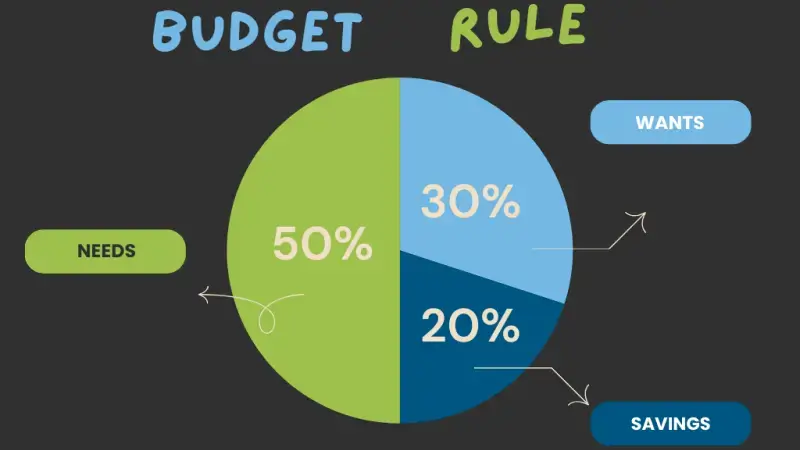

This budget rule is a simple guideline to help you manage your money wisely. Here’s how it works:

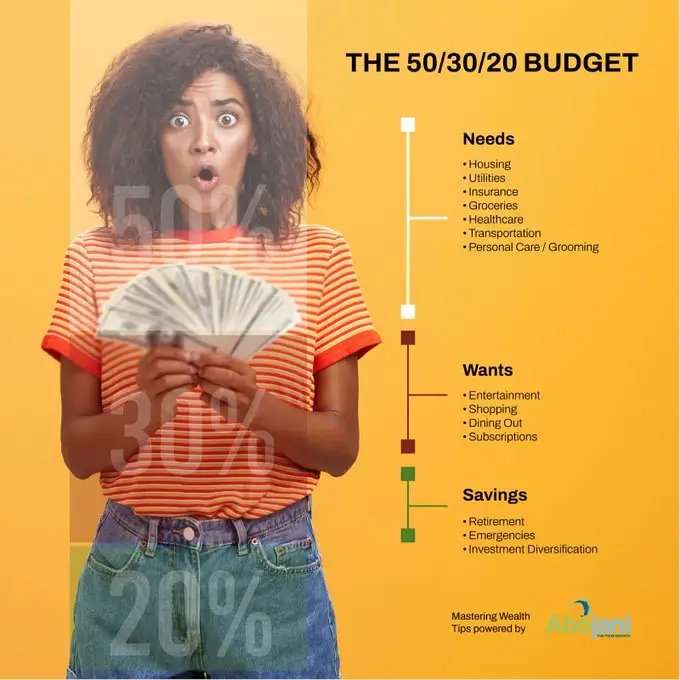

50% for Needs

Allocate 50% of your income for your needs. These are the essential expenses you must pay to survive and maintain your lifestyle. They include things like rent or mortgage, utilities, groceries, and transportation.

Example: Let’s say you earn KES 50,000 per month. With the 50% rule, you would use KES 25,000 (KES 50,000 x 0.50) to cover your needs each month.

30% for Wants

Reserve 30% of your income for your wants. These are non-essential expenses that make life enjoyable but are not absolutely necessary for survival. They can include dining out, entertainment, hobbies, travel, and luxury items.

Example: From the same KES 50,000 monthly income, you would have KES 15,000 (KES 50,000 x 0.30) to spend on your discretionary spending.

20% for Savings and Debt Repayment

20% of your income to savings, investments, and debt repayment. This portion helps you build an emergency fund, save for future goals, and pay down debts faster.

Example: You would set aside KES 10,000 (KES 50,000 x 0.20) from your KES 50,000 monthly income for savings and debt repayment.

It’s important to note that the 50/30/20 rule is a guideline, and you may need to adjust it based on your individual financial situation and goals.

The key is to prioritize your essential expenses, save for the future, and allow yourself some discretionary spending for enjoyment.