For many young men in Kenya, owning a car is a huge milestone, a statement, and a sign that they’ve “made it.” And the journey to acquiring that first car is often a story of ambition, struggle and triumph.

It’s a tale that resonates with many: from the humble beginnings of hopping on a matatu, to the thrill of revving the engine of that first car.

But what does it really take to own your first car in Kenya? And why is this such a significant achievement?

Also read: What Being Good with Money in Your Youth Actually Buys You

From a young age, most Kenyan men are raised with the belief that a car signifies independence. It’s the bridge between childhood reliance on others and adult autonomy. The dream begins with a simple wish a vehicle that can take you wherever you want, whenever you want, without having to beg for a lift or wait for a bus.

At this point, the specifics of the car aren’t so important. For many, it’s less about the make or model and more about the fact that it’s mine. Whether it’s a second-hand Toyota, a battered Subaru, or a sleek new sedan, the first car represents FREEDOM!

For many, it’s the first taste of real success in a world that often feels like it’s waiting for you to catch up.

But the road to acquiring that car is rarely smooth.

Typically, the journey to purchasing your first car in Kenya happens in your mid-to-late 20s or early 30s. By this time, you’ve either been working for a few years or have carved out a hustle that is slowly, but surely, building you towards your goal.

The first car is often bought during a period of early career growth. You’ve probably just landed your first steady job or finally started seeing returns from your side business. Your salary, at this point, is modest – likely between Ksh 100,000 and Ksh 1500,000 a month for many. It’s a far cry from the kind of money you need to buy a car outright, but it’s enough to start laying the groundwork. You’re still navigating the balance of rent, food, utilities, and those “emergency” expenses (because those seem to come out of nowhere).

For most Kenyan men, the path to that first car is marked by careful planning, scrimping, and saving. You’re probably driving that beat-up motorbike, or worse, squeezing into a crowded matatu. It’s frustrating at times – especially on rainy days when the matatus seem to have vanished from the face of the earth. But you stay focused. The end goal is clear: the car.

You begin by researching. You dream of a Toyota Corolla, or maybe a used Subaru Impreza – those are reliable, affordable, and, let’s be honest, the cool cars. The problem? The price tags. Even used cars can set you back anywhere from Ksh 500,000 to Ksh 1,200,000. How do you raise that kind of cash? You’ve got a couple of options: save up enough for a deposit and take out a loan, or look for a financial partner who can help you with asset finance.

It’s here that the role of financial institutions like NCBA comes into play. Many young Kenyans, faced with the reality that they can’t pay for a car upfront, turn to banks for assistance.

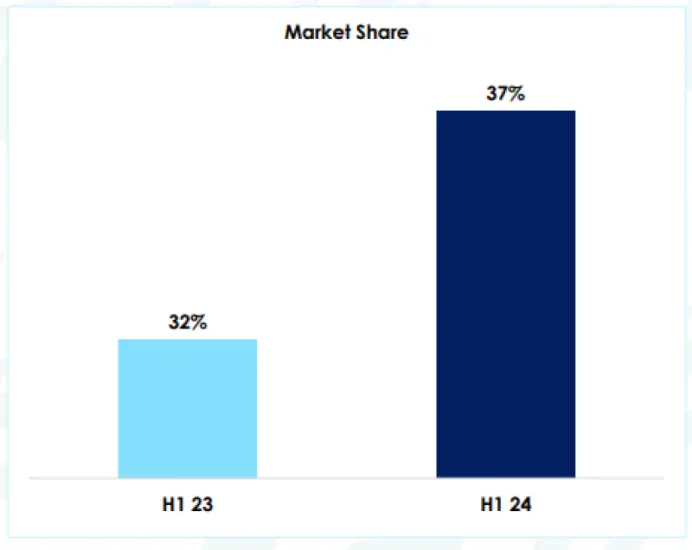

John Gachora, the MD & CEO of NCBA Group, has often said it best: “Every 5th car you see on the roads is likely financed by us!” And after some digging, we can confirm that NCBA’s share of the asset finance market has grown exponentially. From 32% in H1 2023 to a staggering 37% in H1 2024, NCBA has positioned itself as a major player in enabling young Kenyans to own their first cars.

For many, NCBA’s Asset Finance solution provides the crucial bridge between wishing for a car and actually owning one. With competitive interest rates, flexible repayment plans, and a focus on customer satisfaction, NCBA has been helping to turn the dream of owning a first car into a reality for thousands of Kenyans. Whether you’re looking to finance a brand new vehicle or a reliable second-hand model, NCBA is a trusted partner, offering easy access to credit while making the process as seamless as possible.

At the end of the day, a man’s first car is an investment in personal growth, a symbol of hard work, and a reminder that dreams are possible, even when the odds seem stacked against you. Whether it’s a humble sedan or a flashier ride, that first car will forever hold a place in your heart – and in your memories.

And for many, the journey doesn’t stop there. The next car? Maybe that’s the one with the sunroof. Or maybe you’ll be turning the key to your first brand-new model. Who knows? But one thing’s for sure – the hustle never stops, and neither does the drive to keep going.

So, the next time you see that 5th car on the road, you might just be looking at someone who, like many others, is turning his dream into reality—with a little help from NCBA.