Here are some of the biggest stories that made headlines through Week 47 of 2024:

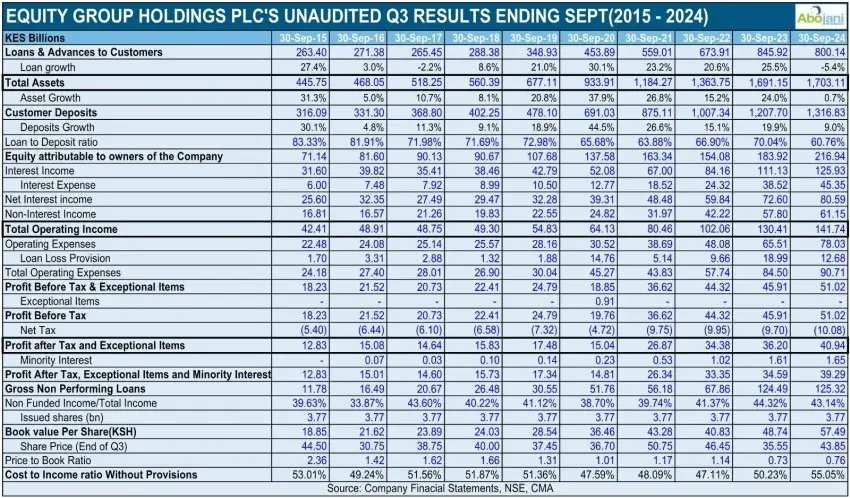

1. Equity Group was the first listed bank to release Q3 2024 results, reporting a 13.1% growth in profit after tax, reaching Ksh 40.9 billion, up from Ksh 36.2 billion in Q3 2023.

Regional subsidiaries contributed 51% of the total profit.@KeEquityBank #Equity2024Q3Results

Catch up with: Your Dose of Weekly Highlights – Week 47 of 2024

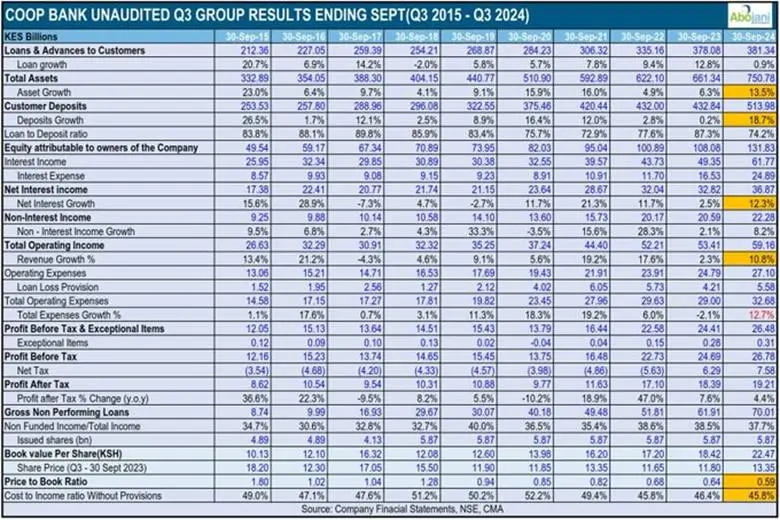

2. COOP followed with a 4.4% profit growth for Q3 2024, reaching Ksh 19.21 billion, mainly driven by a 12.3% increase in net interest income to Ksh 22.28 billion. @Coopbankenya

3. NCBA has expanded its branch network to Homa Bay County, bringing the total number of branches in Western Kenya to eight. @NCBABankKenya #NCBATwendeMbele #Goforit

At the launch, NCBA Group Director of Retail Banking, Mr. Tirus Mwithiga, emphasized that the branch reflects the bank’s commitment to bringing services closer to customers and empowering them with the resources and financial knowledge they need to thrive.

4. In addition to the new branch, NCBA also signed a Memorandum of Understanding with Xpress Money, a cross-border international payment solutions platform.

This partnership aims to offer efficient remittance services to its diaspora customers. #GoForIt #NCBATwendeMbele

5. Old Mutual Kenya hosted a media engagement forum this week, aimed at enhancing financial literacy across the country. @OldMutual_Ke

Old Mutual Group COO Isaac Nzyoka emphasized the media’s power to transform financial narratives, democratize financial education, and set the standard for quality financial education in our markets.

Our CEO, Robert Ochieng, also participated in the occasion, contributing to the discussion on the importance of financial literacy and its role in empowering individuals and businesses.

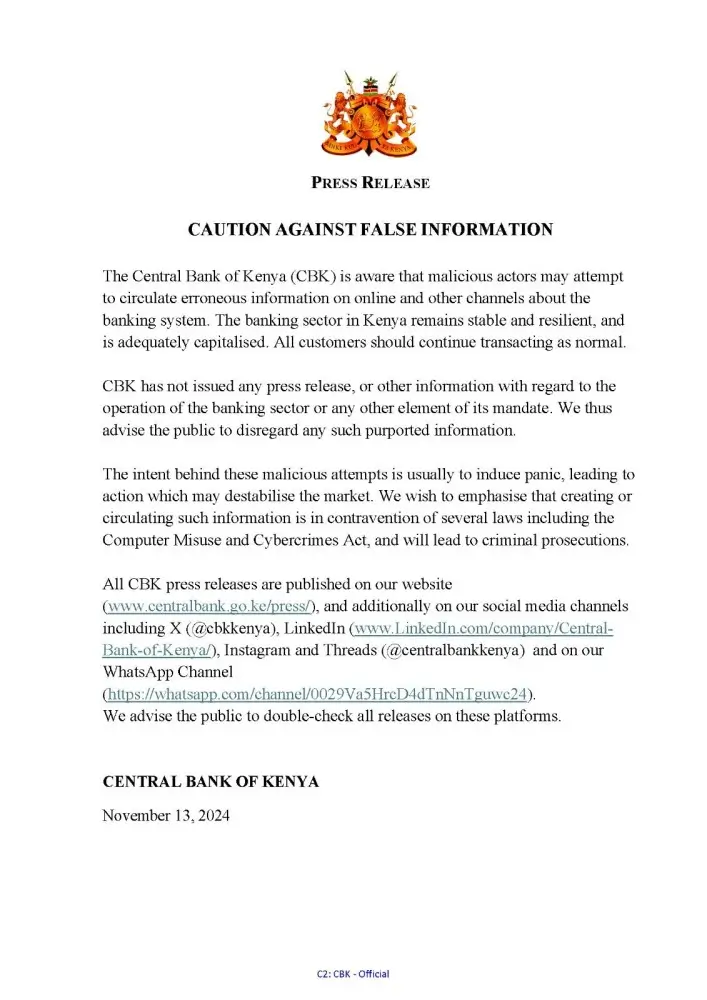

6. CBK issued a press release this week, addressing attempts by malicious actors to spread false information about the banking sector. CBK reassured the public that the banking sector remains stable, resilient, and adequately capitalized. @CBKKenya

7. Safaricom PLC, Tai SACCO, and Old Mutual have joined the list of sponsors for our upcoming Economic Empowerment Conference. #StayingPowerKE #EconomicEmpowermentKE

8. ICEA LION celebrated 60 years of trust, resilience, innovation, and legacy.

In his address, ICEA LION Group Chairman James Ndegwa recognized the contributions of past and present leaders, employees, partners, and clients, highlighting the efforts of those who believed in and supported ICEA LION’s mission.@ICEALION #WhatsYourPlan #ICEALIONat60

9. MSCI has added three more companies from the Nairobi Securities Exchange to its Frontier Markets Small Cap Index. The new additions are Kenya Power and Lighting, Carbacid Investments, and Bamburi Cement. This brings the total number of NSE companies in the index to seven.

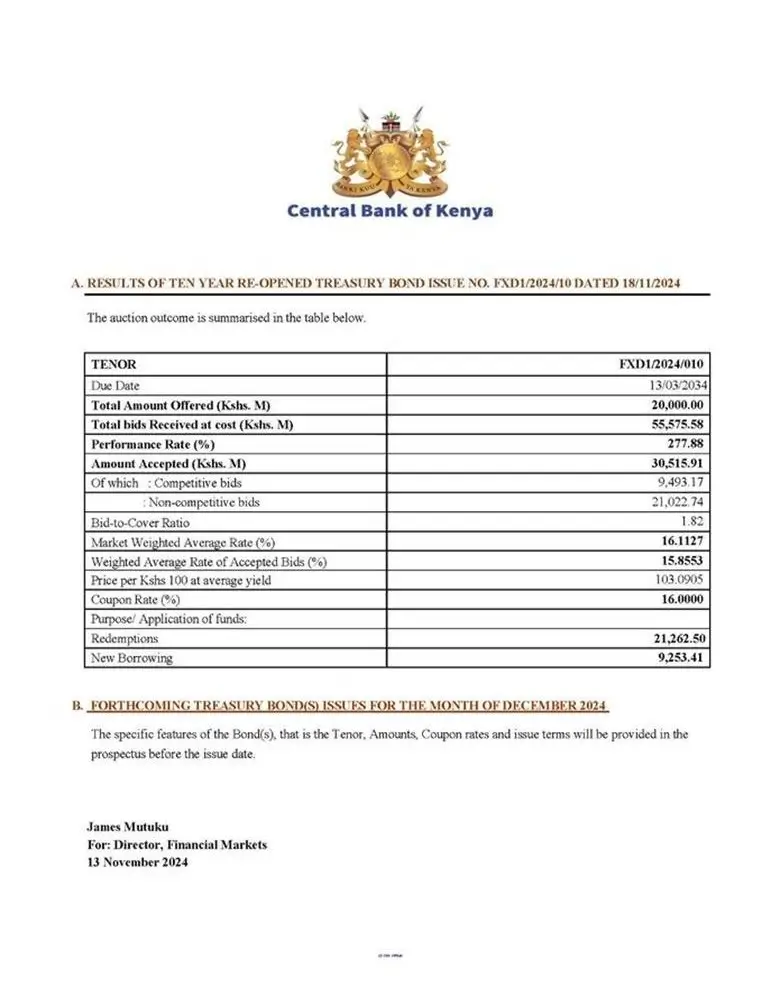

10. The Central Bank aimed to raise Ksh 20 billion by re-opening the 10-year bond FXD1/2024/10. CBK received bids totaling Ksh 55.5 billion and accepted Ksh 30.5 billion. The weighted average rate of accepted bids was 15.8%, with the coupon rate set at 16.00%. @CBKKenya

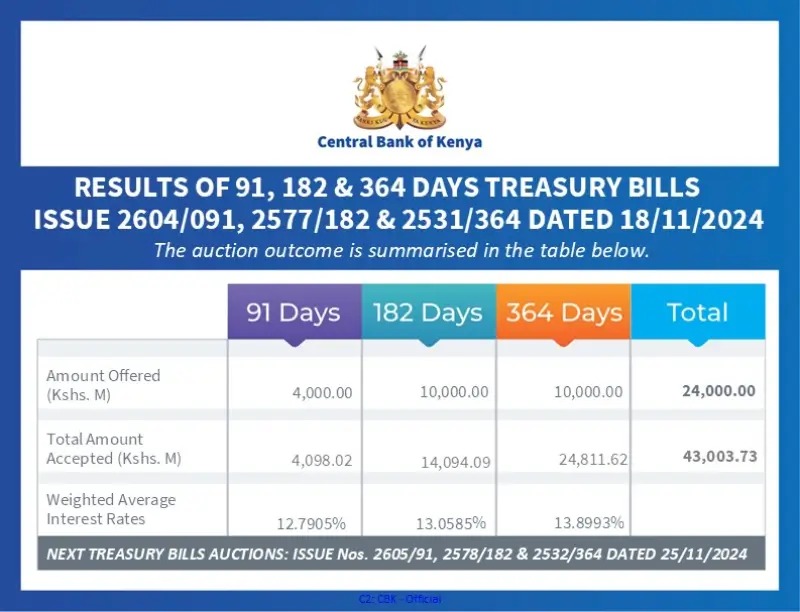

11. T-bills experienced strong demand, with a performance rate of 398%. Average yields declined across all tenors, with the 91-day, 182-day, and 364-day yields dropping by 0.64%, 0.78%, and 0.55%, respectively

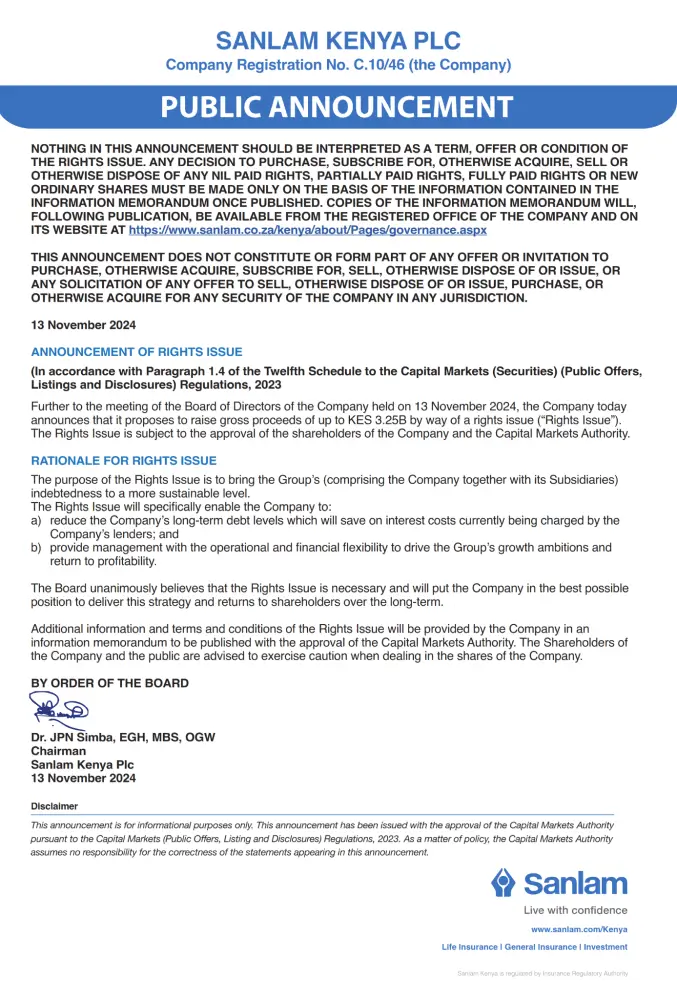

12. Sanlam Kenya Plc has proposed a rights issue aimed at raising up to Ksh 3.25 billion, pending approval from shareholders and the Capital Markets Authority.

13. The Capital Markets Authority released the Kenya CIS Quarterly Report this week, highlighting key developments in the sector:

Total assets under management rose by KES 62.32 billion (24.53%), increasing from KES 245.06 billion in June 2024 to KES 316.38 billion in September 2024. @CMAKenya

CIC Unit Trust Scheme remains the largest in the market, while the NCBA Unit Trust Scheme continues to lead among CISs operated by banking institutions.

14. And finally, all roads lead to Upper Hill next Saturday as investors from all walks of the world meet at the Abojani Economic Empowerment Conference at Radisson Blu to discuss strategies for building staying power in an ever-changing economy. #StayingPowerKE #EconomicEmpowermentKE

Have you registered, if not, click here for the link

We have gone above and beyond to make sure you get unmatched value.