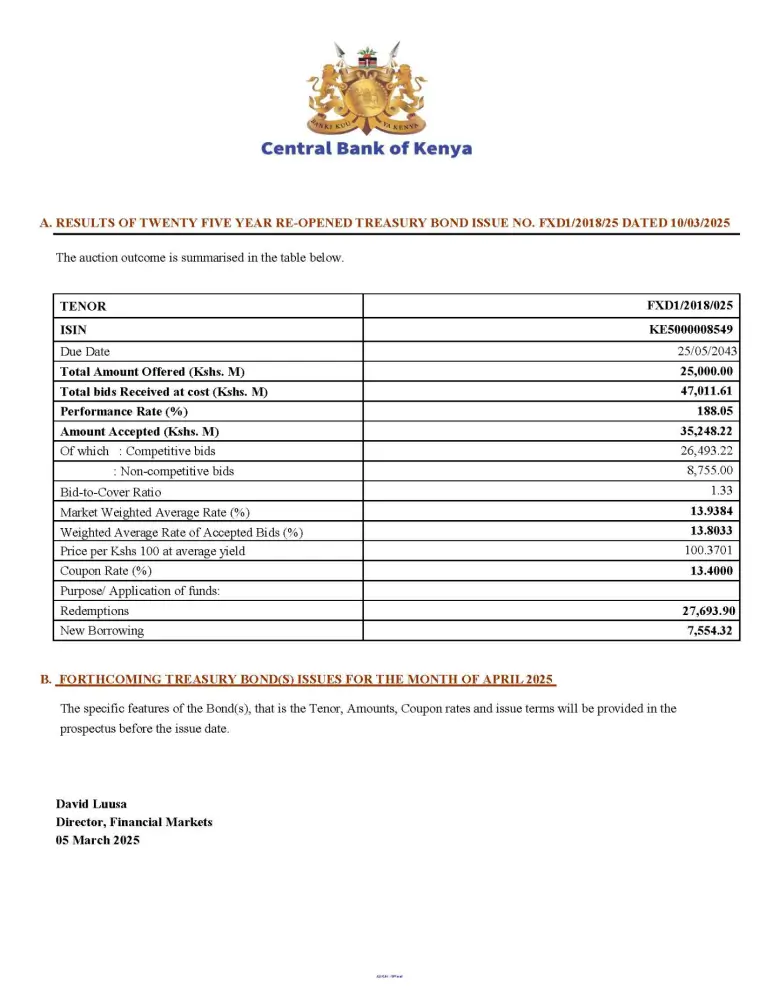

CBK raises Ksh 35.25 billion in reopened 25-Year Treasury Bond auction. The bond attracted total bids worth Ksh 47.01 billion against the offered Ksh 25 billion, representing an oversubscription of 188.05%.

I&M Bank plans to open nine new branches in the first quarter of 2025 under its 2024 -2026 iMara Strategy. This expansion includes the new Mtwapa branch in Kilifi, offering retail and MSME banking services.

Additional branches will open in Nairobi, Central, and Western Kenya, with eco-friendly container designs. This expansion will bring the Bank’s total branch network to 61 branches across 21 counties.

NCBA partners with Family Media to bring expert insights on money management, investments, and smart saving strategies. #NCBAChangeTheStory #NCBAMoneyMastery #Goforit

Equity Group commits to supporting farmers and traders in the leather value chain. Dr. James Mwangi, Managing Director & CEO, announced this during a roundtable discussion at Equity Centre.

The event, organized with KenInvest and MITI, focused on unlocking growth opportunities in the leather sector. #SustainableGrowth #EconomicDevelopment #EmpoweringCommunities

Absa Bank Kenya reaffirms its commitment to increasing diversity at all levels with the appointment of four female directors into its leadership team.

This strategic move enhances the bank’s leadership strength while advancing gender parity in senior leadership to over 47%. #YourStoryMatters #IWD25

M-PESA marks its 18th anniversary,

Since its launch in 2007, M-PESA has grown to serve over 70 million customers in 170 countries, processing nearly 100 million transactions daily.

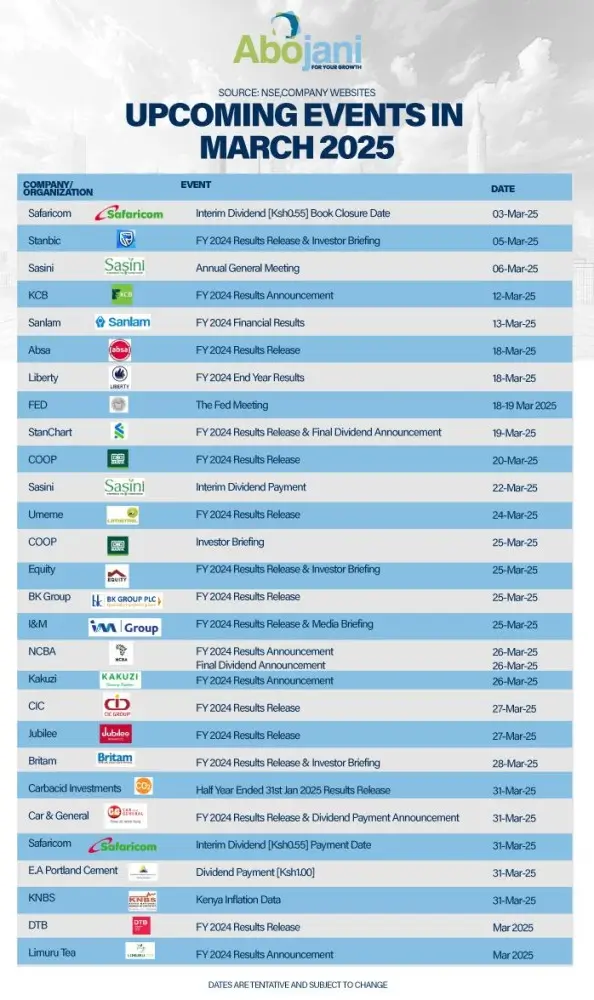

Upcoming events

Next week, KCB will announce its FY 2024 results on March 12, followed by Sanlam’s FY 2024 financial results on March 13.

On Wednesday, 12th March at 7pm EAT, we’re having a conversation with Robert Kibaara, CEO of HF Group, on how to take control of your business and personal finances.

Set reminder here

Finally, we are committed to equipping individuals with practical financial knowledge and proven investment strategies to achieve long-term wealth.

Our 65th Masterclass kicks off next week on March 10, 2024. You’ll gain essential skills in personal finance and investment management, empowering you to build an emergency fund, a homeownership wealth basket, a financial freedom fund, and dedicated funds for both short-term and long-term goals plus much more. Register today!