Saving Insights

Uncover the dynamics of saving and take control of your financial strategy and wealth creation

From understanding different savings vehicles to setting realistic goals, our saving guides will empower you to make informed decisions and maximize your financial growth.

Saving Insights

One Dream, Many Ways: Finding What Works for Your Home Ownership Journey

For many people, the idea of owning a home is more than just a financial goal. It’s a deeply personal

Wealth Building Is A Marathon, Not A Sprint

Many people approach wealth the way they approach a deadline – as a sprint not a marathon: with urgency, pressure,

Building Wealth Starts with How You Think

Your mindset is one of the biggest anchors in your life, quietly steering the direction you take even in building

Why Save More Money Alone Won’t Make You Rich: The Path to True Wealth

Saving money is universally touted as the foundation of financial success. “Save more,” “Cut your spending,” “Live within your means”

Compound Interest: The Engine Behind Wealth Building

Compound interest is one of the most powerful tools in personal finance, yet it’s often misunderstood or underestimated. At its

It’s Not Enough to Just Save; You Need to Save Smart and Invest

For years, financial advice has drilled one thing into our heads: Save your money. Everyone knows they have to save.

Managing Business Cash Flow with Money Market Funds (MMFs)

Running a business means constantly juggling expenses, revenues, and unexpected costs. Effective cash flow management is vital for the survival

Grow Your Wealth, Even from Afar: A Low-Risk Investment for Kenyans Abroad

Living abroad has its ups and downs. As much as we might enjoy the comfort and opportunities overseas, there’s that

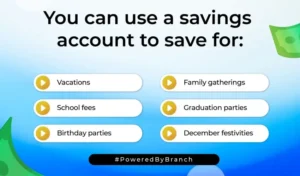

Checklist of What to Save for in 2025

Now that we’re in 2025, it’s time save and to do that, we have to start thinking ahead, especially when

Turning Your 2025 Financial Goals into Achievements with Smart Saving Strategies

Struggling to reach your Financial Goals? Don’t let another year pass you by. Learn how to create a plan and

10 Mistakes to Avoid When Saving Money:

2️⃣ Failing to have a budget

3️⃣ Not automating savings

4️⃣ Neglecting emergency funds

5️⃣ Not tracking expenses

6️⃣ Impatience and indiscipline

7️⃣ Impulse buying

8️⃣ Ignoring high-interest debt

9️⃣ Failing to comparison shop

1️⃣ 0️⃣ Ignoring savings opportunities